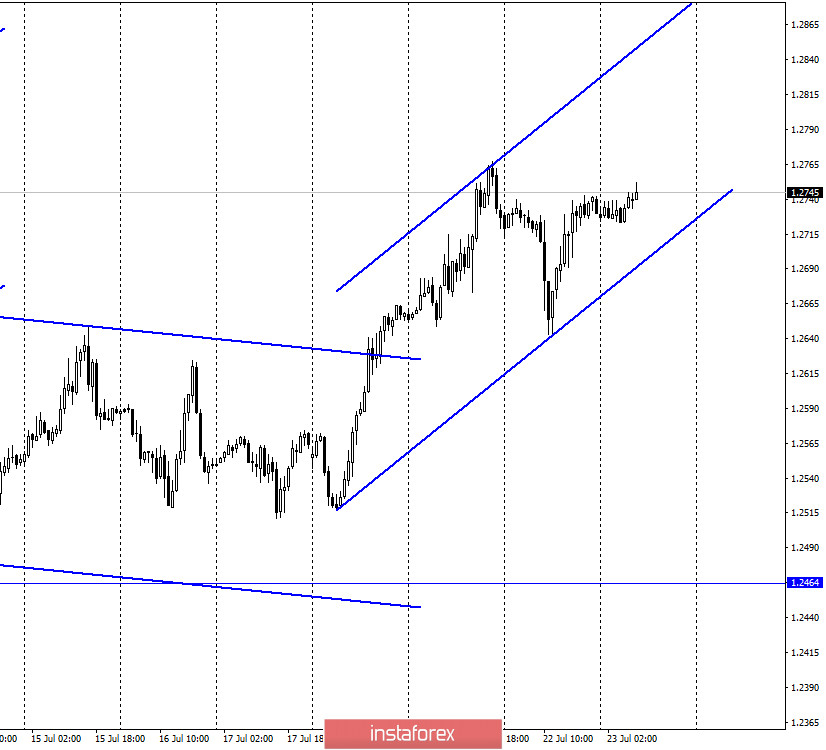

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the quotes of the GBP/USD pair performed the necessary corrective pullback, which allowed bull traders to resume their attack. As a result, the resumption of the growth process made it possible to build an upward trend corridor, which more eloquently reflects the current "bullish" mood of traders. Although there is little news from the UK at this time, yesterday the pair still made an impressive fall on the background of new information "from government circles" that an agreement with the European Union on Brexit will not be reached. However, traders did not grieve for long and very soon restored their bullish mood, based on the same events in America. It turns out that now traders are not afraid of the prospect of no trade agreement between Britain and the EU from January 1, 2021. All attention is on America, the rest is unimportant. If so, the pound may continue to grow for a long time, as there are no signs that the situation in the US is improving. However, I also believe that the British pound will fall for a long time and strongly, as soon as Brexit comes to the fore again and the complete lack of prospects for the British economy for the next year or two.

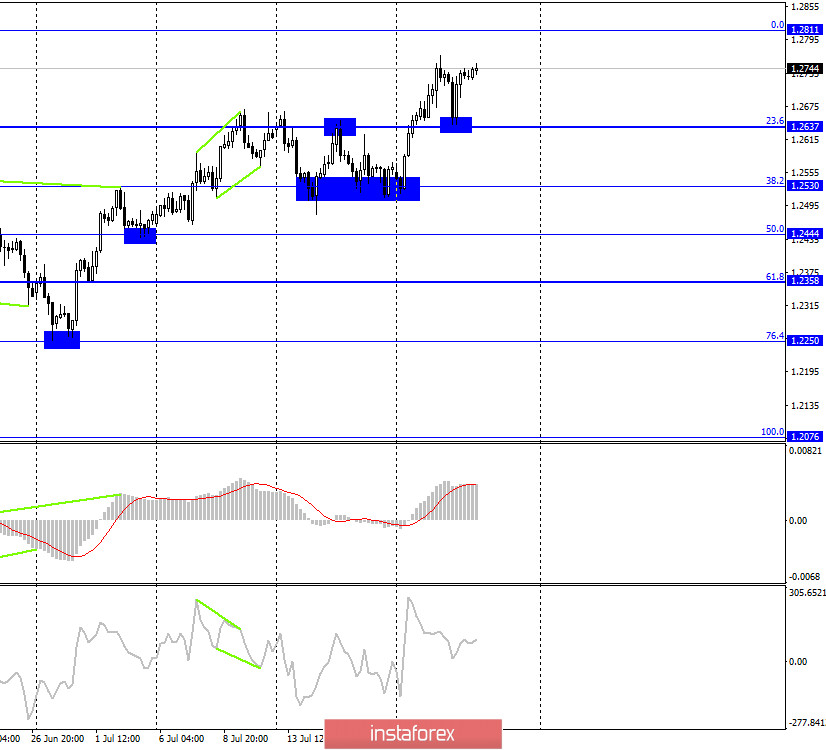

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair fell to the corrective level of 23.6% (1.2637), rebounded from it, turned in favor of the British currency, and resumed the growth process in the direction of the corrective level of 0.0% (1.2811). The rebound of the pair's exchange rate from this level will work in favor of the US currency and resume the fall in the direction of the Fibo level of 23.6%. Today, the divergence is not observed in any indicator.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed an increase to the corrective level of 76.4% (1.2776). Rebound from it will allow you to expect a reversal in favor of the US dollar and a slight drop in quotes.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines. It is in this direction that the pair's quotes continue to move in recent weeks.

Overview of fundamentals:

There were no economic data releases in the UK on Wednesday. In the US, it is the same. But there is regular unscheduled news, such as data on the incidence of coronavirus in the United States, or, for example, news about the activation of negotiations on a trade agreement between the United States and Britain. Traders pay more attention to information from the United States.

News calendar for the US and UK:

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On July 23, there is no scheduled news and reports in the UK again. In America, the report on applications for unemployment benefits is unimportant.

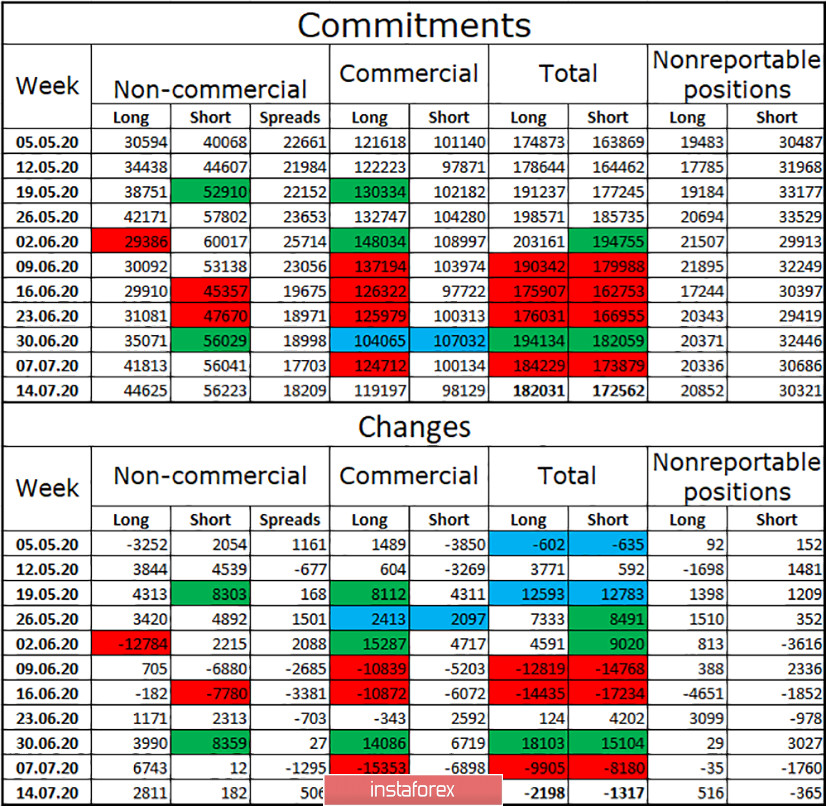

COT (Commitments of Traders) report:

The latest COT report again showed an increase in the number of long-term contracts among the "Non-commercial" group. However, this time the growth was small, which means a slight drop in interest among speculators in the British. Over the past 4 weeks, the Non-commercial group has been increasing its long-term contracts. For the last two weeks, I haven't opened any short contracts. Thus, the group of speculators has no interest in selling the pound. There is interest in the purchases of the Briton, but it is declining. In general, the group of speculators has more short contracts on their hands, but the difference has been decreasing in recent weeks. I still believe that the prospects for continued growth in the British are quite good. Mainly because of the information background from the US.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goal of 1.2637 if the closing is performed under the trend corridor on the hourly chart. I recommend supporting the pair's purchases with the goal of 1.2811, since the closing was made above the level of 1.2637, as long as the pair is trading within the trend corridor on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.