Increased risk appetite weighed on demand for the yen as a safe-haven asset. In the last few hours, it has been trying to approach the psychological level of 115.00. The yen is rising despite the recent rise in equities and other risk-sensitive assets and weak US bond yields.

The USD/JPY pair is trading sluggishly, which limits sharp swings. It is likely to stay in a narrow range. The gap between the high and the low in the last hours does not exceed 24 pips. This could persist until next week. However, we must be very careful. The lack of liquidity could cause the possibility of sudden spikes.

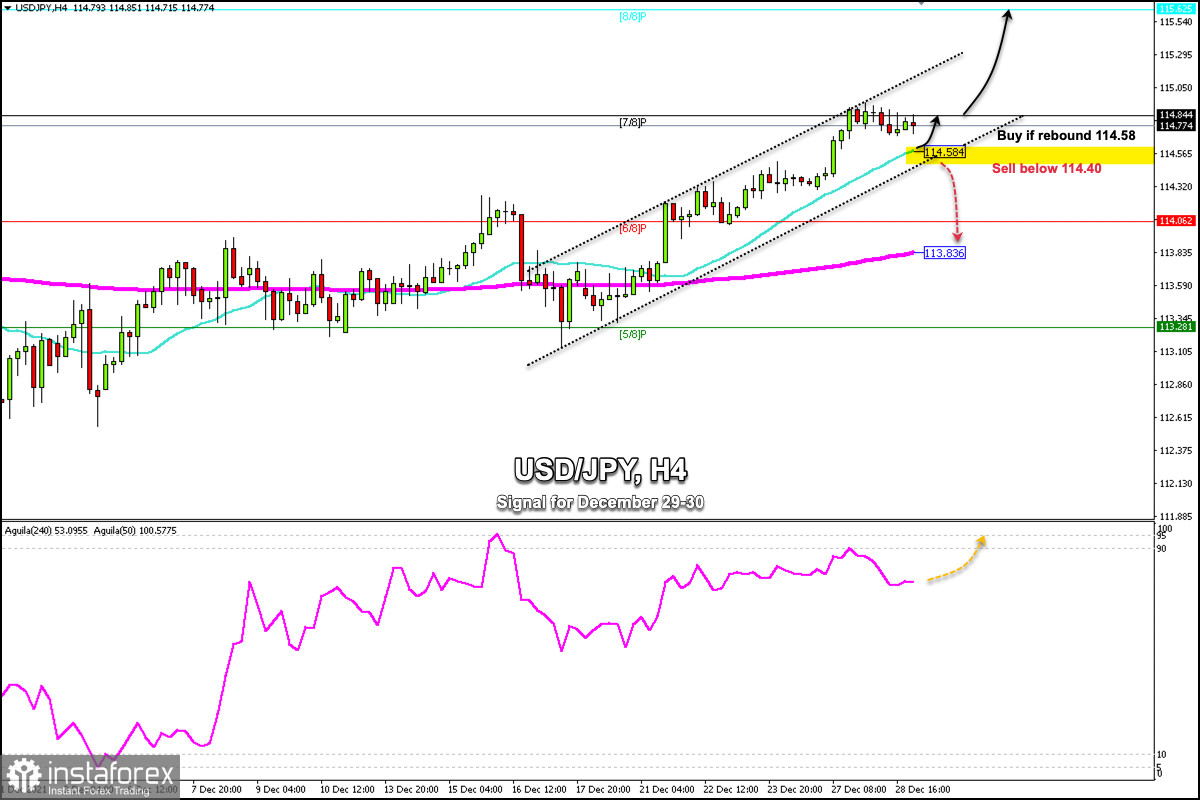

The 7/8 Murray line located at 114.84 represents strong resistance for the yen. The latest candlesticks show that the bullish force is wearing off and there could be a correction in the next few hours to the 21 SMA around 114.58.

A technical bounce around 114.58 (21 SMA) or around the bottom of the uptrend channel will give us another opportunity to buy with the target levels of 115.00 and up to 115.62 of 8/8 Murray.

On the other hand, if the downward movement prevails and if the yen gains demand as a safe haven, a change in trend could occur. A close on 4-hours charts below the 21 SMA and below 114.40 is likely to decline to the 6/8 Murray at 114.06 and to the 200 EMA located at 113.83.

The market sentiment report shows that 73.85% of operators open long positions the yen. This can be a positive sign given that there is a strong accumulation and this indicator acts in inverse correlation with the price. Therefore, a break below 114.40 will be an opportunity to sell with the target level of 112.50 (4/8) in the medium term.

Support and Resistance Levels for December 29 - 30, 2021

Resistance (3) 115.25

Resistance (2) 115.07

Resistance (1) 114.94

----------------------------

Support (1) 114.70

Support (2) 114.59

Support (3) 114.32

***********************************************************

A trading tip for USD/JPY on December 29 - 30, 2021

Buy in case of rebound off at 114.58 (21 SMA) with take profit at 115.00 and 115.62 (8/8), stop loss below 114.18.