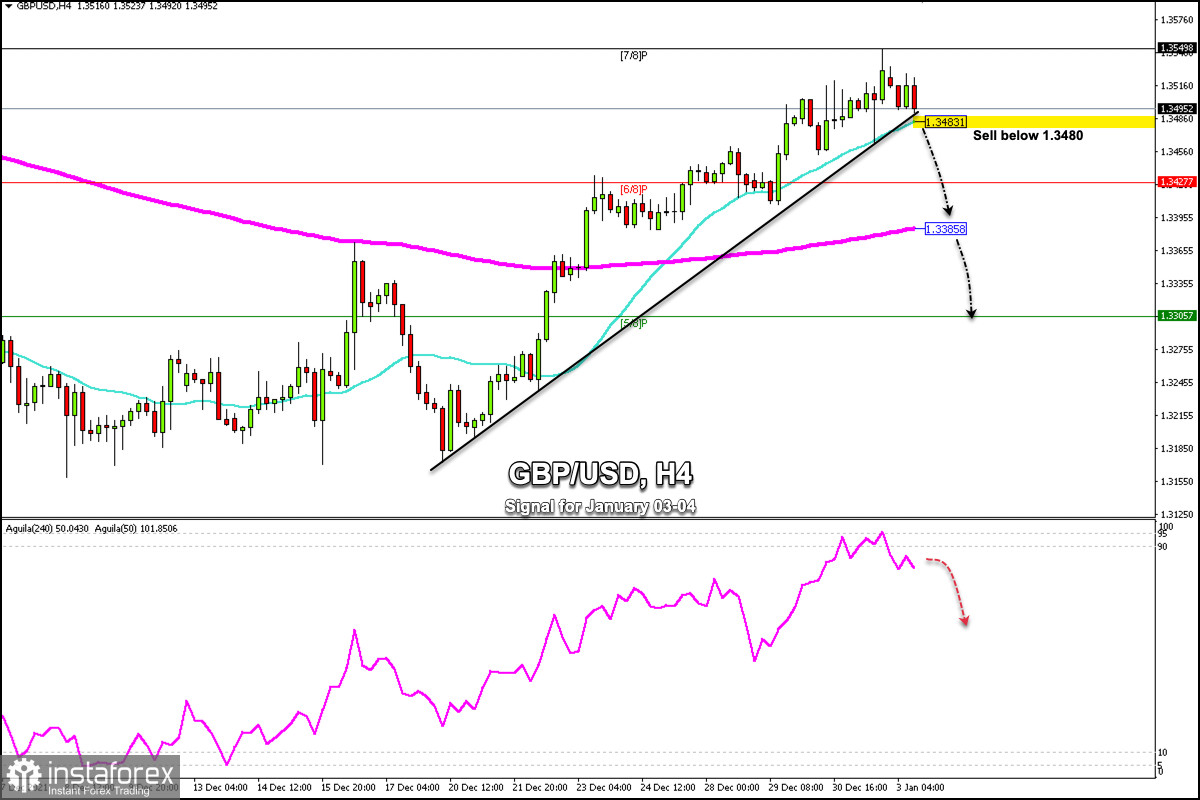

The British pound peaked at 1.3549, which represents a reversal zone around 7/8 Murray. It is likely that there may be a technical correction in the coming days if the uptrend channel formed since December 17 is broken and if GBP/USD consolidates below the 21 SMA located at 1.3483.

The psychological level of 1.3500 also acts as strong resistance for the British pound. As long as the pair makes a technical pullback below this level, it could test the low around 1.3425 (6/8 of Murray).

The market sentiment report for today January 3 shows that there are 56.77% of traders who are buying the GBP / USD. This signal could mean that the British pound could continue to consolidate around the level 1.3550 - 1.3427 in the coming days. If this figure rises, we could see a drop in the pound towards the 3/8 Murray support level at 1.3305.

The eagle indicator has reached the 95-point zone which represents an imminent correction for the British pound. We believe that the signal will be confirmed only if the pound falls below 1.3480. Our target will be 1.3385 (200 EMA) and the 3/8 of Murray around 1.3305.

Support and Resistance Levels for January 03 - 04, 2022

Resistance (3) 1.3564

Resistance (2) 1.3549

Resistance (1) 1.3515

----------------------------

Support (1) 1.3480

Support (2) 1.3427

Support (3) 1.3395

***********************************************************

Sell below 1.3480 (21 SMA) with take profit at 1.3427 (6/8) and 1.3385 (200 EMA), stop loss above 1.3515.