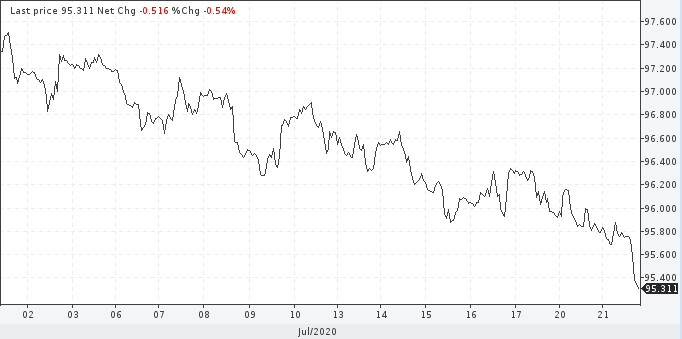

The nine-year upward trend of the US dollar is questionable. Now we are witnessing a correction that seeks to break the long-established upward trend of the greenback. There are technical and fundamental rationales for this.

The one-month chart of the index indicates that the US currency has once again stalled at the 33-year trendline, which has proven its enormous resistance more than once since 1987. Yes, there was one exception to the rule that happened at the turn of the century - in 1999. Then the resistance was overcome without difficulty. The dollar index rose rather quickly, but the rise turned out to be short-term, and then a prolonged "bearish" phase followed.

On the way down, the fall accelerated, and the loss of the US in less than two years reached 20%. By the time the bearish market ended, the dollar index was down by 40%.

Fast forward to see that a rounded top has formed in an area of significant resistance. A fall beyond the 95 mark will complete the formation of the top and provoke a decrease of at least 10%. This drop will turn all of the index's moving averages downward, indicating a major downward trend change.

USDX

Economic and political risks indicate a decline in the dollar. By the end of the month, congressmen should agree on additional stimulus measures to support the US economy in the face of a pandemic. Failure to agree on the aid program will make the economy look gaunt ahead of the presidential election, and Donald Trump will have little chance of winning the presidential race a second time. Many investors are already preparing for the fact that Joe Biden will be able to push Trump out of the presidency. At the moment, the Democratic candidate is ahead of Trump in popularity by about 20 points. This is mainly due to the massive dissatisfaction of the Americans about the measures taken to combat the pandemic.

A Democratic victory is expected to negatively impact the dollar. In addition, there are signs that demand for the dollar as a safe haven asset is waning. Finally, experts note that the greenback lost its yield advantage when the Fed decided in March to cut the rate by a full percentage point for the first time since 2015.

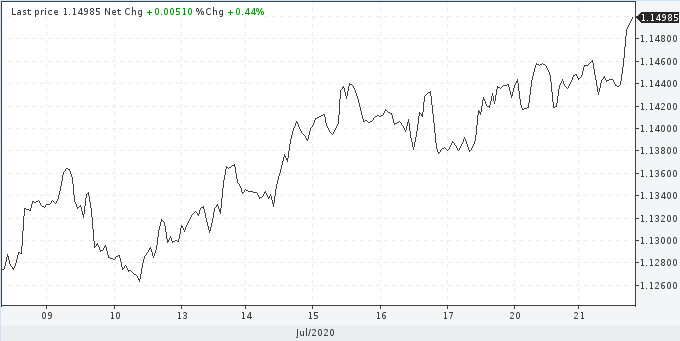

So why might the dollar start a bearish phase? Investors are already losing faith in the dollar due to the fact that Washington was unable to take control of the coronavirus pandemic, as other countries have done. They have flattened their curves and their economy is likely to recover sooner than that of the US. The difference in the growth trajectory will force investors to bet on other currencies, such as the euro.

An important agreement of the EU leaders on economic recovery was made. For the first time in the history of the countries of the block, they launched the emission of common European securities, which will create a real threat to the superiority of the dollar in the financial markets. Being in a depressed state for a long time, the euro may rise to multi-year highs. One of the forecasts, which was announced in Mizuho, envisages an increase in the euro against the dollar in the coming months to $ 1.30. Experts admit that the euro can take the place of a safe asset. After the transaction, its real value must be at least $ 1.22.

EUR / USD

Other strategists made similar, but more modest forecasts. Credit Agricole expects the euro to rise to $ 1.18 "and higher". Their recommendation is to buy the euro "on downturns in the short term, with any new long positions targeting a break above the highs of the year."