Hello!

As has been repeatedly noted before, the USD/JPY currency pair has its own way. Often, when all other major currencies strengthen against the US dollar, the Japanese yen shows a decline, and vice versa.

In this regard, it is worth noting that at the trading on July 20-24, the yen showed solidarity with other allied currencies and also showed growth against the US dollar.

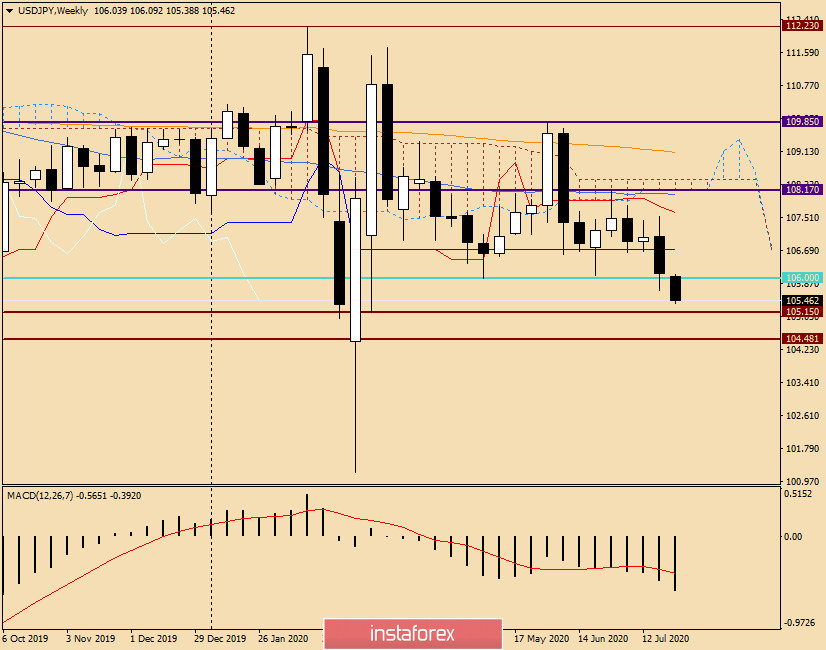

Weekly

As can be clearly seen on the weekly timeframe, the USD/JPY bears finally managed to push through the blue line of the Ichimoku Kijun indicator, which previously provided strong support for the quote. Moreover, the downside players tested the most important technical and psychological level of 106.00 for a breakdown. However, they failed to close the last five-day trading under this mark, which once again showed the strength of this level.

However, this week's trading started as a continuation of the bearish scenario, and at the time of writing, the pair is trading under the level of 106.00 near 105.65. If the downward trend continues, the next target for sellers of USD/JPY will be an important strong price area of 105.15-105.00. If the indicated supports are broken, the pair risks a major failure, and here we will determine the goals in smaller time intervals.

To turn the situation in their direction, the bulls on the instrument need to return the rate above the Kijun and close the weekly trading above this line. After that, players will have many more tasks to improve, but initially you need to complete this one.

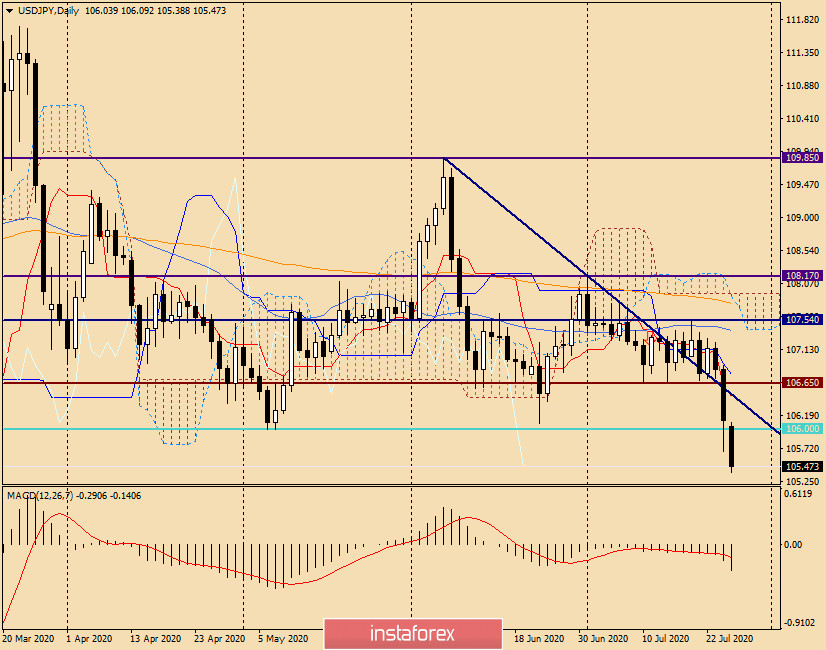

Daily

Looking at the daily chart of the dollar/yen currency pair, we see that the growth attempts were limited by the level of 107.54, as well as the blue 50 simple moving average, which provided its resistance to the price.

At the moment, trading on USD/JPY is dictated by bears. The pair shows a downward trend and shows intentions to break through the significant support level of 106.00. However, this level is quite strong, and it is also considered a weekly one, so you can only judge the truth of its breakdown after closing three consecutive daily candles under this mark. If this happens, you can try selling the pair on the pullback to 106.00. In the event of a change in market sentiment and possible growth from current prices, the dollar/yen will return above 106.00 and try to rise to another important and already broken level of 106.65. Given that the Tenkan line of the Ichimoku indicator is located at 106.50, the price resistance zone can be defined as 106.50-106.65. If the reversal patterns of Japanese candles appear in this area on the daily or smaller timeframes, this will be a signal to open short positions on USD/JPY.

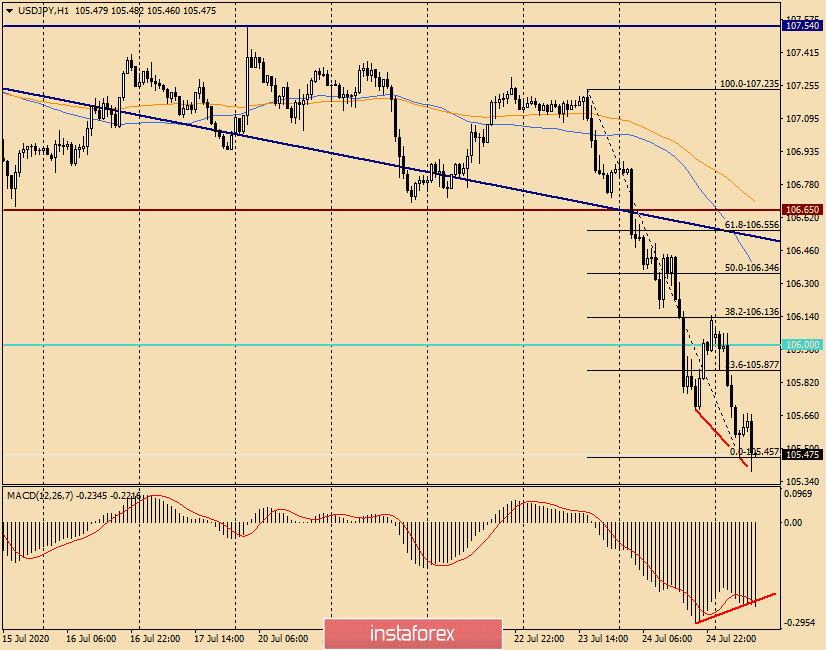

H1

On the hourly chart, it is necessary to note the bullish divergence of the MACD indicator, which is an additional signal for possible growth. After reaching the current lows at 105.45 and the appearance of a circled reversal candle, the pair is really trying to conduct a corrective pullback to its previous decline.

I stretched the grid of the Fibonacci tool to a decrease of 107.23-105.45, and I suggest considering opening sales after rises to 105.88 (23.6 Fibo), 106.00 and 106.13 (38.2 Fibo). You should look for more favorable prices for opening short positions in the price zone of 106.40-106.50.

In my personal opinion, selling USD/JPY is the main trading idea. The support that the US dollar received during the first wave of COVID-19 has sunk into oblivion, and the technical picture for the main currency pairs shows that the prospects for a decline in the US currency are not yet exhausted. However, much will become clear on Wednesday evening, when the fed will announce its decision on interest rates, and after that, the head of the Federal Reserve, Jerome Powell, will hold a press conference. I believe that this event will be decisive for the US dollar.

Good luck with trading!