A surge of optimism regarding the results of successful trials of vaccines against coronavirus infections, conducted by a number of US pharmaceutical companies, gave investors hope that drug production will begin in the near future.

Markets rallied again on Tuesday, driving up demand for stocks in companies that had previously experienced widespread problems due to the impact of the pandemic. On this wave, the US dollar expectedly came under pressure and continued to decline to a basket of major currencies, and not only to them. Its weakness is natural given the direct dependence of the demand for dollars as a safe-haven currency, which manifested itself again in the spring and summer of this year in the wake of the coronavirus pandemic, on the demand for company shares.

Earlier, we have repeatedly pointed out that large-scale stimulus measures in the United States fundamentally weaken the US currency, but this weakness was constrained by the high risks of the consequences of COVID-19 for the country's economy, which led to a decline in the value of company shares, crude oil and other commodity assets. But at the moment, with one drug company after another reporting successful trials, it is already becoming clear that mass production of vaccines is likely to begin in September and the reign of COVID-19 will decline markedly. In this case, the fundamental weakness of the dollar will come to the fore, which may quite significantly decline in the long term, primarily in relation to highly profitable currencies, commodities and, of course, to the euro and pound.

We believe that such a scenario of the development of events will already be implemented, as they say now. The decline in the US currency rate, which began against the basket of major currencies three months ago, will only strengthen.

On the other hand, important economic data will be released today, which can only push the dollar to a further decline if it turns out to be above expectations. These are the values of sales in the secondary home market for the month of June in the United States. They are expected to rise to 4.78M on a monthly basis from 3.91M. In percentage terms, growth may amount to 24.5% against 9.7%.

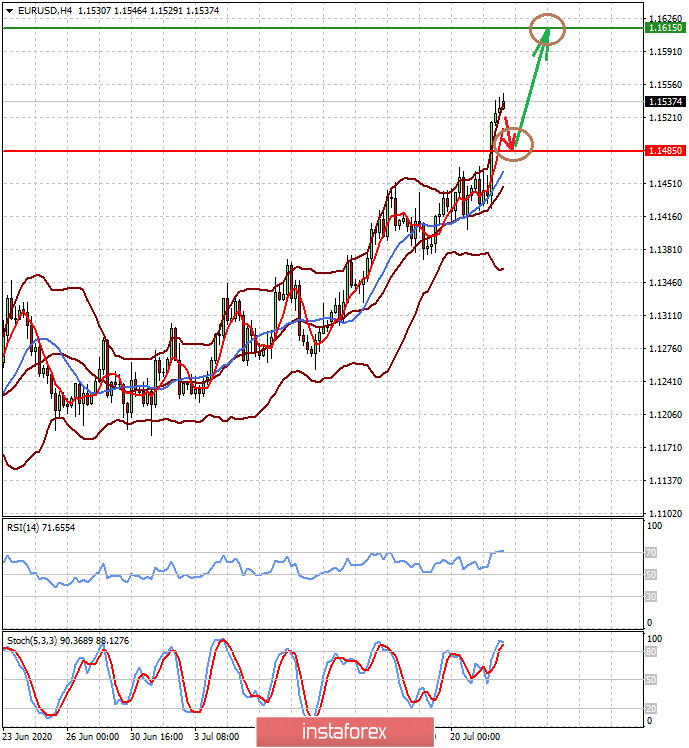

Forecast of the day:

The EUR/USD pair surged on a wave of rising demand for risky assets and the EU's agreement on the Recovery Fund. It could correct to the level of 1.1485 before continuing to rise to 1.1615.

The USD/CAD pair has pulled out of the range of 1.3485-1.3665 amid optimism about COVID-19 vaccine production and higher crude oil prices. The pair may also correct upward to the level of 1.3485 in order to try to continue declining to 1.3370.