The dollar has been under constant pressure over the past week, and the single European currency has been growing almost non-stop. But if at first, the reason for the weakening of the dollar was solely political factors, then later, everything became somewhat more interesting. It turned out that the state of affairs in the American economy, especially in comparison with Europe, does not look very good. So the preliminary data on business activity indices, literally finished off the dollar. This is despite the fact that the euro is no longer just overbought. The market is literally overheated, and a correction is already asking for itself. It may well happen now and in an empty place.

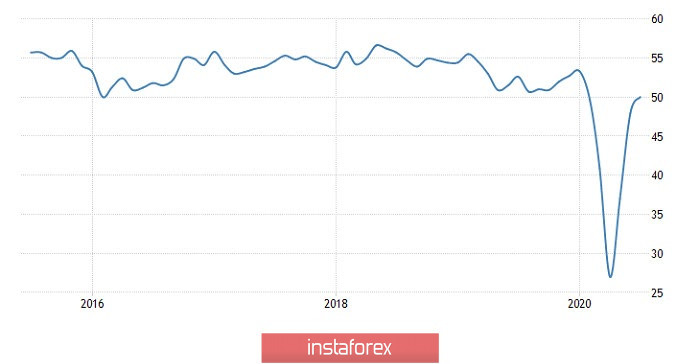

So, the European index of business activity in the service sector rose from 48.3 to 55.1, instead of the expected 50.8. The manufacturing index, which was expected to rise from 47.4 to 49.8, rose to 51.1. As a result, the composite PMI rose from 48.5 to 54.8. It was predicted to rise to 50.7. It is noteworthy that all indices did not just rise more than expected. They all rose above the 50.0 point mark that separates stagnation from growth. In other words, PMIs indicate that the European economy is recovering steadily, which of course does not contribute to the correction in the foreign exchange market.

Composite PMI (Europe):

But although the indices rose in the United States, the results were worse than expected. For example, the index of business activity in the services sector rose from 47.9 to 49.6, although it was supposed to climb to 50.4. The manufacturing index rose from 49.8 to 51.3 instead of 51.5 as expected. Overall, the composite PMI rose from 47.9 to 50.0. It was expected to rise to 50.8. And here it is important that the index of business activity in the service sector is still below 50.0 points. So the recovery of the US economy is going extremely hard and slow. At the same time, risks of further decline remain. This is what scares investors and prevents the dollar from finding support.

Composite Service PMI (United States):

Roughly speaking, the past week has taught investors that US data is much worse than forecasted. So, taught by bitter experience, market participants began to lay down such a development of events from the very beginning of the new trading week. That is, no one believes that durable goods orders will grow by 5.0%. And this despite the fact that there are few calculations showing that orders may even increase by 7.2%. Better prepare for the worst. And there is every reason for this, in the form of an index of business activity in the service sector. Thus, it turns out that the worst case scenario is already included in the euro's value, and if the data really turn out to be worse than forecasts, then it will simply have nowhere to grow. But, if the forecasts are confirmed, we will finally see the long-awaited correction.

Durable Goods Orders (United States):

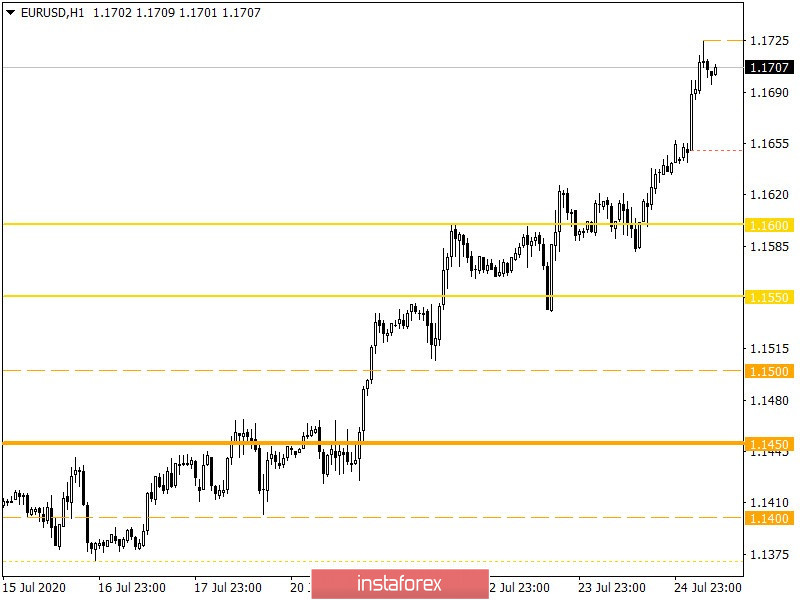

The euro/dollar pair continued to climb along the vertical course, as a result, the current year's high of 1.1650 --> 1.1725 was updated, and the signal of an oversold US dollar acquired an unprecedented scale. Speculators continue to work without paying attention to all the resulting reversal signals, but how much more of them will be enough, this is the main question that traders face, since sooner or later, an understanding will come, and then long positions will be consolidated, where the downward movement will be no less bright than the upward one.

Relative to market dynamics, volatility is still high, which confirms the presence of speculators in the market.

Looking at the trading chart in general terms (daily period), you can see that the medium-term downward trend from 2018 is no longer the main one, its place is taken by the current momentum, where the rate of change indicates instability of interests.

It can be assumed that if the price is consolidated lower than 1.1680, there will be a primary pullback towards 1.1650, which may lead to a consecutive corrective move in the direction of 1.1600-1.1550.

An alternative scenario considers the persistence of speculative excitement with price taking higher than 1.1740, which will lead to a further uncontrolled move to the values of 1.1800-1.1850.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments unanimously signal a buy, due to finding the price at the conditional highs of this period.