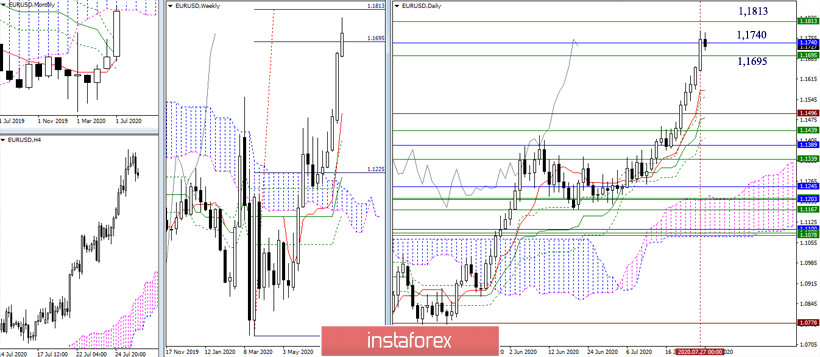

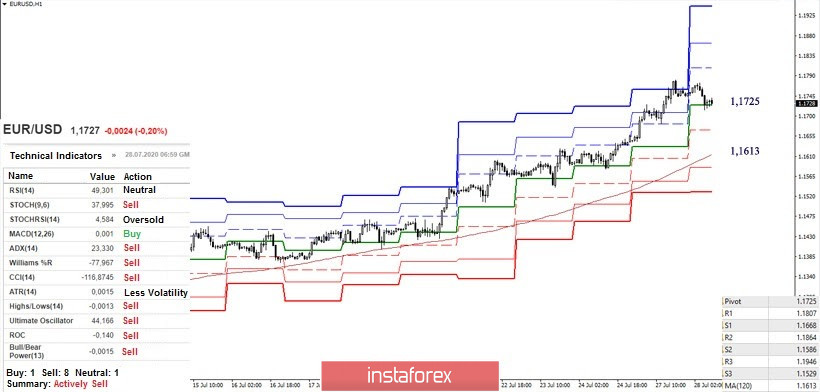

EUR / USD

The pair continued to rise and has reached the zone where important resistance-reference points of this area have united - the weekly target for the breakdown of the Ichimoku cloud (1.1695 - 1.1813) and the lower border of the monthly cloud (1.1740). The zone of resistance encountered is wide enough and formed by strong levels, therefore, the formation of the result of interaction may take some time and will be important for further movement.

At the moment, at the lower time intervals, the pair is in the zone of the developing downward correction. The bearish traders secured the majority of the analyzed technical indicators and reached the support of the central Pivot level (1.1725). Breaking through the level (1.1725) will allow us to consider the further development of the downward correction, which may contribute to the formation of a rebound from the encountered resistances of the upper time intervals. The next intraday downside target will be the weekly long-term trend (1.1613), with nearest support at 1.1668 (S1). In case of completion of the corrective decline and the restoration of the upward trend, the interests of the upward traders will be directed to the resistances of the classic Pivot levels, which are located at 1.1807 - 1.1864 - 1.1946 today.

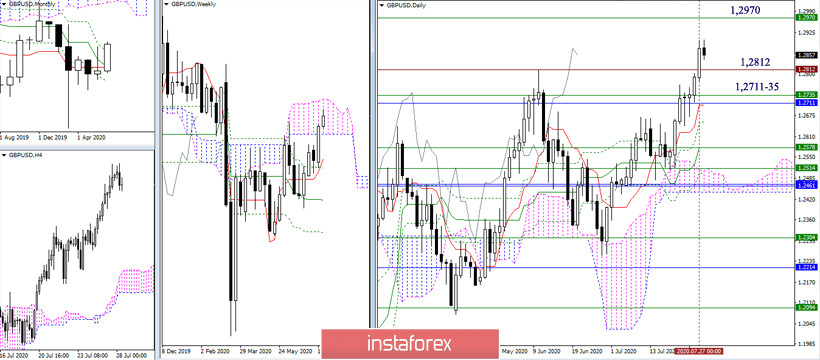

GBP / USD

The players to increase currently have an advantage. They managed to close last week in a weekly cloud. As a result, they are now busy implementing a rise to its upper border (1.2970). The levels passed earlier - 1.2812 (maximum extreme) and 1.2711-35 (daily Tenkan + monthly Fibo Kijun + weekly Senkou Span B) serve as support levels.

In the lower time frames, the bearish players are fighting for the central Pivot level (1.2853). If we manage to consolidate below, the current downward correction will receive new benchmarks - 1.2804 (nearest support S1) and 1.2768 (weekly long-term trend). The inability of the downside traders to cope with the first key support at H1 (1.2853) may complete the next correction. In this case, the bullish players, having the main advantage, as well as the support of the higher halves, will continue the upward trend. Its intraday reference points are located today at 1.2927 (R1) - 1.2976 (R2) - 1.3050 (R3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)