Hello, dear colleagues!

Yesterday's trading was mostly risk-averse. This was facilitated by news of success in the development of the COVID-19 vaccine. As you know, work on the creation of a coronavirus vaccine is underway in many countries around the world. In particular, in Russia, the United Kingdom, the United States of America, China and a number of other countries.

Nevertheless, market sentiment was not unambiguously positive, as the next round of tension between the US and China, as well as the continued spread of COVID-19 infections in the US States of Florida, Texas, and California forced investors not to wave their swords and be cautious.

As for the trade relationship between Washington and Beijing, there is considerable uncertainty. As recently as yesterday, US President Donald Trump expressed his disinterest in conducting a dialogue with Beijing. The American leader still blames China for all the troubles associated with the spread of the coronavirus. It is clear that the significant slowdown in the American economy due to COVID-19 significantly reduces the chances of Donald Trump's second term in the White House.

In general, the foreign policy of the United States is based on the mandatory presence of an external enemy. If earlier it was the USSR, now the enemy number 1 has become China, as the economic development of this country is going by leaps and bounds and the PRC is biting off more and more markets from the United States. Of course, there are other "enemies" besides China, such as Russia, Iran, and Syria. You can continue the list if you want, but that's not the point. As for Russia's position, it is clearly expressed in defending its own national interests, and Vladimir Putin, to put it simply, does not engage in provocations from across the ocean and the UK.

Since this article is not political, it is time to move on to the events that occur on the EUR/USD currency pair. Actually, this review is dedicated to it.

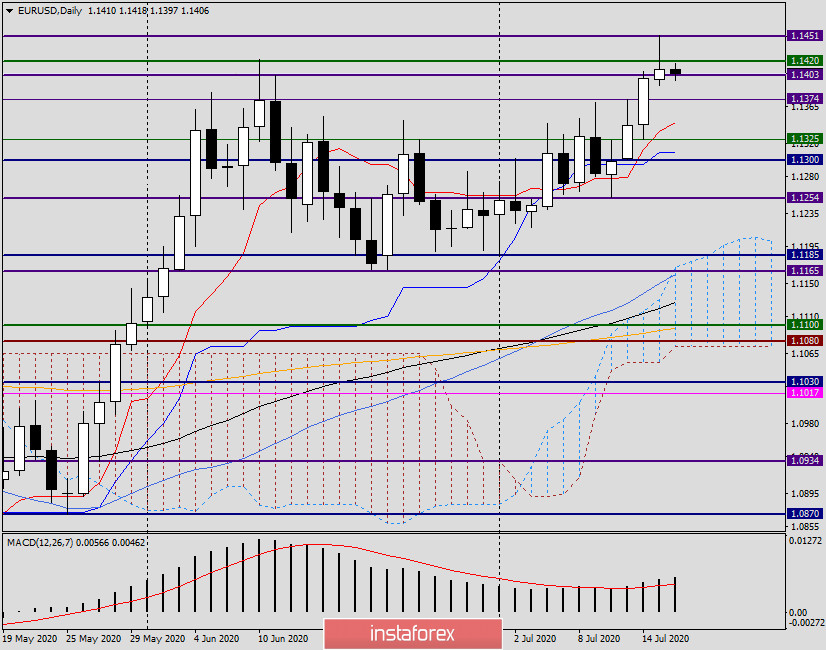

Daily

At the trading on July 15, the euro/dollar currency pair continued its upward movement. As can be clearly seen on the daily chart, the quote rose to the level of 1.1452, that is, there was an attempt to break through the strong resistance of sellers at 1.1422. However, the euro bulls failed to solve this problem, the pair bounced back from the maximum values and ended yesterday's session at 1.1411.

Thus, the level of 1.1422 was only punctured, but not broken. The impression, to be honest, is twofold. On the one hand, yesterday was able to close above the important and significant mark of 1.1400, and on the other, the resulting candle may well be perceived as a reversal model, and the failed (false) breakdown of 1.1422 may affect the balance of forces.

At the time of writing this article, the pair is trading near 1.1406, and it is very interesting and important how today's trading will end. The appearance of a bearish candle is likely to signal a corrective pullback, or even a reversal of the euro/dollar pair. If the euro bulls still have some powder left in their flasks, they need to continue the rise of the quote and absorb the growth of yesterday's candle with a long upper shadow, and this implies closing trades above yesterday's highs of 1.1452. Once again, I will note the resistance that the bull can meet when trying to lift the course. These are: 1.1452, 1.1460, 1.1480, 1.1494 and 1.1500. As previously assumed, only a true breakdown of the important psychological and technical level of 1.1500 will indicate the ability of the euro bulls to continue to fulfill their mission to move the price northward.

A bearish scenario implies the formation of a corresponding candle with the closing price below yesterday's lows of 1.1391. In this case, the correction (let's call it that for now) will have a good chance of continuing.

H1

Looking at the hourly timeframe, you can offer the following trading recommendations, the main of which are still purchases.

I suggest looking at the opening of long positions after a short-term decline to the area of 1.1377, where the level of 38.2 Fibo from the growth of 1.1255-1.1452 and 89 exponential moving average passes. Those who are more aggressive and risky can try to buy a pair near 1.1400.

If, after the rise to the area of 1.1420-1.1450, there are reversal patterns of candle analysis on the four-hour and (or) hourly charts, this will be a signal to open short positions on the euro/dollar pair. At the same time, I recommend setting goals for purchases at 1.1450, and higher at 1.1490. We fix sales in the price zone of 1.1380-1.1360.

At the same time, we do not forget that today at 12:45 (London time), the ECB will announce its decision on interest rates. No changes are expected, and the main interest rate is likely to remain at zero. Following the ECB's decision, a press conference will be held at 13:30 (London time) by the head of the European Central Bank, Christine Lagarde. I believe that this event will be decisive and will have a significant impact on the price dynamics of the euro/dollar. So we do not relax and remain vigilant.

Good luck!