Hello, dear colleagues!

The beginning of this week was a stormy continuation of the previous one, and yesterday the main currency pair of the Forex market continued to grow, which turned out to be quite strong.

Escalating tensions between the US and China, as well as concerns about the US economy, did not contribute to the strengthening of the dollar, but on the contrary, put pressure on the world's leading reserve currency. Even a preliminary agreement in the US Senate on the adoption of an unprecedented package of measures to support the world's leading economy did not help the dollar avoid problems. Yesterday's reports on orders for durable goods in the United States were very mixed, and, by and large, were ignored by market participants. If we are talking about statistics, the main macroeconomic event of today will be the US data on consumer confidence, which will be published at 15:00 London time.

However, the main events for investors are still ahead. Let me remind you that tomorrow, at 19:00 (London time), the US Federal Reserve will announce its decision on interest rates. Half an hour after that, at 19:30 (London time), there will be a press conference of Fed Chairman Jerome Powell. It is expected that the US regulator will again signal that rates will remain at the current low levels for a long time. The Fed will call the recovery of the world's leading economy slow, and will focus on the federal program of assistance to the American economy.

The next day, on July 30, the US will release data on GDP for the second quarter, which, according to consensus forecasts of minus 34%, may become a collapse, with all the consequences for its national currency. Both of these events do not seem to bode well for the US dollar. If so, the "American" will continue its rather strong fall across the entire spectrum of the currency market.

Regarding COVID-19, the situation does not change, and the United States continues to hold the lead in the daily increase in infected people. The number of coronavirus infections in the United States ranges around 70 thousand per day.

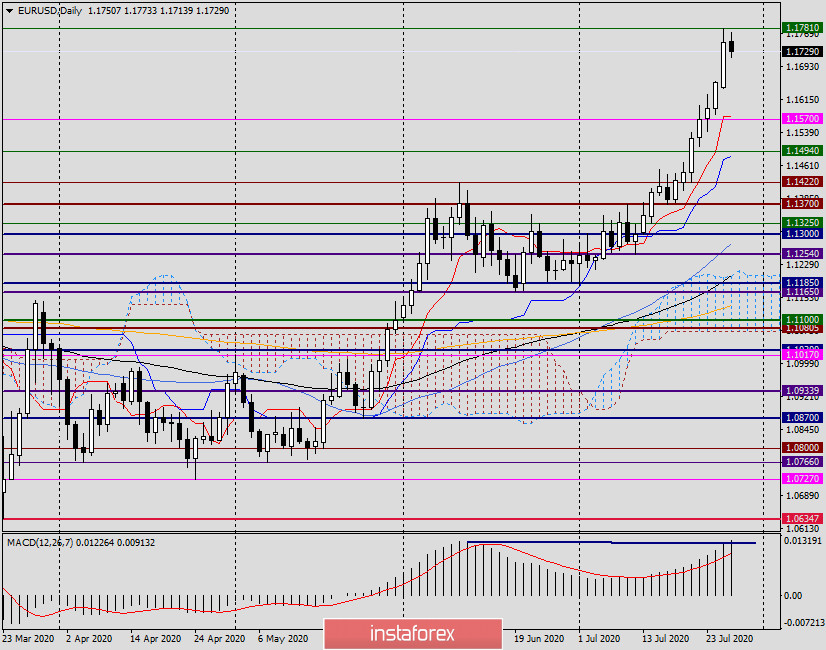

Daily

The upward trend in EUR/USD on the trading results of the first day of the new week confirmed its strength. As a result of significant strengthening, the pair showed maximum values at 1.1781, and ended Monday's session at 1.1750. Thus, with a high probability, we can assume that the strong technical zone of 1.1700-1.1715, where sellers' resistance was expected, was broken. However, it is still too early to make final conclusions about the breakdown of this area. Moreover, the main events for the US dollar are still ahead. One thing is for sure, market participants have lost interest in the US currency, and they prefer the Japanese yen and Swiss franc as protective assets. That is, everything goes back to normal.

If we briefly describe the technical picture on the daily chart, it is brightly colored in bullish tones. The Tenkan and Kijun lines of the Ichimoku indicator confidently rushed up after the price. The used moving averages (50 MA, 89 EMA, and 200 EMA) are moving slightly slower in the north direction. As for the bearish divergence of the MACD indicator, it is about to be broken, which will indicate further upward prospects for the euro/dollar.

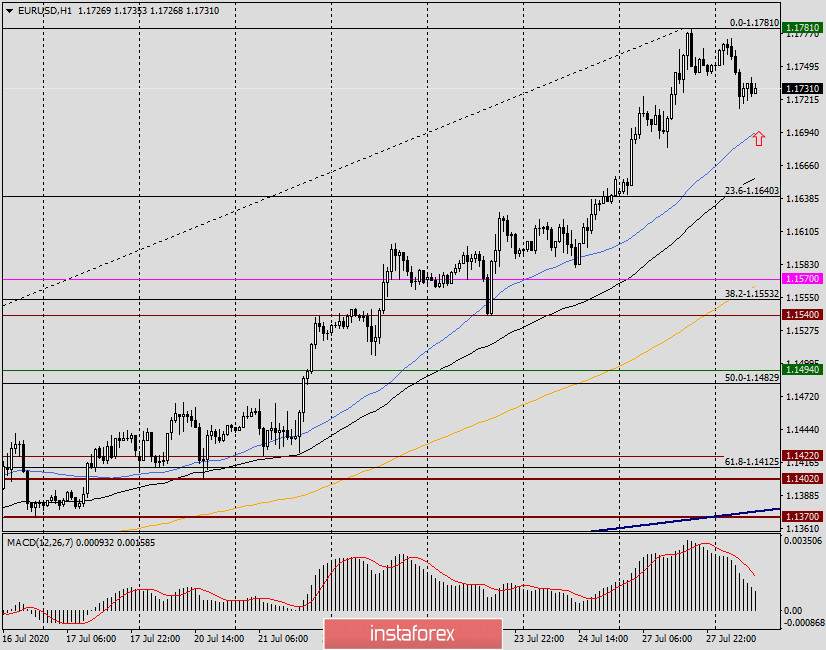

H1

On the hourly chart, the bearish MACD diver was broken long ago, after which the pair continued its ascent. If you go to today's trading recommendations, then, of course, the main thing is purchasing. However, buying the euro/dollar pair at such high prices and without adjustment is, in my opinion, an ungrateful and rather risky activity. Yes, given the strength of the bullish trend, the pair can continue to grow from the current prices, but it would be good to wait for a pullback to the price zone 1.1715-1.1690 and from there consider opening long positions on EUR / USD.

If the pullback does not occur and the quote continues to move up from the current prices, I recommend observing the behavior of the price in the area of 1.1800-1.1820. This is a fairly strong technical zone, and if reversal patterns of Japanese candles are formed here, you can try neat sales with a small stop and goals in the area of 1.1750-1.1715. Why not? However, it is necessary to understand that such positioning is against the current and very strong upward trend, and therefore carries additional and high risks.

Good luck!