Technical analysis recommendations for EUR/USD and GBP/USD on July 23

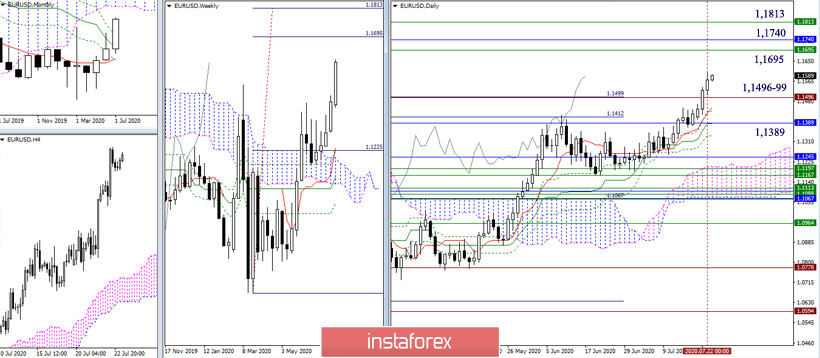

EUR / USD

Players on the promotion seek to implement the elimination of the monthly dead cross Ichimoku. The higher they can rise and consolidate above its final boundary, the more reliable the result will be. Upward guidance is now focused on the boundaries of 1.1695 - 1.1740 - 1.1813 (target for the breakdown of the weekly cloud + the lower border of the monthly cloud). Supports can be noted at 1.1496-99 (100% target development for the breakout of the daily cloud + the maximum extremum of the March high wave) and 1.1389 (daily Kijun + monthly Fibo Kijun).

In the lower halves, the advantage is on the side of the players to increase, the weakening factor is the pair's finding in the correction zone. If the upward trend continues, the resistances of the classic Pivot levels 1.1611 (R1) - 1.1653 (R2) - 1.1705 (R3) can serve as reference points within the day. The development of a downward correction will lead the pair to testing supports. The key supports on the H1 are 1.1559 (central pivot level of the day) and 1.1469 (weekly long-term trend), the nearest support level is at 1.1517 (S1) today. Anchoring below key supports can change the current balance of forces, as a result of which the situation will require a new assessment.

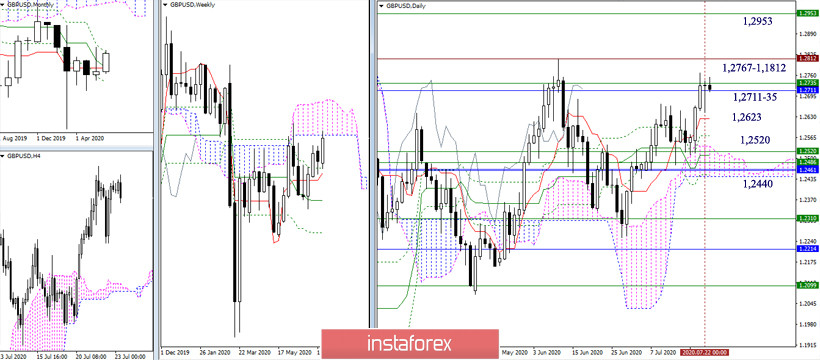

GBP / USD

The pound closed the last working day quite unclear. The meeting of strong and significant resistances provoked a pullback almost to the support of the daily Tenkan, but by the closing of the day, the pair returned to the area of influence and attraction of the met levels. Updating the maximum extremes of 1.2767 and 1.2812 is likely to lead to new active and effective bullish actions. The nearest reference point for which is located at 1.2953 (the upper border of the weekly cloud). In this case, the return of the correctional decline will facilitate the implementation of the correction, the scale and duration of which can delay the development of the upward trend for a long time.

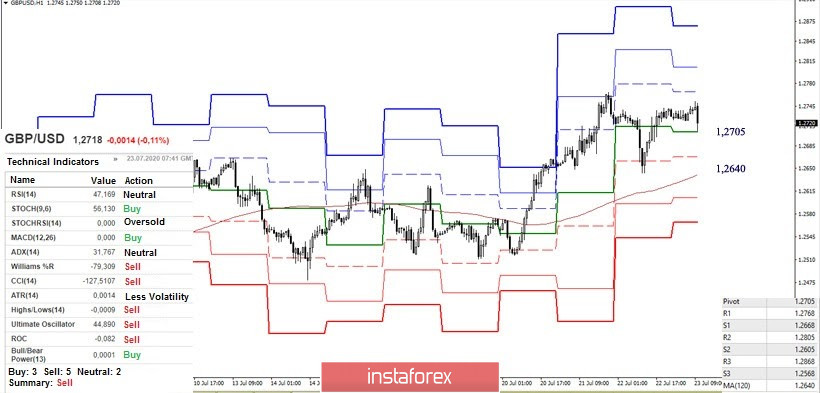

The pair remains in the correction zone. The central pivot level of the day (1.2705) is currently being tested on the smaller halves. Now, the next significant support is the weekly long term trend located at the level of 1.2640, strengthened by the daily short-term trend (1.2623). A consolidation below will change the current balance of forces not only on H1, but also on the daily time frame. If the players keep on increasing the support of key levels, we can count on the continued rise. The classic pivot levels 1.2768 (R1) - 1.2805 (R2) - 1.2868 (R3) will serve as upward guidance within the day.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)