The dollar is just extremely unlucky. Not only did the political background favor the single European currency in the first half of the week, but yesterday the only portion of significant macroeconomic data further undermined the dollar's position instead of contributing to its growth. And the worst thing is that we are talking about the labor market, where the situation seems to be getting worse again.

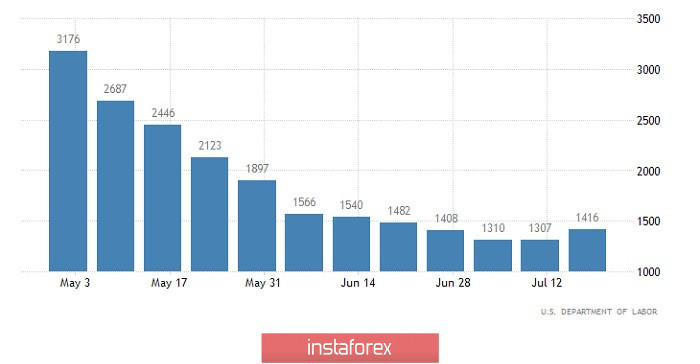

It all started well, and market participants were waiting for relatively good data. So, before the publication of data on applications for unemployment benefits, the dollar was quite actively strengthening. It strengthened for another half hour after their publication. This is not surprising, since the number of repeated applications for unemployment benefits fell from 17,304,000 to 16,197,000. That is, a decrease of more than a million. And the previous results were revised for the better from 17,338,000. And after all they expected a decrease only to 17,100,000. So everything is just fine. But it took market participants some time to understand the data on initial applications for unemployment benefits, the number of which did not decrease from 1,307,000 to 1,295,000. Their number increased to 1,416,000. In other words, reductions and layoffs resumed in the United States. Moreover, if the data is for repeated applications for July 11, then this is the primary for July 18. So it is highly likely that soon we will see an increase in the number of repeat applications. So the trend is somewhat scary. After all, economic growth depends on the state of the labor market. Moreover, the unemployment rate is already extremely high. And if in this situation unemployment does not decrease, then the state of affairs will begin to deteriorate at a catastrophic rate.

Number of initial claims for unemployment benefits (United States):

Nevertheless, the overbought nature of the euro has not gone away. The market is overheated even more than before the release of data on applications for unemployment benefits. The market needs a correction. But we can hardly wait for it today. Preliminary data on business activity indices will be published in Europe, the forecasts are quite good. Thus, the index of business activity in the service sector should grow from 48.3 to 50.8. In the manufacturing sector, the index may grow from 47.4 to 49.8. The result is a composite index of business activity is expected to grow from 48.5 to 50.7. So the euro has no reason to decline.

The composite index of business activity (Europe):

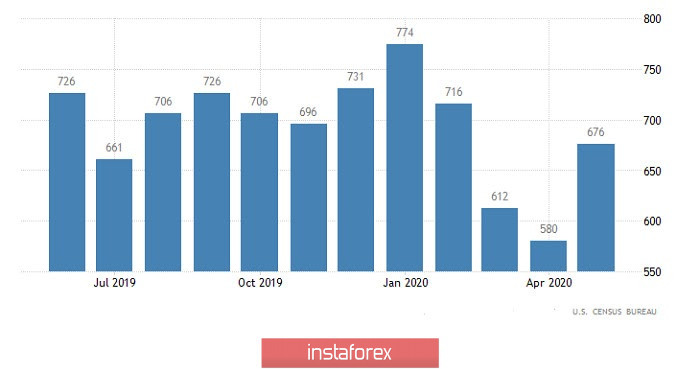

However, there are no reasons for the dollar's fall either. The same preliminary PMI data should also show growth. Thus, the index of business activity in the manufacturing sector may rise from 49.8 to 51.5. The service sector can grow from 47.9 to 50.4. The composite PMI should rise from 47.9 to 50.8. So forecasts look even better than in Europe, as all indices should rise above the 50-point mark, which separates recession from growth. In addition, new home sales could increase by 3.2%. In absolute terms, sales should grow from 676,000 to 680,000. So it's time to talk about the dollar's growth again. However, market participants are still impressed by recent data on claims for unemployment benefits. And this will hold back the dollar's upside potential.

New home sales (United States):

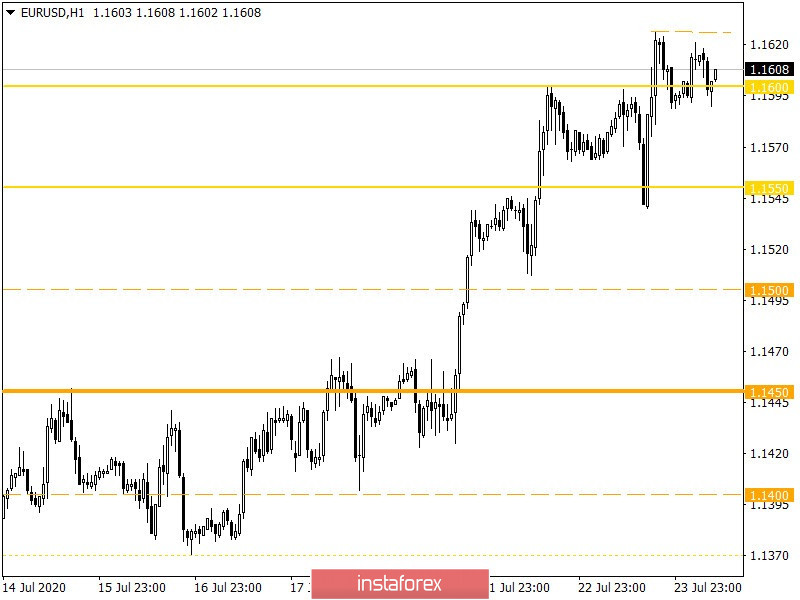

The euro/dollar pair showed high activity during the past day, where the quote managed to jump locally towards the value of 1.1626, forming a new high, but there were no major changes after that. Market participants, as before, focus on the variable range of 1.1550/1.1600, slightly adjusting its borders (1.1550/1.1626), which indicates an overbought signal in the market.

On the trading chart, in terms of market dynamics, you can see that the current week reflects high volatility indicators, which confirms the fact that there are speculators in the market.

We can assume that the quote will continue to follow in the side band, where if the price is consolidated below 1.1590, we will head towards the lower border of 1.1550. An extension of the upper limit on the background of speculative interest is possible, but not significant, 1.1626 --> 1.1650.

From the point of view of complex indicator analysis, we see that indicators of technical instruments at minute intervals signal a sale due to the initial pullback. Hourly and daily periods, keep the signal about the purchase.