Yesterday's releases did not help the Australian currency against the US dollar in overcoming the key resistance level of 0.7000. Another assault ended with another failure: the pair attracted sellers as soon as the price crossed the red line, which provoked a downward pullback. Neither optimistic data on the growth of the Chinese economy, nor (especially) data on the growth of the Australian labor market, turn into a catalyst for the aussie's growth. By and large, the fundamental background for the aussie has not changed much – however, now there is a risk of strengthening the dovish rhetoric from the Reserve Bank of Australia. As it turned out, the Australian economy is not recovering as fast as previously expected. This fact will put background pressure on AUD/USD - especially amid the ongoing political conflict between Australia and China.

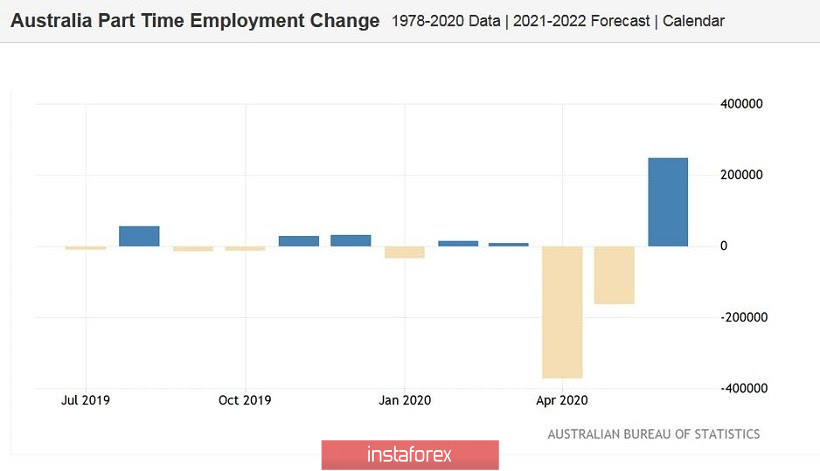

Data on the growth of the Australian labor market in June was released yesterday. It is worth noting here that Australia began to quit quarantine in early May, so investors expected to see a steady increase in the June indicators. But the release was, to put it mildly, controversial. Firstly, the unemployment rate was in the red zone: instead of the expected increase to 7.2% (from the previous value of 7.1%), the indicator unexpectedly rose to 7.4%. Secondly, the IPA's estimate of real unemployment is 11.7%, and the total number of unemployed almost reached one million people - this is the highest in the entire history of the study, that is, since 1978.

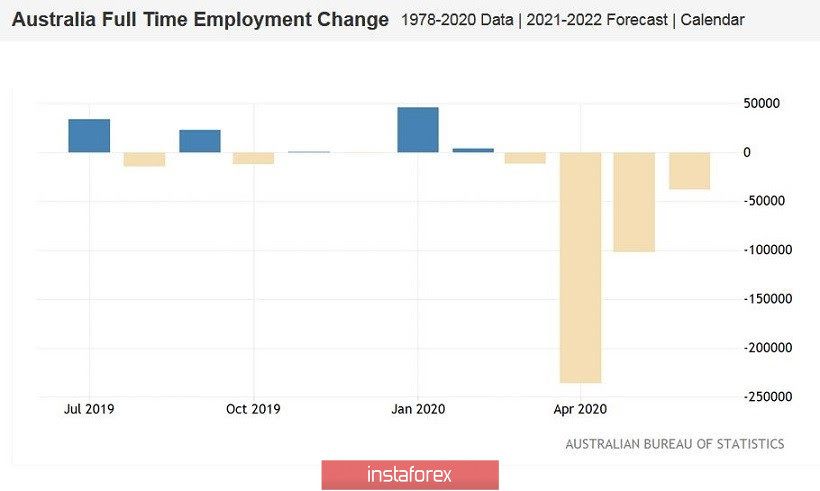

As for the growth rate of the number of employed, it immediately jumped to 210,000 (with a forecast of growth of 106,000). And although de facto this is a really strong result, it is separately necessary to dwell on the structure of this indicator. The fact is that the positive dynamics of the growth of employment in December was only due to the increase of part-time employment - this component jumped by 249,000. Whereas full employment showed negative dynamics, decreasing by 38,000. This trend may negatively affect the dynamics of wage growth, as regular positions, as a rule, offer a higher level of wages and a higher level of social protection. Therefore, in the context of recent statements by RBA Governor Philip Lowe, published data on the growth of the Australian labor market are negative.

But the Chinese data came out in the green zone. And although some experts doubted the objectivity (reliability) of the published figures, the release itself could increase interest in risky and commodity currencies. According to official reports, China's GDP in the second quarter grew by almost 12% in quarterly terms and by 3.2% in annual terms. Both components were better than expected, reflecting the recovery of the world's largest economy. The industrial production indicator also showed a positive trend (+4.8% y/y).

However, the Australian dollar coolly reacted to news from China. The ongoing Australian-Chinese political conflict puts background pressure on the aussie acting as a kind of anchor for AUD/USD. The conflict has been smoldering since spring, when, in the midst of the pandemic, Canberra became one of the initiators of the anti-Chinese campaign, urging the world community to conduct an independent investigation of the causes of the spread of coronavirus. This proposal was supported by more than 120 countries, but at the same time it was extremely negatively received by the Chinese side. Beijing accused Australia of "attacking China", after which the political conflict passed into the economic plane. The Chinese, in particular, increased duties on certain types of Australian goods, while refusing to import beef. The Australian foreign ministry was trying to organize a negotiation table with Beijing, but the Chinese have ignored (and are still ignoring) such requests. Later, the conflict worsened - mutual accusations of espionage and almost subversive activities followed. The latest example of diplomatic instability was the PRC's threat to retaliate after Australia's offer of asylum to people from Hong Kong.

All this suggests that the tension between the two countries persists, and this fact does not make it possible for buyers of AUD/USD to count on a stable growth trend. Conflicting data on the growth of the Australian labor market only added fuel to the fire. By and large, the current spikes in purchasing activity are due only to the weakness and vulnerability of the US currency, while many fundamental arguments play against the aussie.

All this suggests that the growth of AUD/USD should still be considered as a reason to open short positions. The resistance level is located at 0.7020 - this is the upper line of the BB indicator on the daily chart. Buyers have repeatedly tried to overcome this target since the beginning of June, but to no avail. Therefore, you can consider sales with a target of 0.6930 in this price area – this is the average line of Bollinger Bands on the same timeframe.