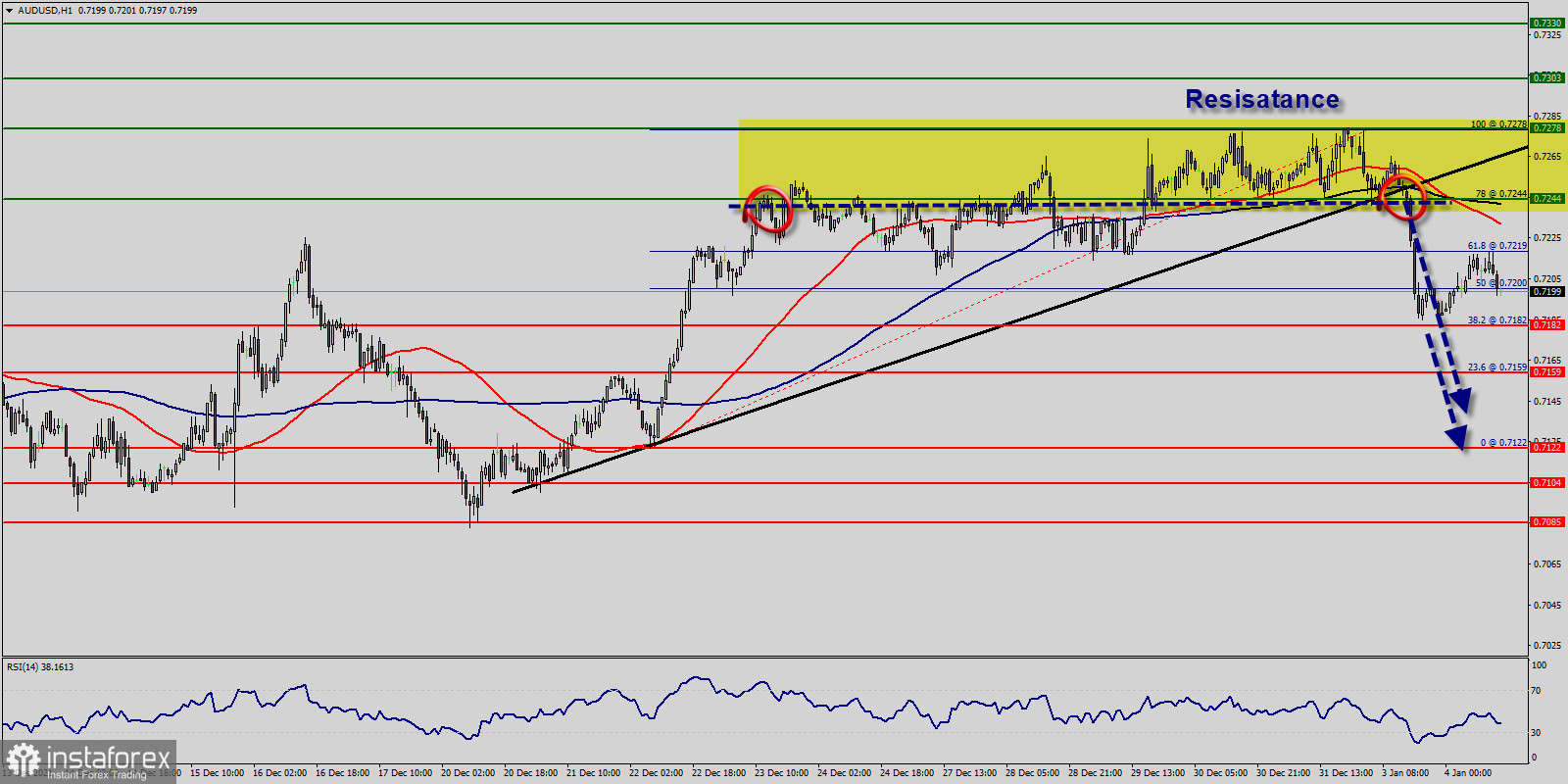

The AUD/USD pair has faced strong resistances at the levels of 0.7244 because support had become resistance.

So, the strong resistance has been already formed at the level of 0.7244 and the pair is likely to try to approach it in order to test it again.

However, if the pair fails to pass through the level of 0.7244, the market will indicate a bearish opportunity below the new strong resistance level of 0.7244 (the level of 0.7244 coincides with a ratio of 78% Fibonacci).

Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50).

Thus, the market is indicating a bearish opportunity below 0.7244 For that it will be good to sell at 0.7244 with the first target of 0.7159.

It will also call for a downtrend in order to continue towards 0.7122.

The daily strong support is seen at 0.7085. The price spot of 0.7244/0.7278 remains a significant resistance zone.

Therefore, a possibility that the AUD/USD pair will have downside momentum is rather convincing and the structure of a fall does not look corrective.

However, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 0.7303.