Good day, dear traders!

At the trading last week, the British pound fell against the US dollar by 0.35%. The main negative impact on the downward dynamics of the British currency was caused by market participants' fears that the Bank of England may switch to using negative interest rates in the very near future.

Due to the COVID-19 epidemic and the forced introduction of several restrictive measures, the economy of the United Kingdom is rather pale.

I will not mention again the May data on UK GDP, they were much weaker than forecasts. I will better indicate the most important British reports that will be presented to investors during the trading on July 20-24. If we talk about macroeconomic statistics from the UK, in my opinion, the most attention of market participants will be focused on data on retail sales, the index of manufacturing activity PMI, as well as the number of net borrowings of the UK public sector. For more detailed information on these and other events, it can be found in the economic calendar. Just in case, I note that there are no macroeconomic reports from either the UK or the US scheduled for today, so the pair will be influenced by technical factors and market sentiment, which has recently been determined by the situation related to the spread and threat of the second wave of COVID-19.

Of course, other global issues affect market sentiment, including the ongoing trade standoff between the US and China. In truth, it seems that this confrontation will never end. In my personal opinion, one of the main culprits of this situation is the current head of the White House, Donald Trump, whose contradictory and sometimes inappropriate statements aggravate the situation and provide opportunities for its normalization.

Regarding the pound, the current impact on its price dynamics will continue to have the theme of Brexit. This will continue until all points are placed between the UK and the European Union in the divorce proceeding. However, this is a topic for a separate review. Let me just remind you that Brexit has been going on for about four years and is quite painful. It is necessary to understand that almost half of the UK's exports are to the EU countries. That is, the dependence of trade relations between the parting parties is very great, and then there is the coronavirus, which has caused a very painful blow, especially to the British economy. In general, there is still something to work on, and there is enough time before the end of this year. Let me remind you that the process of Britain's exit from the EU should be completed by December 31 this year.

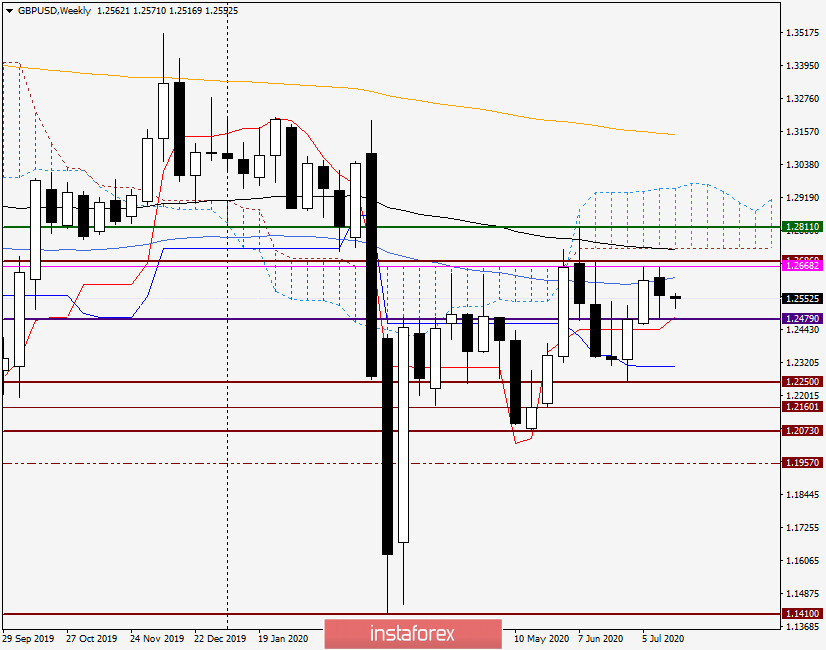

It's time for us to consider the charts of the GBP/USD currency pair, and let's start with a weekly timeframe to analyze the prospects for the price movement of the pound/dollar pair, after Friday's closing of trading.

Weekly

As already noted at the beginning of the article, at the trading of the last five days, the "British" declined against the US dollar. However, the decline was not so significant, and the last weekly candle has a long lower shadow.

During trading on July 13-17, the GBP/USD pair traded in different directions. There was a decline under the significant psychological and technical level of 1.2500 but has found support at 1.2479, the quote began to recover. As a result, the last trading week ended for the pound/dollar pair at 1.2563, which is not so bad for the prospects of further implementation of the upward scenario.

As for the resistance, it was again provided by the 50 simple moving average, and the technical zone near 1.2668 is also strong. As you can see, the maximum values of the previous trades were shown at 1.2665. Still, if we consider the prospects for growth of the pound/dollar pair, they are very vague. To do this, players need to use all their resources to increase the rate and overcome many strong resistances from sellers. In the case of a census of previous highs, the next targets of the bulls for the pound will be 1.2668 and 1.2686. Then the pound bulls will have to bring the price within the limits of the Ichimoku indicator cloud, and it will be quite difficult to do this since there is a black 89 exponential moving average right on the lower border of the cloud, which can resist attempts to move the pair in the north direction. At the same time, strong support is observed in the price zone of 1.2480-1.2440, where the lows of the last two weeks and the Tenkan red line.

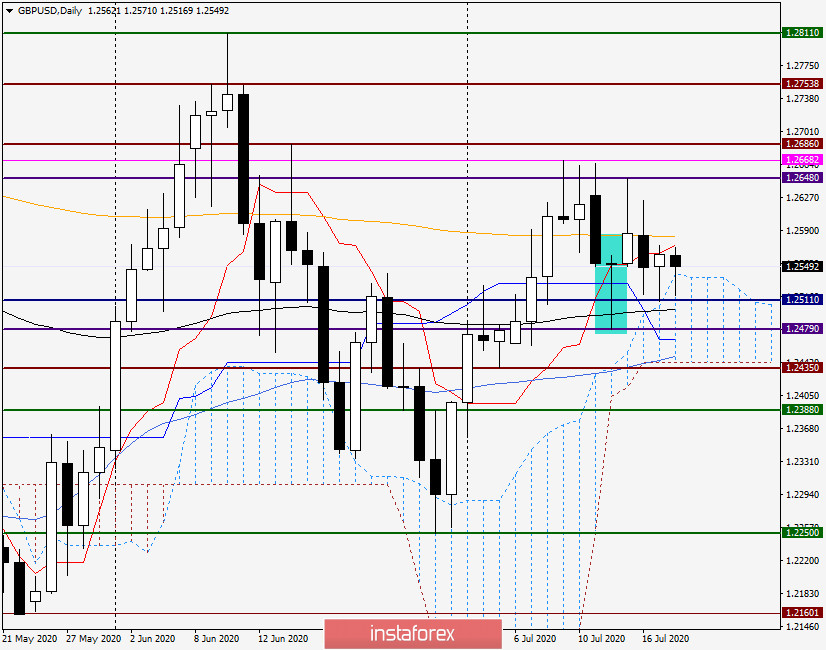

Daily

The daily chart shows a contradictory and uncertain picture. It would seem that after the appearance of the candle for July 14, which with good reason could be considered a reversal, the growth began. However, the next candle, with highs at 1.2648 and a large upper shadow, showed that the bulls on the pound do not have enough strength to move the quote in the north direction. I believe that the 200 exponential moving average (orange) played an important role in this situation, which cannot be overcome and fixed higher. The same applies to the Tenkan red line.

The nearest support zone is 1.2511-1.2479, and the resistance area is 1.2648-1.2686. I believe that the true exit of the pair from the range of 1.2686-1.2479 can largely determine its prospects. At the moment, it is still possible to position in both directions.

Trading recommendations for GBP/USD:

Given the uncertain nature of the price movement of the pound/dollar pair, I will indicate options for sales and purchases. The nearest sales can be considered in the price zone of 1.2580-1.2620. Above, I recommend that you take a closer look at the opening of short positions after the growth in the area of 1.2645-1.2685 and the appearance of reversal patterns of candle analysis on the daily four-hour and hourly charts.

We are looking for options for the nearest purchases after the pair's decline to the area of 1.2540-1.2500, and lower after a short-term fall to the support level of 1.2479. Before opening long positions, I also recommend that you enlist the support of the corresponding candle signals on the daily and lower charts. That's all for now.

Good luck!