The new week on the currency market has traditionally started with the continuation of the weakening of the US currency, which is receiving hit after hit. They are the expectation of an early production of vaccines against COVID-19, then, it seems, endlessly expanding stimulus measures from the US financial authorities and the generally positive reporting of American companies for the second quarter, which encourages investors to buy shares in the hope that the economic recovery will not will only continue, but will strengthen after the vaccination of the American population and the full recovery of economic activity in the country.

The single currency is likely to test the level of 1.2000 in the near future amid the release of encouraging data on the European economy, the resolution of the dispute over who and how from the needy countries will receive assistance from the EU Recovery Fund.

As for the economic data, the values of the German IFO business climate index presented on Monday rose to 90.5 points in July against the upwardly revised June value of 86.3 points, with the forecast of growth to 89.3 points. Business expectations in Germany also rose to 97.0 points against 91.6 points in June and expectations of an increase to 93.7 points. These numbers supported the euro/dollar pair, allowing it to test a new local high.

And, interestingly, fears of a second wave of the coronavirus pandemic, not only in the States, but also in Europe, do not support the dollar, which is simply losing its very recent function as a safe haven currency. One would think that investors are buying US Treasury bonds with dollars again, but the dynamics of the benchmark yield on the 10-year Treasury indicates that this is not the case. There is little demand for 2-year bonds, but it is limited. This means that we can assume that investors, frightened by the "consular" confrontation between Washington and Beijing, are actively buying all the other currencies, of course, among the main ones, in order to somehow insure themselves against possible negative consequences.

On the other hand, the Fed starts its two-day monetary policy meeting today. The regulator is expected to leave interest rates, as well as other parameters (asset repurchases) unchanged. You can hardly expect that there will be anything positive in his press release. We expect the same from the speech at the press conference by the head of the FRS, J. Powell.

What impact will the Central Bank meeting have on the market? We believe that if only there are no new catastrophic sayings about the prospects of the American economy, then its influence will cause a local increase in volatility and nothing more, since it is impossible to imagine anything worse than the word "catastrophe". However, Powell and his colleagues are unlikely to dare to do this.

Forecast of the day:

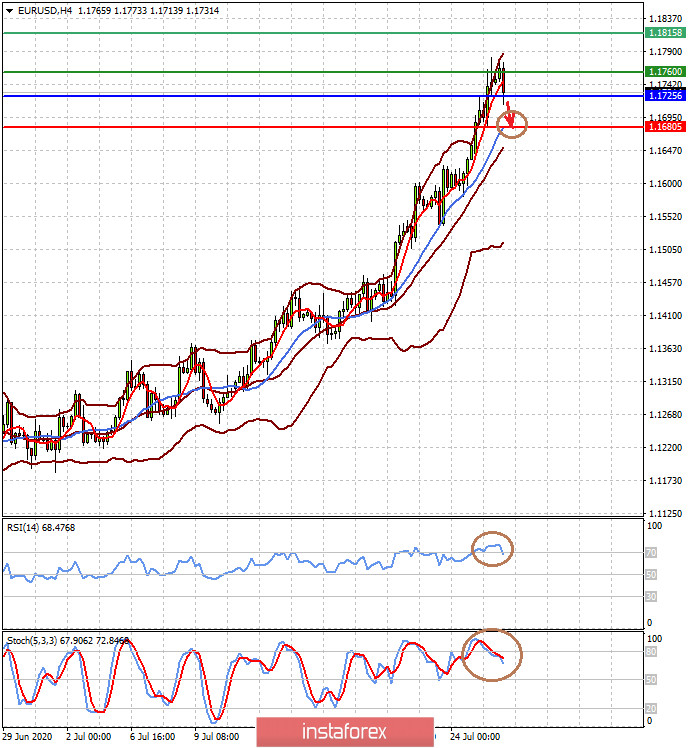

The EUR/USD pair tested our target at 1.1760 and corrected down to 1.1725. If it does not hold above this level, it will decline even lower to the level of 1.1680.

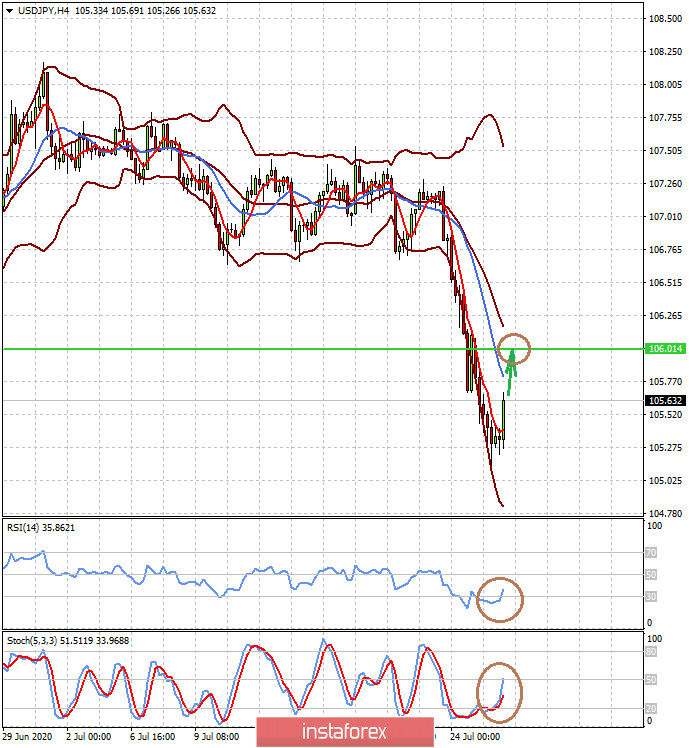

The USD/JPY pair is recovering from a two-day fall in anticipation of the Fed's final monetary policy decision. On the wave of local oversold, the pair may rise to 106.00.