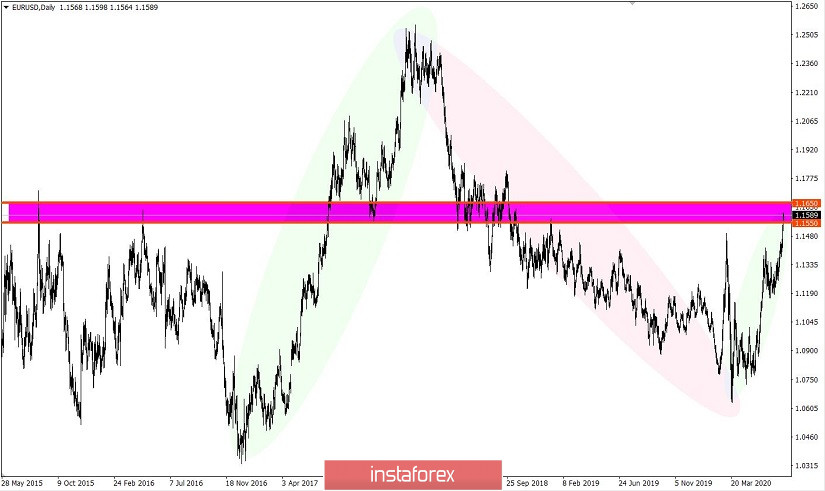

A bullish mood persists in the EUR/USD pair, as a result of which the quote reached the value of 1.1600 in the trading chart. It reflected the fluctuation observed in October 2018, which indicates that the 50% milestone relative to the medium-term downward trend has been passed, and that any consolidation higher than 1.1650 could lead to an upward trend in the medium-term.

However, the movement and trend in the pair remains uncertain, as many nuances associated with the EU economy could affect the rate of the European currency, based on which more and more traders are starting to believe that the current rise in the euro is caused by speculative mood, so the direction may change as quickly as it appeared in the market.

Nevertheless, note that the US dollar lost almost 9% against the euro in four months, which is a very good discount.

If we analyze the past trading day in more detail, we can see that the round of long positions started at 09:30 and lasted until the start of the American session, during which the quote reached a value of 1.1600. Afterwards, a fluctuation of prices occurred, which was in the form of a pullback and slight stagnation within the levels 1.1563 / 1.1600.

This is because as discussed in the previous review, traders worked on an upward movement towards the level of 1.1600, at which the process of reducing the volume of long positions should have started.

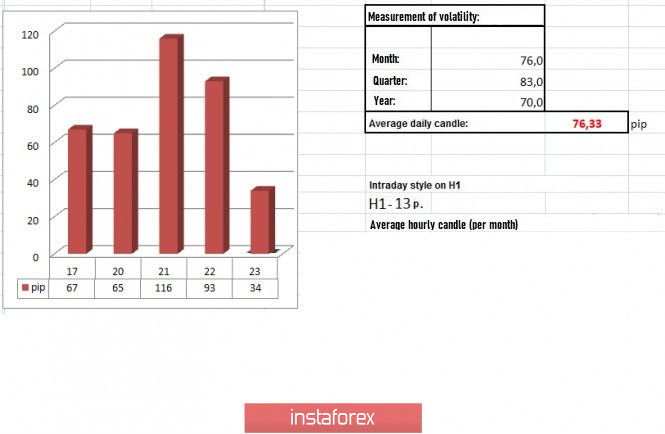

As a result, a 93-point volatility was recorded, which is 22% above the average daily value. This confirms that the market is under a speculative mood.

Analyzing the trading chart in general terms (daily period), we can see that an attempt was made to change the medium-term downward trend which, if we compare with the upward trend observed in December 2016 to February 2018, the quote developed in two levels. The first one had increased acceleration and longitude [1.0426-1.2092], while the second one had a reduced speed by about half [1.1554-1.2555]. Now, the quote is in the area of the second development, and if we analyze it in detail, we can see that such movement is the main one, and it can play both as a strongest resistance level and the starting point of a medium-term trend break.

As for news, the reports published yesterday included data on home sales in the US secondary market, in which there was a recovery of about 20.7% in June, against its -9.7% figure in May. Although the forecasts did not coincide on a full scale, the recovery is good, which is a positive signal for the US economy.

The US dollar rose because of the strong economic data.

Unfortunately, there remains concerns regarding the relations between the US and China. A new round of noise arose due to the decision of the United States to close the Chinese consulate in Houston, adding a threat that it would close several more Chinese diplomatic institutions in the country. Following this, Beijing is considering the possibility of closing the US Consulate General in Chengdu in the southwestern province of Sichuan, which would further deteriorate the relations between the two countries.

Today, the latest data on the US labor market will be published, where weekly jobless claims will be reported, the forecasts for which is a decrease from 1,300,000 to 1,295,000 for initial applications, and a decrease from 17,338,000 to 17,100,000 for repeated applications. If these coincides with the actual record in the US, a positive movement may be seen on the dollar.

Further development

Analyzing the current trading chart, we can see that trade forces concentrated within the level of 1.1600, during which a fluctuation within 1.1560 / 1.1600 was formed. Traders will not hold the quote in this range for a long time, since on the one hand, there is an impressive oversold of the US dollar, which may well lead to a correction in the trading chart, while on the other, there is an opportunity to change the medium-term trend by just a consolidation above 1.1650.

In addition, market sentiment remains unstable, which attracts speculative mood in the market.

Thus, it is assumed that the limits 1.1560 / 1.1600 will fall soon, after which price jumps will occur in the market. In such a case, the most optimal tactics are local operations in the direction of a breakout.

So, based on the above information, we present these trading recommendations:

- Sell positions when the quote moves below 1.1550, towards the values 1.1500-1.1450-1.1400.

- Buy positions when the quote moves above 1.1600, towards the value 1.1650. Also buy when the price becomes higher than 1.1650 in the daily chart.

Indicator analysis

Analyzing the different sectors of time frames (TF), we can see that the indicators of technical instruments in the minute period have different signals due to the movement within the fluctuation 1.1560 / 1.1600. Meanwhile, hourly and daily periods reflect a buy signal due to the rise of prices at the highs of the current year.

Weekly volatility / Volatility measurement: Month; Quarter; Year

The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year.

(July 23 was built, taking into account the time the article is published)

The volatility at this current time is 34 points, which is 55% below the average daily value. It is assumed that a breakout from the limits [1.1560 / 1.1600] will lead to a sharp surge in activity in the market.

Key levels

Resistance zones: 1.1650 *; 1.1720 **; 1.1850 **; 1.2100

Support Zones: 1,1500 1.1350; 1.1250 *; 1.1.180 **; 1.1080; 1.1000 ***; 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1.0500 ***; 1.0350 **; 1.0000 ***.

* Periodic level

** Range level

*** Psychological level

Also check the hot forecast and trading recommendation for the GBP/USD pair here, or the brief trading recommendations for both the EUR/USD, GBP/USD and USD/JPY pairs here.