The EUR/USD currency pair managed to renew the annual high, consolidating above the level of 1.1650. A consistent movement in the same direction indicates a trend. In this case, it has an upward slope. The structure of the trend includes not only a purposeful movement in the direction of the trend, but also a corrective move that serves to stabilize the trading interest and prevent overheating of the trading positions of market participants.

Analyzing the trading chart below, it can be seen that the price has approached the upper border of the trend line, which may signal an upcoming correctional movement in the market.

In terms of the economic calendar, there is news from the United States on durable goods orders, which are expected to rise by 5.0%.

This economic indicator reflects the value of orders received by manufacturers of durable goods. They mean those goods whose service life exceeds 3 years, for example, cars. Since the production of such goods involves a large investment, a strong performance strengthens the US dollar.

Based on the above, it can be assumed that if the quote manages to rebound from the upper trend line (1.1700) and consolidate below the level of 1.1680, then in this case, the formation of a corrective move in the direction of 1.1650-1.1600 is not excluded.

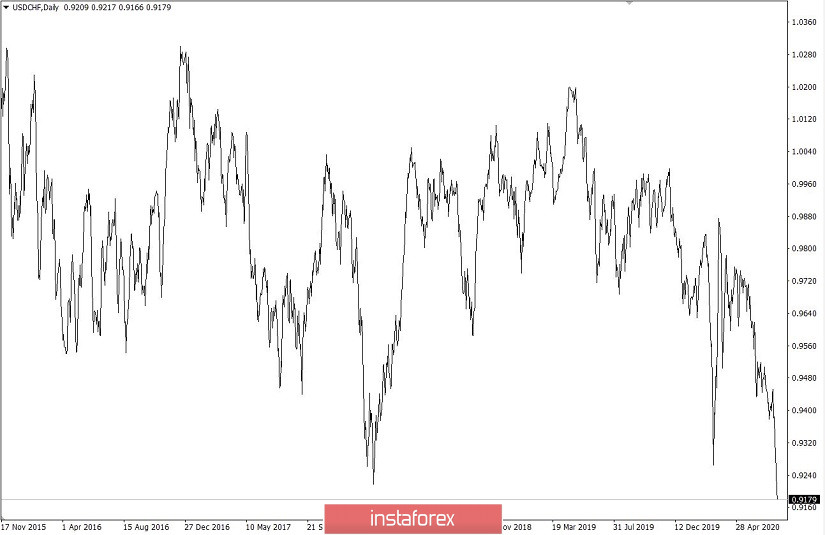

For the USD/CHF currency pair, you can see not just a downward movement, but a full-fledged rally, during which the quote managed to update the five-year low, declining below 0.9200. Such a sharp weakening of the US currency leads to the "oversold" effect on the market, which may lead to a reversal movement.

Based on the foregoing, it can be assumed that in the area of 0.9100/0.9150, there will be buy positions that will try to adjust the USD/CHF rate towards the level of 0.9250.