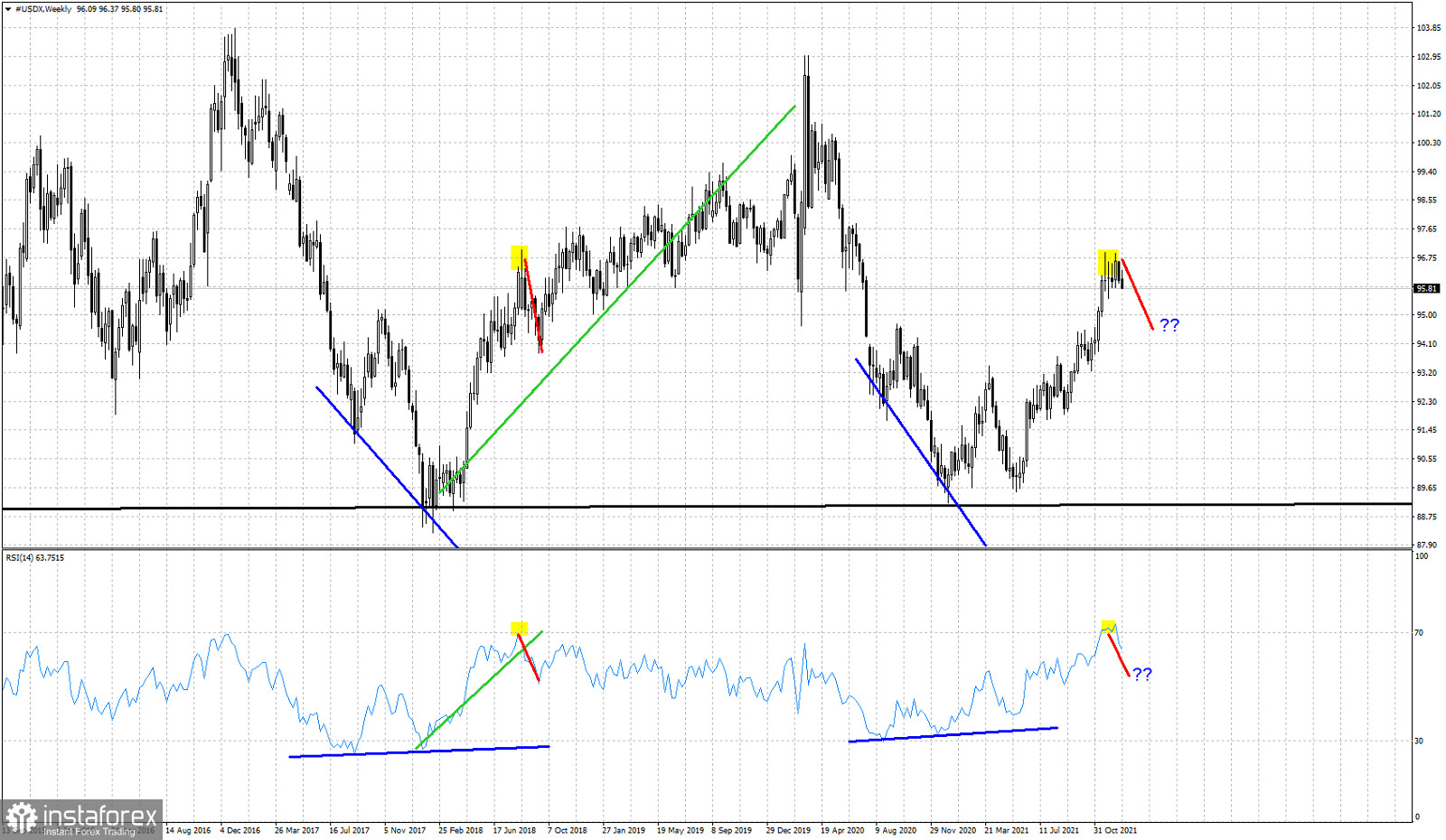

We have mentioned in previous posts before, the similarities of the current technical picture on the Dollar index, relative to the price action and the similar conditions back in 2018. Our conclusion was that the most probable outcome would be for the Dollar index to make at least a downward move that would last at least two to three weeks.

Red lines - expected path

Yellow rectangles- similar tops

Back in 2018 a short-term top around the same levels we were over the last two months, lead to a decline that lasted nearly 5 weeks and took price from 97 to 93.80. The same decline is what we also expect to see at least in the near term. At current levels we prefer to be neutral if not bearish Dollar, as we believe there are more chances of a move lower and that the upside is limited. ;ast week price made a negative close and this week we are now trading below last week's lows. With the RSI turning below 70, I can see that it is very probable to repeat such a decline if not bigger.