The euro continues to break through the highs, gradually approaching the 18th figure. The sharp rise in risky assets during the Asian session continued through the European trading after the release of the data showed that Germany is confidently on the path of recovery, and the Ifo business sentiment index rose for the third month in a row. The situation around the yield of US Treasuries adjusted for inflation is putting pressure on the US dollar, which only forces market participants to bet on the growth of European currencies.

Before the release of the leading statistics on Germany, the euro slightly went on correction, but the downward movement was of a purely technical nature, after which the expectations that the growth of the German economy in the 3rd quarter will be very strong, gave the euro a new impetus. The removal of stop orders above 1.1720 only strengthened the demand for the euro. However, despite the current indices, you need to understand that the economy will not recover to pre-crisis levels soon, and the risk of a second wave of a surge in coronavirus infections could seriously affect the indicators, since exports, which Germany is targeting, may remain at rather low levels. The number of cases in Spain, Germany, and France is already growing, and many doctors unanimously say that the second wave of the outbreak cannot be avoided, but it will have to be in the winter.

There is also an option that the high debt burden of German companies, which occurred at the time of the outbreak of the pandemic, would hinder investment. Labor market problems, which will only have to be dealt with at the end of next year, will have a negative impact on private consumption.

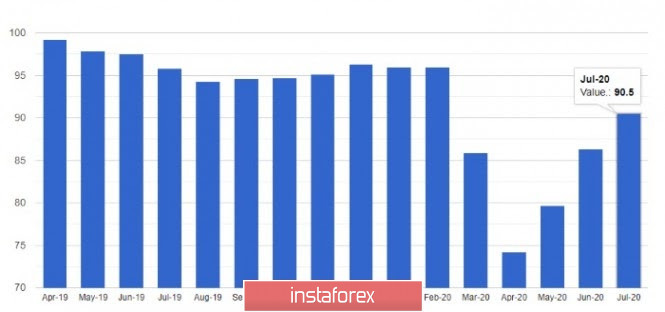

Now let's get back to the numbers. According to the Ifo Institute, the index of business sentiment in Germany in July this year jumped to 90.5 points against 86.3 points in June. Economists had expected the index to reach 89.0 points in July. The situation has also improved with the indicator of the current situation, which in July rose to 84.5 from 81.3 points in June. A significant increase was also noted in the indicator of expectations, which jumped to 97.0 from 91.6 points. This suggests that many companies are optimistic about the future and believe in a quick return of the economy to life after the end of the Covid-19 pandemic.

The euro is also supported by the agreement on the EU recovery fund, which was signed early last week. However, this does not mean that now all European countries can sleep peacefully. To receive assistance, it is necessary to develop detailed plans, which will then be approved, and without significant reforms, especially in Italy, it will be difficult to achieve approval. First of all, we are talking about making changes in the fiscal sphere and policy of European countries, Italy, in particular since it is in this country that the deficit is very calmly inflated and without much nervous tension they take budget holes and national debt as a matter of course, which is outside the scope of the current eurozone agreement.

As I noted above, the pressure that the US dollar is now experiencing is primarily associated with a decrease in the real yields of US Treasury bonds, adjusted for inflation. The outflow from the dollar is obvious, since even the news that the US and China are closing each other's consulates did not lead, as it did before, to the strengthening of the greenback as a safe-haven asset. On the contrary, all the money now goes into gold, which is the most protected from inflation. Given the fact that the real profitability of American securities is scanty, investors are looking for profitability in riskier assets. Given that the Federal Reserve will continue to pump money into the economy and keep rates close to zero, the outlook for the US dollar is not that exciting. Therefore, the prospect of strengthening the Euro, the pound, and other risky currencies, along with an update to the level of 2000 dollars per Troy ounce for gold, is quite real.