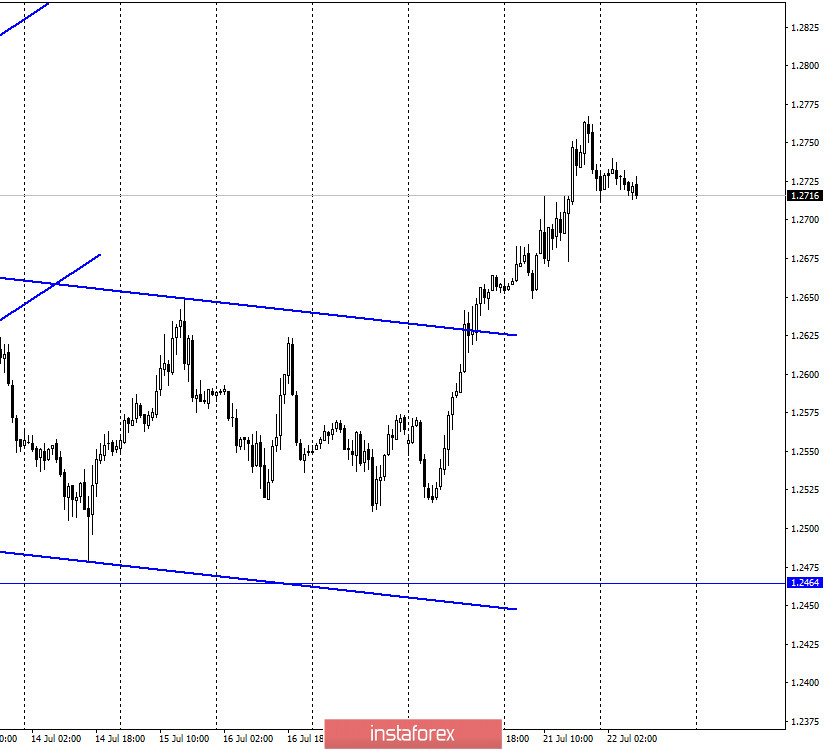

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the quotes of the GBP/USD pair continued the growth process for most of the past day and only this night performed a reversal in favor of the US currency and began a slight process of falling. Meanwhile, there was some really good news for the pound at last. On Tuesday this week, at the residence of the British Prime Minister at 10 Downing Street, a meeting was held with US Secretary of State Mike Pompeo, after which the parties to the negotiation process expressed their desire to agree and sign a mutually beneficial trade agreement as soon as possible. In addition, Pompeo and Johnson discussed the problem of China, its actions in the international arena, as well as in relation to neighboring countries (probably referring primarily to Hong Kong). However, negotiations between London and Washington have not yet begun, and they are tightly stranded with Brussels. Thus, the British can't be really optimistic yet. So far, it is growing exclusively on news from America, where Donald Trump continues to fight with Democrats, protesters and coronavirus.

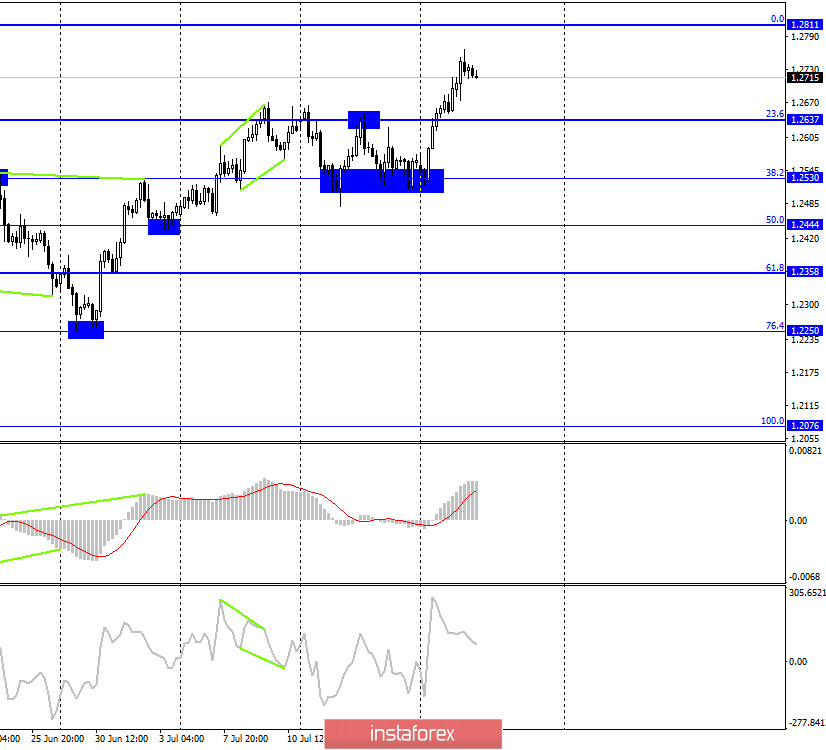

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair, after rebounding from the corrective level of 38.2% (1.2530), performed a reversal in favor of the English currency and resumed the growth process, simultaneously completing a close above the Fibo level of 23.6% (1.2637). Thus, the growth can now be continued in the direction of the corrective level of 0.0% (1.2811). Today, the divergence is not observed in any indicator. The rebound of the pair's exchange rate from the level of 1.2811 will work in favor of the US currency and some fall in the pair's quotes.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the corrective level of 61.8% (1.2516), so the growth process can be continued in the direction of the Fibo level of 76.4% (1.2776), the rebound from which will work in favor of the US currency.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines. It is in this direction that the pair's quotes continue to move in recent weeks.

Overview of fundamentals:

There were no economic data releases in the UK on Tuesday. In the US, it is the same. But there are regular unscheduled news, such as data on the incidence of coronavirus in the United States, or, for example, news about the activation of negotiations on a trade agreement between the United States and Britain.

News calendar for the US and UK:

No reports or events are scheduled for July 22 in the UK and US again. The information background will again be absent today. At least, according to the news calendar.

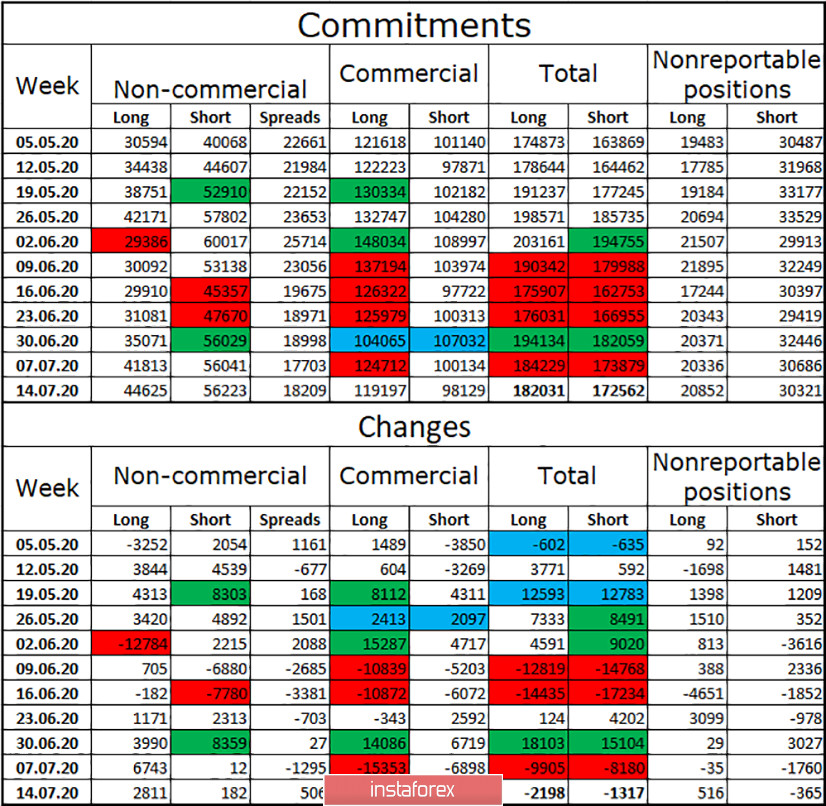

COT (Commitments of Traders) report:

The latest COT report again showed an increase in the number of long contracts among the "Non-commercial" group. However, this time the growth was small, which means a slight drop in interest among speculators in the British. Over the past 4 weeks, the Non-commercial group has been increasing its long-term contracts. For the last two weeks, I haven't opened any short contracts. Thus, the group of speculators has no interest in selling the pound. There is interest in the purchases of the Briton, but it is declining. In general, the group of speculators has more short contracts on their hands, but the difference has been decreasing in recent weeks. I still believe that the prospects for continued growth for the British are there, and since bull traders managed to gain a foothold over the downward trend corridor on the hourly chart, the chances of continued growth for the British are increasing.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goal of 1.2637, if the rebound from the level of 1.2811 is made on the 4-hour chart. I recommend supporting the pair's purchases with the goal of 1.2811, since the close was made above the level of 1.2637, while I recommend being careful, since there are no graphical constructions on the hourly chart that would help determine the change in the traders' mood to "bearish".

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.