The single European currency and the pound behaved the same yesterday in many ways. Yes, they grew and then declined during the opening of the American session. The only difference is that for the pound, the scale of movements was somewhat more substantial. And this is due to the fact that if the single European currency grew exclusively by inertia, then the pound had real reasons for growth. And the fact that the pound subsequently weakened more rapidly than the single European currency only indicates that it is overbought, although the single European currency is also overbought.

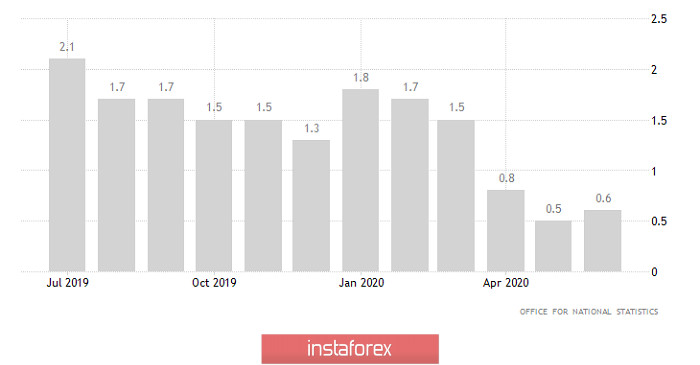

So, the growth of the pound was largely due to the growth of inflation in the UK from 0.5% to 0.6%. The very rise in inflation hints at a gradual recovery in consumer activity, without which economic growth is unthinkable. Naturally, this is an extremely positive factor. So, Yes, the growth of the pound was quite justified.

Inflation (UK):

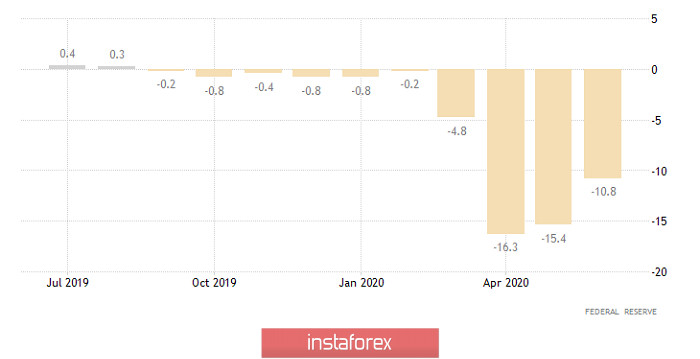

The subsequent decline in the single European currency and the pound was due to the nature of American statistics. Of course, the data on industrial production turned out to be slightly worse than forecasts, but in general, their overall positive tone did not change much from this. It was expected that the pace of industrial production would slow down from -15.3% to -6.2%, which looks very, very impressive, especially the scale of the slowing recession. But at first, the previous results were reviewed for the worse, to -15.4%, which, of course, is not so critical. But the pace of decline itself slowed down to only -10.8%. So the recovery of industry is much slower than predicted. But the fact remains that the industry is gradually climbing out of the hole into which it has fallen.

Industrial Production (United States):

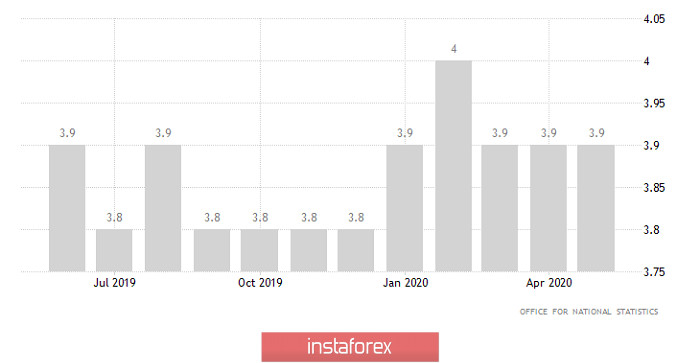

Today, the pound started to confidently weaken, which is still trying to drag along the euro. However, it resists quite well. The data on the labor market is the reason why the pound behaves that way. Although the unemployment rate itself can be misleading, as it remained at the previous value of 3.9%. The fact is that precisely to this indicator there have been too many questions since the outbreak of the coronavirus epidemic. British statistics stubbornly produce amazing figures on the labor market, which are extremely bewildering. So investors pay more attention to indirect indicators, but they are not at all encouraging. Yes, the number of applications for unemployment benefits declined by 28.1 thousand, but this may be due to the fact that the main shaft of cuts and layoffs has already passed and employment services no longer face the wild influx of unemployed. At the same time, employment declined by 126 thousand, which, of course, cannot be considered as a positive factor. This is extremely negative news. In the same way as the situation with wages, the growth rate of which slowed down from 1.7% to 0.7%. But if you look at wages taking into account bonuses and overtime, then their growth rate of 1.0% is completely replaced by a decline of 0.3%. Thus, the situation on the UK labor market is extremely worrisome, and it is not surprising that the pound has confidently declined.

Unemployment Rate (UK):

Formally, the main event for today is the European Central Bank's meeting and largely because of the expectation of its results, the single European currency resists and does not decline after the pound. But, most likely, it will turn out that the meeting itself will pass unnoticed. Not only will there not be any practical changes in the ECB's monetary policy, but also the subsequent press conference will be completely passing. Against the background of a gradual recovery in inflation, Christine Lagarde will confine herself to on-duty phrases about the need to monitor developments and the regulator's readiness to take emergency measures if necessary. To simply put it, this means that nothing changes in the policy of the European Central Bank, and the regulator does not even understand what will happen next. There is nothing surprising in this in the current conditions.

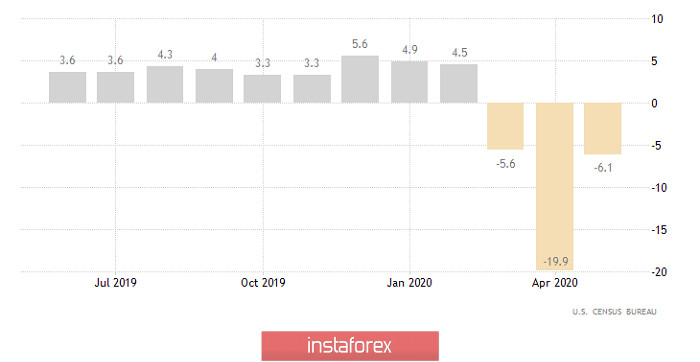

The US statistics may contribute to the dollar's further strengthening. First, a gradual reduction in the number of applications for unemployment benefits is expected again, which indicates a leisurely recovery in the labor market. In particular, the number of initial applications for unemployment benefits may decline from 1,314 thousand to 1,290 thousand. The number of repeated applications for unemployment benefits, in turn, should decline from 18,062 thousand to 17,700 thousand. Yes, the total number of applications continues to be prohibitive but the trend is clearly positive. Secondly, the decline in retail sales should slow down from -6.1% to -3.0%, which also indicates a recovery in consumer activity, although uncertain. In general, the US statistics can be entirely positive.

Retail Sales (United States):

The EUR/USD currency pair still found resistance in the area of 1.1450 after rapid growth, where it slowed down and formed a rebound. It can be assumed that in case of holding short positions, the quote will go towards the subsequent level of 1.1350.

The GBP/USD currency pair showed high activity, during which the quote managed to jump to the resistance area of 1.2620, and then recover almost 100%. It can be assumed that the downward beat specified yesterday was preserved on the market, directing the quote towards the level of 1.2500.