US and EU stock indices started off the week in the positive zone, strengthened by hopes for a COVID-19 vaccine in the near future and persistent efforts by European leaders despite initially significant disagreements, to form an EU recovery fund.

The US reported a 1.3% increase in cases of the virus, the slowest daily increase in two weeks. This is a promising result as it suggests the peak infection rate may be behind us, improved risk appetite and stronger euro are driving the US dollar down, a trend likely to continue in the coming days. The dollar weakening will also be facilitated by negotiations between the Republican part of the US Congress and the Trump administration on another package of measures to stimulate the US economy "in the trillion dollar range."

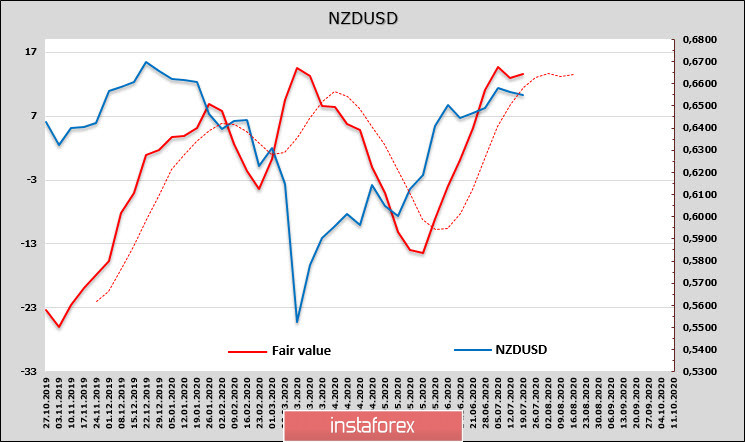

NZD/USD

The New Zealand dollar is trading near the June high, while, unlike most G10 currencies, has pretty good reason to continue growing. Expenses on credit cards rose sharply in June, and they amounted to only -9.2% y/y against the forecast of -24.7% y/y, which is significantly better than the level of May and indicates a fast pace of recovery in consumer demand. Although inflation eased 0.5% in Q2, the year-on-year remains in the target zone at 1.5% in line with forecasts, and there is a good chance that inflation will rebound in Q3.

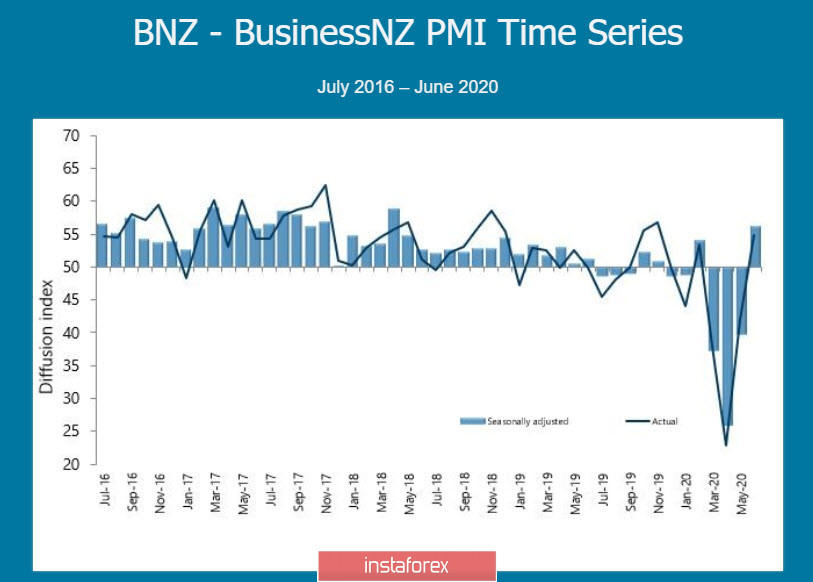

As far as business activity is concerned, significant shifts are observed here as well. And if PMI in the service sector rose from 37.5p to 54.1p was generally expected, since almost all restrictive measures were lifted, then the simultaneous surge in activity in the manufacturing sector was a big surprise, the growth to 56.3 p against 39.7 p in May immediately brought the PMI index into a zone of strong growth. This indicator implies, among other things, a confident recovery in exports, which many other countries cannot boast of.

It should also be noted that there was no collapse in the housing market, which was facilitated by a decline in mortgage interest rates and the introduction of payment deferral schemes, and wage subsidies.

Thus, fundamentally, New Zealand's economy looks more convincing than many others. The CFTC report was also in favor of the kiwi, the growth of longs led to the formation of a net long position, and although the margin is not large, the estimated fair price level is kept above the average and slightly above the spot, which gives the chances for the growth to continue.

It is not yet possible to go above the 0.6560/80 resistance zone, but the chances are good. It is logical to buy with the calculation of a breakout of the resistance zone and the goal of 0.6750 - a docked maximum, where the NZD will aim in the coming weeks.

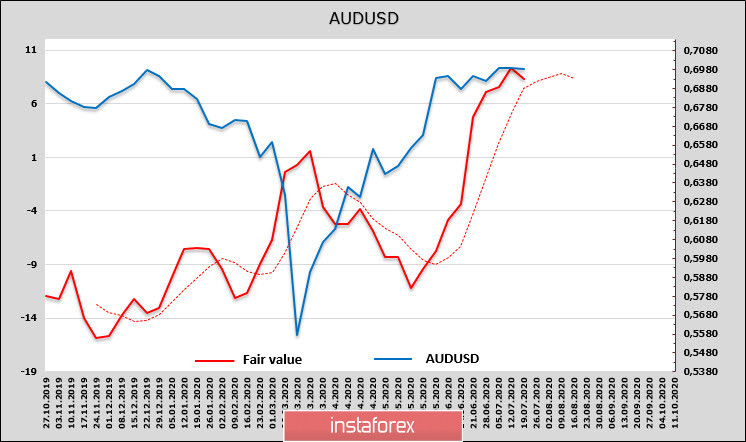

AUD/USD

NAB Bank overestimated the impact of COVID-19 on the Australian economy. In particular, the decline in GDP in the second quarter is now expected to be about 4%, and not 8.5%, as previously assumed. NAB also notes a sharp increase in business activity, but advises to treat research with caution, since all indicators are still at a low level by historical standards.

The publication of the minutes of the RBA meeting did not stir up interest, as did the speech of the head of the RBA on the situation in the Australian economy.

The calculated Australian level is almost equal to the spot price. The futures market is net long on the Aussie, but momentum is weakening.

As long as the risk appetite remains high, the AUD has a chance to continue to rise. The second attempt to break through the dock high of 0.7025 has a good chance of being successful, consolidation above which will open the way to 0.7080. However, stronger growth is still in question, since the reasons for the growth of demand for risk in the current environment should still be recognized as quite weak.