If you look at the graphs, it can be assumed that inflation data in the United States came out not just worse than forecasts. They should have been terrifying. However, everything is not like that at all. This is another round of Washington's confrontation with Beijing. The White House passed the so-called "Hong Kong autonomy" law, which implies the abolition of certain privileges of the city in terms of trade and economic relations with the United States. The fact is that many Chinese companies used Hong Kong as a kind of window for simplified access to European and American markets. In other words, this law is part of Washington's overall policy of restricting the Chinese economy, which has long been the largest in the world. It is designed to complicate the lives of many Chinese companies and to facilitate their crowding out of world markets. Naturally, China just won't leave it that way, especially since many high-tech companies worked through Hong Kong, due to which Chinese industrial companies gained access to new technologies which is also extremely important for the economy of China. So Beijing announced the imminent imposition of retaliatory sanctions against individuals, as well as companies involved in the adoption of this law. It is especially noteworthy that some companies will fall under the sanctions of China. That is, in response, they will limit the access of American companies to its market, which is the largest in the world. So the trade war between China and the United States is only gaining impulse. And do not be surprised that the dollar suffers from this. After all, as has been said many times, it is China that is the world's largest economy, not the United States. So American companies, and with them the American economy, are losing more than China.

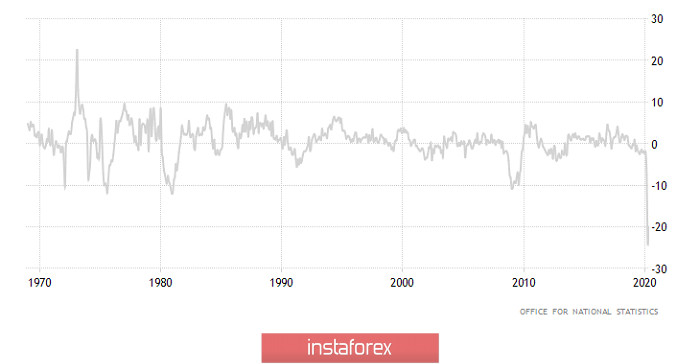

And although it is extremely exciting and fun to follow the political theater of the absurd, do not forget about macroeconomic statistics especially since yesterday, it was enough in excess. Thus, the rate of decline in industrial production in the UK slowed from -23.8% to -20.0% which, by the way, exceeded all the wildest expectations, as it was predicted to slow down the rate of decline to -20.3%. So the British industry is really starting to show signs of at least some improvement.

Industrial Production (UK):

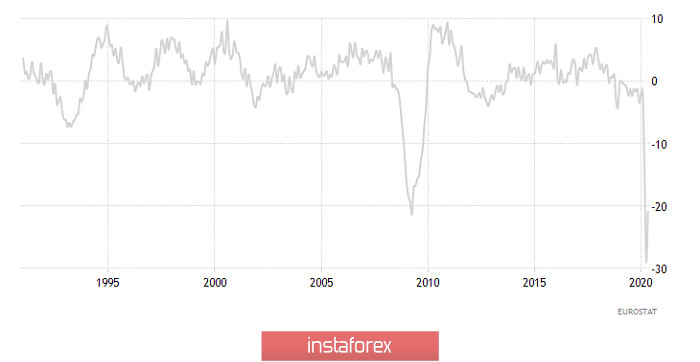

The situation is similar in the Euro area,, where the decline in industrial production slowed down from -28.7% to -20.9%. However, in contrast to the United Kingdom, data in Europe came out slightly worse than forecasts, since they expected a slowdown in the decline to as much as -20.2%. But much more important were inflation data in Germany and Spain, as they precede similar data for the entire euro area. So, in Spain, that is, the fourth economy of the euro area, the level of deflation declined from -0.9% to -0.3%. This is still a decline in consumer prices, but there is hope that they will begin to rise soon. In Germany, which is the largest economy not just in the euro area, but throughout Europe, inflation accelerated from 0.6% to 0.9%. Thus, we can safely assume that we should expect inflation to rise in the entire euro area. This also means that the European Central Bank will not please us with new measures to ease its monetary policy at least in the near future.

Industrial Production (Europe):

Of course, there is nothing to be surprised that the dollar was losing its position, given such macroeconomic data. Here, and without all kinds of trade wars between China and the United States, it is obvious that the pound and the single European currency should have seriously grown. However, everything is not so simple, as inflation data was published yesterday in the United States, confirming its growth from 0.1% to 0.6%. But recently, there were fears that inflation could even decline and the US economy will slide into deflation. But this did not happen, and the data themselves coincided with the most optimistic forecasts. At the same time, the exchange of political conflict between Beijing and Washington pushed all this into the background.

Inflation (United States):

Today, the inflationary marathon continues, and the UK has already reported on this issue, confidently reporting that consumer price growth has accelerated from 0.5% to 0.6%. However, there were fears that inflation could decline to 0.4%. Thus, rolling into deflation is being postponed until things will get better. And this did not fail to affect the pound, which continued its gradual strengthening.

Inflation (UK):

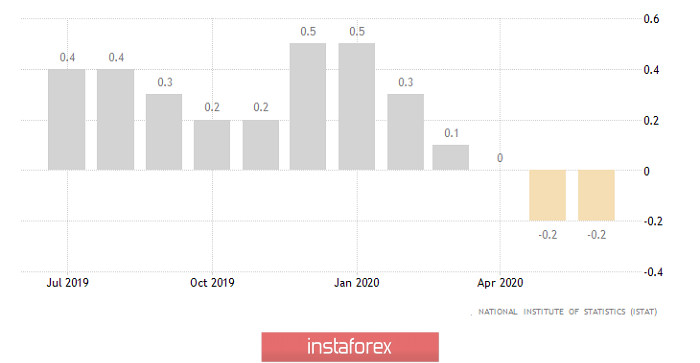

Italy is still the third economy of the euro area to report on inflation. And here, everything is not so smooth, since it should remain unchanged. In other words, the decline in consumer prices should remain at -0.2%. So, yes, deflation continues in Italy. But if you recall the data for Germany and Spain, the pan-European trend is relatively positive. Inflation is rising and this please investors. And in general, data for individual countries of the euro area do not particularly affect the single European currency itself. Therefore, there's no reaction to Italy's data.

Inflation (Italy):

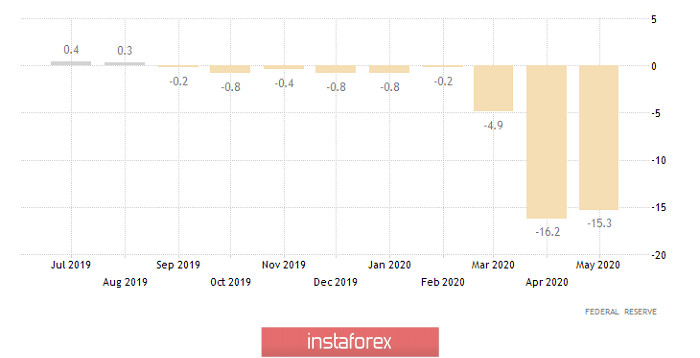

Today, the United States will tell tales about its industry, the decline of which should slow down from -15.3% to -6.2%. Yes, this is a decline in industry. But it is enough to recall the extent of the industrial decline in Europe to see that the situation in the United States is clearly better. But unfortunately, the dollar is now more influenced by political factors. Investors are waiting for a concrete response from Beijing. And as long as this story is remembered, the dollar's growth potential is significantly limited.

Industrial Production (United States):

The single European currency is clearly overbought, and if there are no loud statements from China will follow, then the single European currency will almost certainly decline to 1.1350.

The pound does not look so overbought, which means its position is somewhat better. Nevertheless, it reacted quite weakly to inflation data and so, its growth potential is significantly limited. It can be concluded that if there is a lull on the political front, then data on industrial production in the United States may cause the pound to decline to 1.2550.