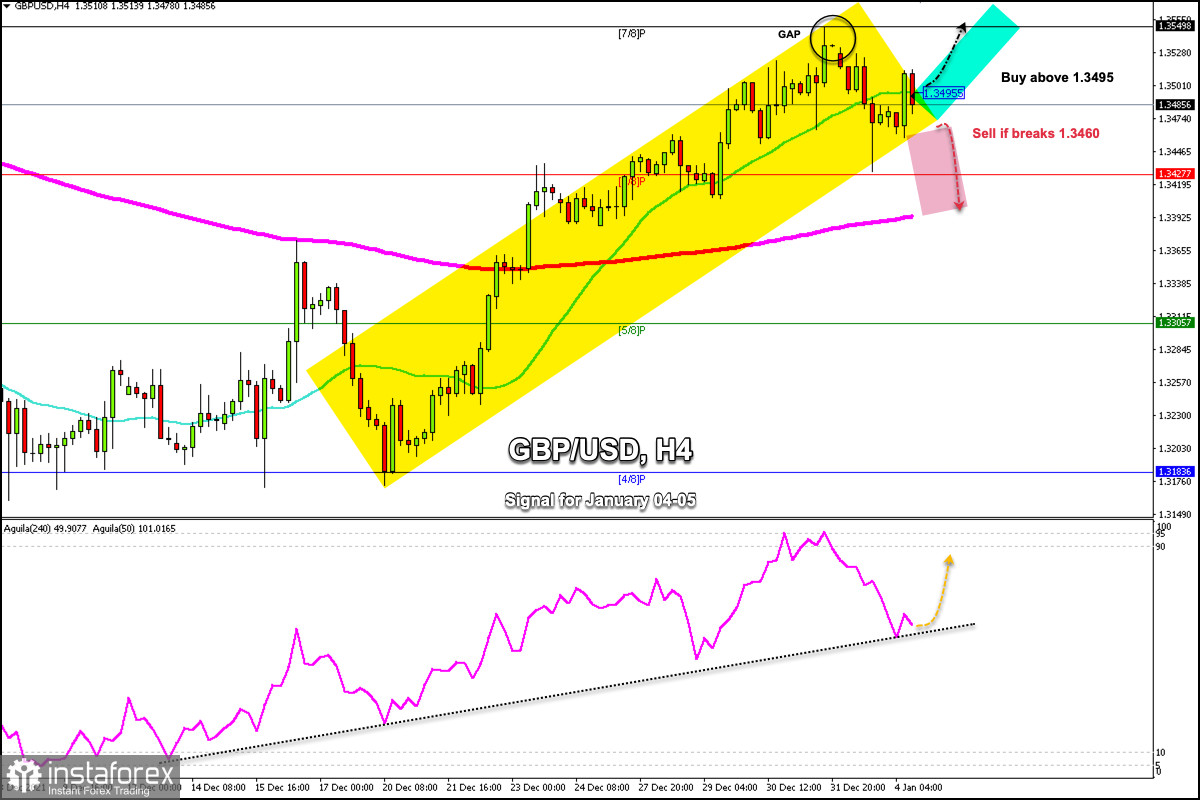

GBP / USD is trading within the uptrend channel (yellow color). It is currently trading below the 21 SMA located at 1.3495. Given that the trend is still upward and the fall that it made yesterday was a technical correction, it is likely that the upward movement will continue in the next few hours.

A consolidation above the key level 1.35 and above the 21 SMA could favor the recovery of the British pound and it could reach resistance at 1.3550.

On December 31st, the pound left a GAP at the level of 1.3530 that could be a positive sign. If you trade above 1.3495, GBP/USD will be able to return to these price levels and thus cover the gap. Therefore, you can buy GBP / USD as long as it remains above the 21 SMA.

Since December 31, the eagle indicator is oscillating above an uptrend channel. having touched this level in the European session, the currency pair is now rebounding. It is likely to be a positive sign and could give us an opportunity to buy GBP/USD in the next few hours.

On the contrary, a sharp break below the uptrend channel and a negotiation below 1.3460 could cause a fall towards 6/8 of Murray located at 1.3427 and towards the EMA 200 located at 1.3390.

The dollar index (USDX) is showing signs of exhaustion. Given that it is approaching the zone of strong resistance at 96.48, it could be a favorable sign for GBP/USD.

Scenario

Timeframe | 4-hours |

Recommendation: | Buy |

Entry Point | 1.3495 |

Take Profit | 1.3550 |

Stop Loss | 1.3455 |

Murray Levels | 1.3549, 1.3671, 1.3793 |

Alternative scenario

Recommendation: | Sell |

Entry Point | 1.3460 |

Take Profit | 1.3427, 1.3390 |

Stop Loss | 1.3498 |

Murray Levels | 1.3427, 1.3305, 1.3183 |