The failure of negotiations in the EU on the recovery Fund on Monday, and then the agreement reached, caused high volatility in the currency and stock markets in Europe. At first, trading started in a negative way. Shares of European companies and the rate of the single European currency were under pressure,but as the market began to filter rumors that the summit did not stop its work and the negotiation process continued, we should thank Spanish Prime Minister, Sanchez.

He said he was confident that EU leaders would reach an agreement on the Recovery Fund on Monday within a few hours. This was the important supporting factor that turned up the European stock market and the rate of the single European currency, which was tightly correlated with it.

Another event, in our opinion, is important from the point of view of the reality of the invention of a working vaccine against COVID-19 - this is the message that European structures have begun to discuss the possibility of purchasing hundreds of millions of doses of vaccine from America. This can only indicate that there is insider information from US pharmaceutical companies that the drug is being tested successfully, which is also confirmed by the companies themselves, which means that mass production of these drugs will begin either by the end of August or in September. In this case, we expect an increase in demand for risky assets with a simultaneous start of a noticeable drop in the dollar rate in the currency market. Investors will no longer perceive the coronavirus infection as an impassable obstacle.

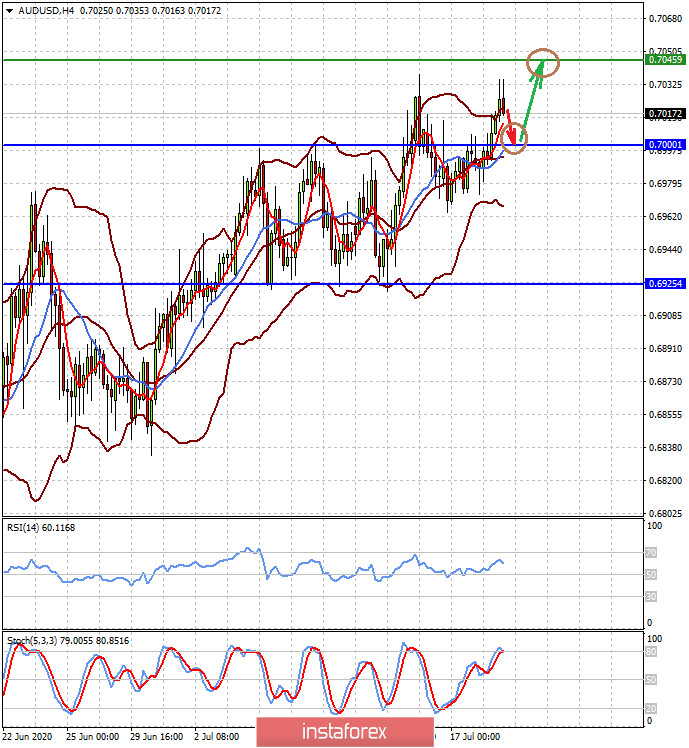

On Tuesday, we will single out the publication of the minutes of the last meeting of the Central Bank of Australia from the important events of the day. In addition, investors will closely follow the words of the head of the RBA, Lowe. We do not expect that the minutes will reveal anything new, different from the final decision of the Central Bank on monetary policy. The attention will most likely continue to focus on the topic of coronavirus and its consequences for the Australian economy. As in the States, this is the number one topic and is the main limiting factor in Australia.

Retail sales in Canada are also released today. The core retail sales index is expected to rise 12% in May against the 22.0% fall in April. It is expected to jump 20% from a 26.4% decline in May.

Despite the likely strong data, which is just a pullback after a landslide fall in the spring, do not expect the Canadian currency to change significantly. Consolidation of crude oil prices is holding back the unambiguous dynamics of the Canadian currency against the dollar, against which it has been consolidating for a month and a half.

As before, we believe that real movements in the currency market will only begin after the introduction of vaccines against coronavirus infection, and so, the current dynamics in the market will continue until this happens.

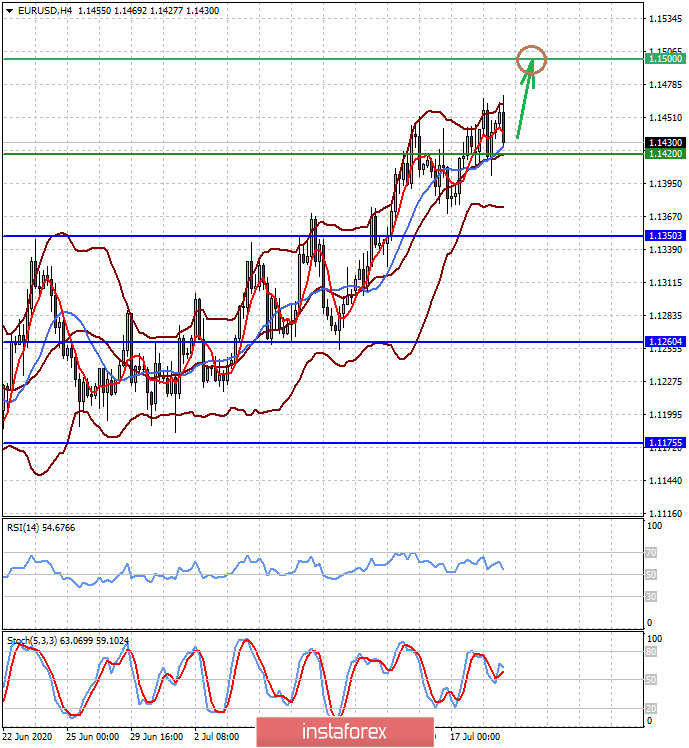

Forecast of the day:

The EUR/USD pair seems to have consolidated above 1.1420. If it holds above it, there is a high probability that the price will continue to rise to 1.1500.

The AUD/USD pair rose on the wave of the publication of the minutes of the last RBA meeting. On the wave of positives regarding the production of vaccines against COVID-19 and the growth of the Chinese stock market, it may continue to grow to the level of 0.7045 after a slight correction and even higher - 0.7100.