Latest COT report (Commitments of Traders). Weekly outlook for EUR/USD

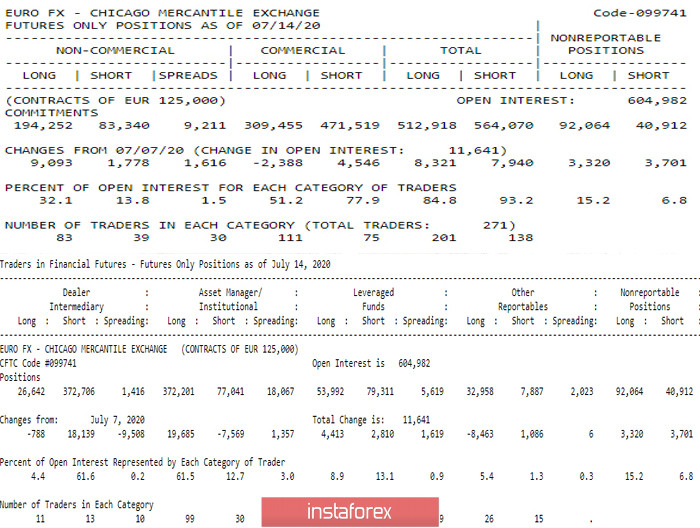

The next COT report (Commitments of Traders from 07/14/2020) showed an increase in open interest in the European currency again - 604982 (07/14/2020) against 593341 (07/07/2020). It should be noted that the groups of large players, whose indicators are mostly used in the analysis of reports, have increased their net positions in the dominant directions. The Non-Commercial group increased its support for the upside by 7315 (long 110912 net position). At the same time, the net position of the Commercial group is also in the positive zone (short 162064 (+6934)). Here, it should be noted that, despite the increase in comparison with the previous report, the support for the bears still declined. Most actively, long positions were increased by customers of leading dealers (net position 346064 (+18927)), in this group for the reporting period, the maximum percentage advantage of open positions is 4.4 against 61.8.

Main conclusion

The support of the players to increase and decrease the final long-term advantage of the opponent allowed to update the maximum extremes and go beyond the long-term downward correction during the reporting period. If this tactic is maintained, bullish traders may continue to strengthen their positions in the near future.

Technical picture

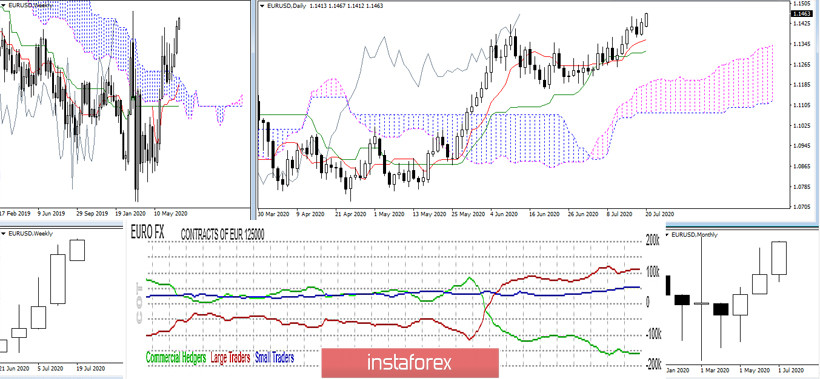

On the charts, there is a recovery of the upward trend on the daily and weekly times frames. This circumstance was confirmed in the expansion of the forming bullish clouds of Ichimoku. The nearest significant upward reference is now the maximum of the March candlestick 1.1496, consolidation above which will open the way to new bullish target prospects. In this situation, a significant support can be noted in the region of 1.1320-60 (daily cross of Ichimoku) and 1.1160 - 1.1200 (daily cloud + upper border of the weekly cloud + weekly Tenkan).

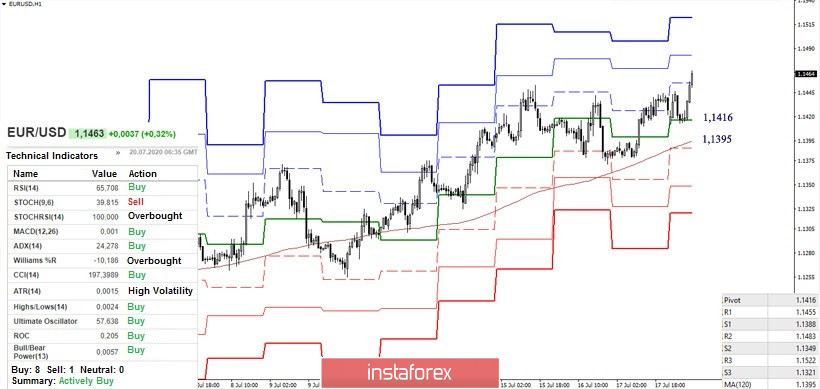

An upward trend is currently developing in the lower halves with the support of all analyzed technical instruments. The upward reference points within the day are the resistances of the classic Pivot levels 1.1455 (R1) - 1.1483 (R2) - 1.1522 (R3). In the case of a downward correction, the key support of H1 is located today in the region of 1.1416 (central Pivot level) - 1.1395 (weekly long-term trend). Anchoring below will change the balance of power in the lower halves and require a new assessment of the situation.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)