Good day, dear traders!

Yesterday, the Bank of Canada held a meeting, following which no changes in monetary policy were made. The main interest rate of the Canadian Central Bank, as expected, remained at 0.25%. The bank announced the continuation of the quantitative easing program, which is aimed at large-scale purchases of Canadian government bonds with a weekly volume of about 5 billion US dollars. At the same time, the Canadian Central Bank is ready to provide additional incentives, if the situation requires it. Let me remind you that the Bank of Canada and all other leading world central banks are conducting ultra-soft monetary policy to support their economies from the consequences of COVID-19.

If we look at the Bank of Canada's monetary policy report, it shows the beginning of economic recovery in the Maple Leaf Country due to the removal of a significant number of restrictive measures that had to be introduced during the COVID-19 outbreak. The bank also noted that in the second quarter, economic activity fell by 15% compared to the end of 2019, this is a very serious decline, but the worst-case scenarios, fortunately, did not materialize, and they were avoided.

Canada's inflation rate dropped to zero due to a sharp decline in demand for gasoline and airlines. At the same time, the Bank of Canada's target inflation rate now hovers in the range of 1.4%-1.9%. I remember that earlier, before the coronavirus, the inflation target was 2%.

How the Canadian dollar and in particular the USD/CAD currency pair reacted to all this, let's look at the price chart.

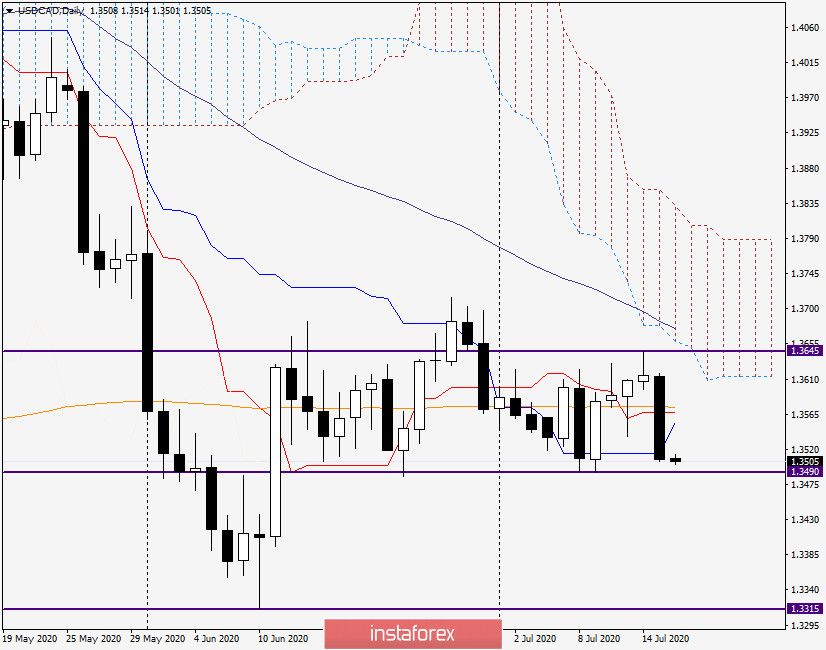

Daily

As we can see, the Canadian dollar reacted positively to the decision and statements of its regulator. Market participants evaluated the Bank of Canada's measures to support their own economy and rushed to buy the Canadian currency.

As a result, the USD/CAD currency pair showed an impressive decline, during which the Tenkan and Kijun lines of the Ichimoku indicator were broken, and with them the 200 exponential moving average. At the end of this review, the pair is trading near the most important psychological and technical level of 1.3500. Largely from the closing of weekly trading relative to this mark, the subsequent direction of the exchange rate of the "Canadian" will be determined. A true breakout of this landmark mark will open the way to the levels of 1.3455, 1.3400 and support at 1.3315.

If the USD/CAD bulls manage to reverse the situation, which is doubtful, the pair will need to return above Kijun, Tenkan, 200 EMA, and then test the strong resistance of sellers at 1.3645 for a breakdown.

Conclusion and trading recommendations for USD/CAD:

Given the positive mood of the market after the decision and report on the monetary policy of the Bank of Canada, as well as the current weakness of the US dollar, the most likely scenario is a downward one.

I suggest you take a closer look at the opening of short positions after short-term rises in the price zone of 1.3550-1.3570. More aggressive and risky, you can try to sell the pair from the current prices or after a true breakdown of 1.3500, on a pullback to this level.

I wish you success!