When the financial world moves from risk-free assets to interest-free risk, it is difficult to think of a better option than investing in gold. Most likely, April was the worst month in the current recession, and March – for world stock indices. When the worst is over and the markets come to their senses, demand for safe haven assets, primarily the US dollar, falls. At the same time, a large-scale monetary stimulus has generated a lot of instruments with almost zero returns, which are not able to compete with the precious metal.

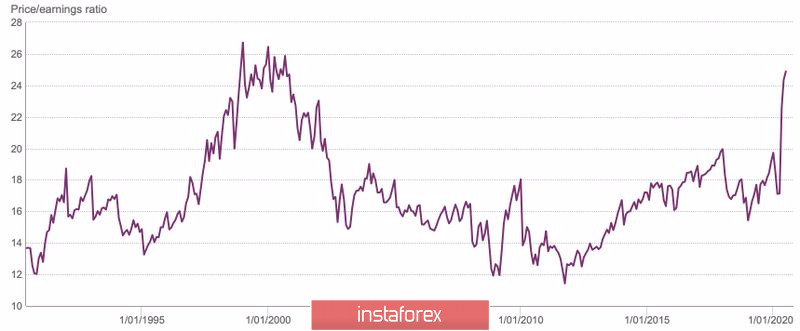

According to Wall Street experts, corporate profits of American companies included in the S&P 500 calculation base will fall by 45% in the second quarter. The financial sector will suffer even more: its losses will amount to 57%. Nevertheless, the stock index recovered more than 40% from the March bottom levels thanks to investor confidence that stocks usually return to trend faster than the economy does after a recession. As a result, the price-to-earnings (P/E) ratio is now as high as it was during the dot-com crisis. Then the bubble burst. Growing risks that it will do the same now support the "bulls" for XAU/USD.

The dynamics of P/E on the American stock

Bonds also cannot compete with gold. Their rates are so low that it feels like the Fed is already controlling the yield curve. At the same time, the acceleration of June inflation in the United States to 0.6% m/m against the background of a gradual exit from the lockdown lowers real rates, which is good news for the precious metal. Even California's reluctance to open because of the growing number of COVID-19 infections does not cause inflation expectations to fall, as the hope of a return to normal life has not disappeared.

There are no competitors for gold among the major world currencies. The pandemic-induced recession has forced central banks to soften their already soft monetary policy. Lowering interest rates to zero levels, quantitative easing programs, and growing balance sheets do not allow monetary units to raise their heads. In Forex, as well as in the stock market, bubbles are inflated, and the precious metal is an excellent tool for hedging the risks that they will burst.

If the choice is small, you do not have to choose for a long time. In January-June, net capital inflows to gold-focused ETFs totaled almost $ 40 billion or 734 tons. This is better than previous records for the whole year both in terms of value ($ 23 billion in 2016) and in kind (646 tons in 2009). Should we be surprised at the first growth of the precious metal over the past 9 years above the psychologically important mark of $ 1800 per ounce?

Dynamics of capital inflows to gold-focused ETFs

The fact that any attempts of "bears" on XAU/USD to launch a correction wave run into the stubborn resistance of their opponents, who do not want to let the initiative out of their hands, indicates that the potential of the upward movement of gold is far from exhausted. A break in the resistance at $ 1815-1820 per ounce will allow you to form longs with targets at $ 1865 and $ 1915.

Gold, the daily chart