The second half of July was full of events that could radically change the current market structure. First of all, this concerns the major currencies, such as the US and European, which are acutely experiencing ups and downs. Now, this list has been replenished with the cryptocurrency impulse - Bitcoin, which also actively defends its leadership position, despite periodic failures.

With regard to the US currency, experts are unanimous in the opinion that the peak of its growth is over, and now the dollar needs to prepare for difficulties. The dollar will have to gather all his strength to fight for market leadership, primarily in a pair with the euro. Analysts consider the Eurocurrency to be a worthy rival of the USD, on whose side is the active support of European states.

The European currency experienced an unprecedented rise in hopes related to the EU summit at the end of last week. It was assumed that last Friday and Saturday, July 17-18, European leaders will be able to agree on the creation of a common fund for the countries of the European bloc most affected by the COVID-19 pandemic. In the case of a positive decision, a single currency could receive additional strong support.

However, the current situation was not as rosy as the market expected. On the first day of negotiations, the parties could not reach a compromise either on the EU's seven-year budget plan for 2021-2027 in the amount of € 1.074 trillion, or on the financial assistance fund in the amount of € 750 billion. According to the plans of the European Commission, the countries of the Euroblock, during a pandemic, will receive this loan (€ 750 billion) for its restoration, and loan payments are provided until 2056.

The current situation has become a problem for the European currency. Uncertainty about the financial aid fund and the inability of European leaders to agree on a number of key issues began to undermine the position of the euro. Experts fear that the euro will begin to fall under the onslaught of the dollar again, creating a distortion in the EUR/USD pair. According to experts, the current EUR rate has already considered the probability of creating a single EU fund, but the risk of failure remains. According to analysts at Societe Generale, if progress is made in the negotiations, the euro will receive a strong impulse for growth to 1.2000 in the coming months. If the opposite scenario is implemented, that is, the collapse of the negotiations, the Eurocurrency will noticeably decline, the bank is confident. As a result, Societe Generale warns that the EUR/USD pair is capable of sliding to the level of 1.1000.

Currently, the EUR/USD pair show a clear upward trend. On Monday morning, July 20, the pair started from a moderately high position of 1.1441, gradually gaining impulse. Later, the EUR/USD pair was trading near the range of 1.1451 - 1.1453, trying not only to consolidate at current levels, but also to overcome next barriers.

The confident rise of the pair was noticed by the market. Experts have recorded the growth of the euro and the dollar in efforts to overcome obstacles that slow down the rise in USD. At the same time, many analysts are confident that the chances of a dollar for further growth are not very high. Economists believe the reasons for this are the growing Fed balance sheet and excessive liquidity of the dollar supply. Against this background, the prospects for the recovery of the American economy, weighed down by a new round of the COVID-19 pandemic, look unclear. The current situation has an extremely negative impact on the dynamics of the USD, making it less attractive to investors.

Cameron Winklevoss, one of the founders of the Gemini crypto exchange, gave the exact definition of the dollar's decline, saying that the Fed had hacked the dollar. Such statements by the businessman are caused by the actions of the Federal Reserve, which has repeatedly emphasized its readiness to turn on the printing press in case the US economy needs it. The Gemini co-founder, along with most analysts, believes that USD's current hack weakens the national economy, exhausted by the struggle with the consequences of COVID-19.

Meanwhile, other crypto enthusiasts have gone even further, accusing the regulator's leadership of incompetence. For example, Robert Kiyosaki, author of the popular book Rich Dad Poor Dad, argues that current Fed policies are killing the US economy. In addition to the negative impact on the dollar, he believes that the current actions of the regulator can provoke a sharp rise in the price of the first cryptocurrency to $ 75,000. Such statements look fantastic given the current course of a major digital asset. On Monday, July 20, Bitcoin is trading near $ 9139- $ 9140, that is, it is far from even reaching the psychologically significant mark of $ 10,000.

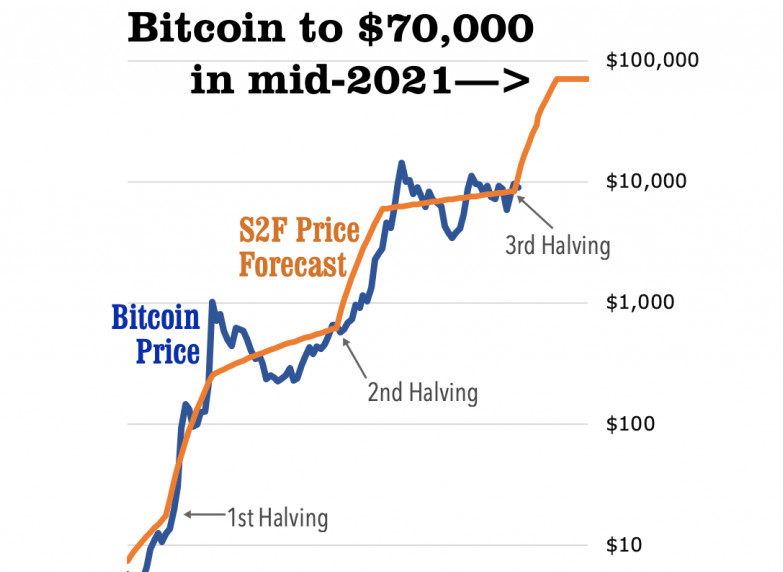

However, analysts and participants in the cryptocurrency market do not lose hope. Many of them are close to the position of R. Kiyosaki, for example, the experts of the Weiss Crypto Ratings research company, who predict a Bitcoin rally to $ 70,000 by mid-2021. They use the Stock-to-Flow (S2F) model as an argument. It can be recalled that this indicator includes the ratio of the total supply of the asset and its annual growth. According to the calculations of Weiss Crypto Ratings, based on the S2F model, the value of MTC may increase many times over the next 12 months.

Experts explain the "bullish" moods in relation to the leading digital asset for two reasons: the growing popularity of military-technical cooperation among institutional investors and the instability in the global economy caused by the growing issue of the US dollar. According to analysts, it was the emission that became the weakness of the US currency. The euro took advantage of the dollar's current weakness, finding itself on the rise at the end of last week. At the moment, experts and market participants are witnessing the confrontation between the "American" and the "European" in the EUR/USD pair. They watch with hopeful breath the struggle with an unpredictable outcome, counting on maintaining the balance in a classic pair.