Excess liquidity and slowing bond market volatility are currently the main factors that lead to a further weakening of the US dollar and a sustained recovery in stock indexes. Reports of new outbreaks, as well as reports of new types of coronavirus, are ignored. Investors prefer to respond to reports of imminent vaccines.

Moreover, investors prefer to be guided by good news over bad news, rightly assuming that if bad news dominates, central banks will simply provide more liquidity.

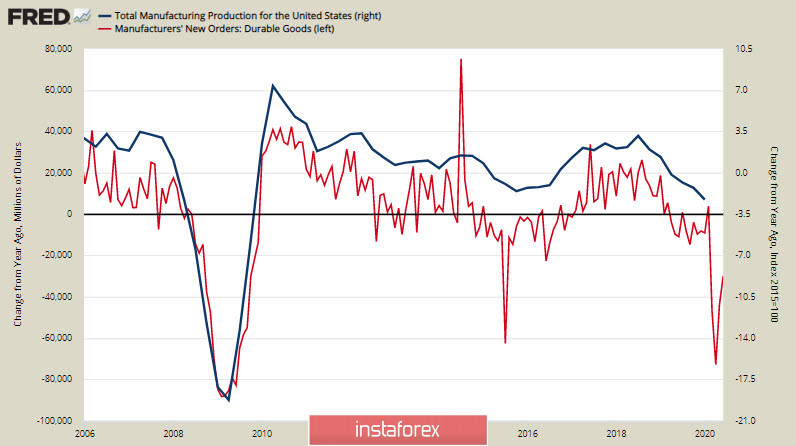

The dollar remains under pressure. Durable goods orders in June showed weak growth against the fall in March-April and the industrial production index is likely to continue to decline.

So far, there are no official announcements of a financial support plan to replace the completion of supplementary unemployment benefits. According to rumors, it is not 1 trillion, but already 1.5 trillion. It is not clear yet, but it is obvious that the deprivation of 30 million Americans of the weekly income of $ 600 can affect the form of a sharp decline in household spending.

Gold continues to break records, and so impulse remains strong. Based on fundamental data, a reversal is unlikely - the approaching elections in the US makes the dollar dangerous against the backdrop of growing civil confrontation.

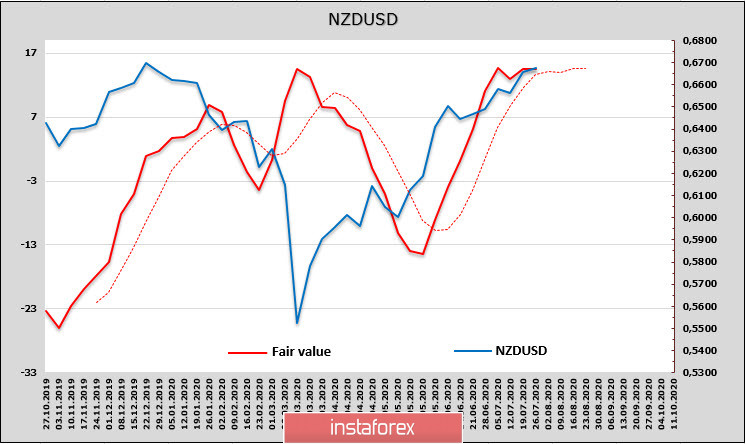

NZD/USD

The New Zealand dollar has been looking strong in recent weeks. After abandoning restrictive measures, there is a positive trend in most indicators, including PMI and PSI. The housing market has made full use of support measures, such as low mortgage rates and loan deferrals, with the move towards a recovery in GDP growth in the short term.

Raw material prices remain stable, especially milk and dairy products. As a consequence, strong growth in business activity, commodity prices and improved housing forecasts reduce the risks for the New Zealand dollar.

The NZD net long position increased slightly over the reporting week, but, apparently, the momentum is whooshing out. The spot price is close to the target price and the upward trend is still a priority, however, further growth is questionable. Most likely, a correction is approaching.

The next meeting of the RBNZ will be held on August 12, while confidence prevails in the markets (it is actively disseminated, for example, by the ANZ bank) that QE will be expanded. On Thursday, the RBNZ will provide its version of the Business Optimism Index in July, the overall situation for the New Zealand dollar remains stable. Testing the resistance level of 0.6750 will almost certainly take place, after which the target will settle at the level of 0.6790. A consolidation above will improve the technical picture for this currency, the odds remain high, but a breakdown of resistance could trigger a correction.

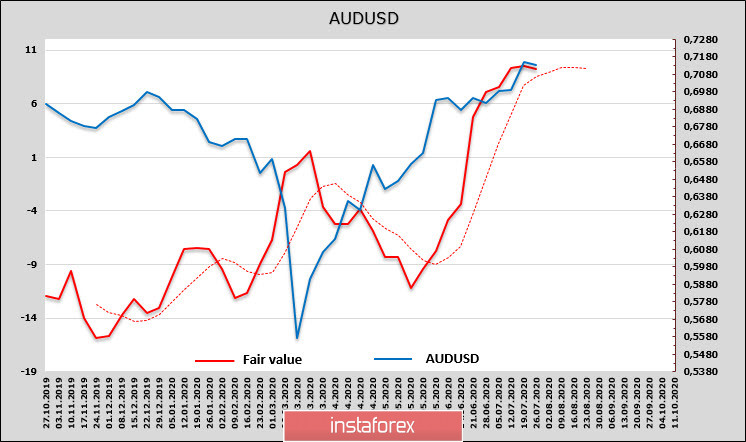

AUD/USD

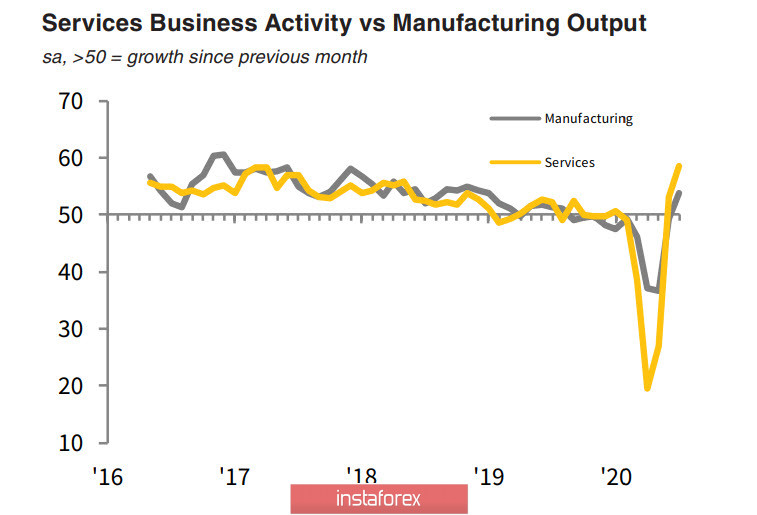

Business activity in Australia is recovering at a faster pace than the rest of the world - PMI in services from Commonwealth Bank in July rose to 58.1p, which is significantly higher than the dock level, but there is also an alarming data - a weekly household survey conducted on last week, showed that the number of jobs declined from 64.6% to 63.5% of the labor force, that is, the dynamics of the recovery of the labor market is under threat.

The Australian dollar, like the NZD, is influenced by similar factors and has similar dynamics. The growth of the fair price has been suspended, the net position on the CME has no advantage either long or short, and the momentum is still growing, but its strength has weakened.

Moreover, it has consistently broken through the resistance levels of 0.7022 and 0.7072, consolidation above which confirms the bullish technical picture. The momentum, in turn, is not completely exhausted; therefore, we cannot exclude attempts to develop success, the next resistance is located at the level of 0.7395. At the same time, the probability of a correction is increasing, which can happen at any time, for example, if the US Congress declares its readiness to pass a new stimulus bill.