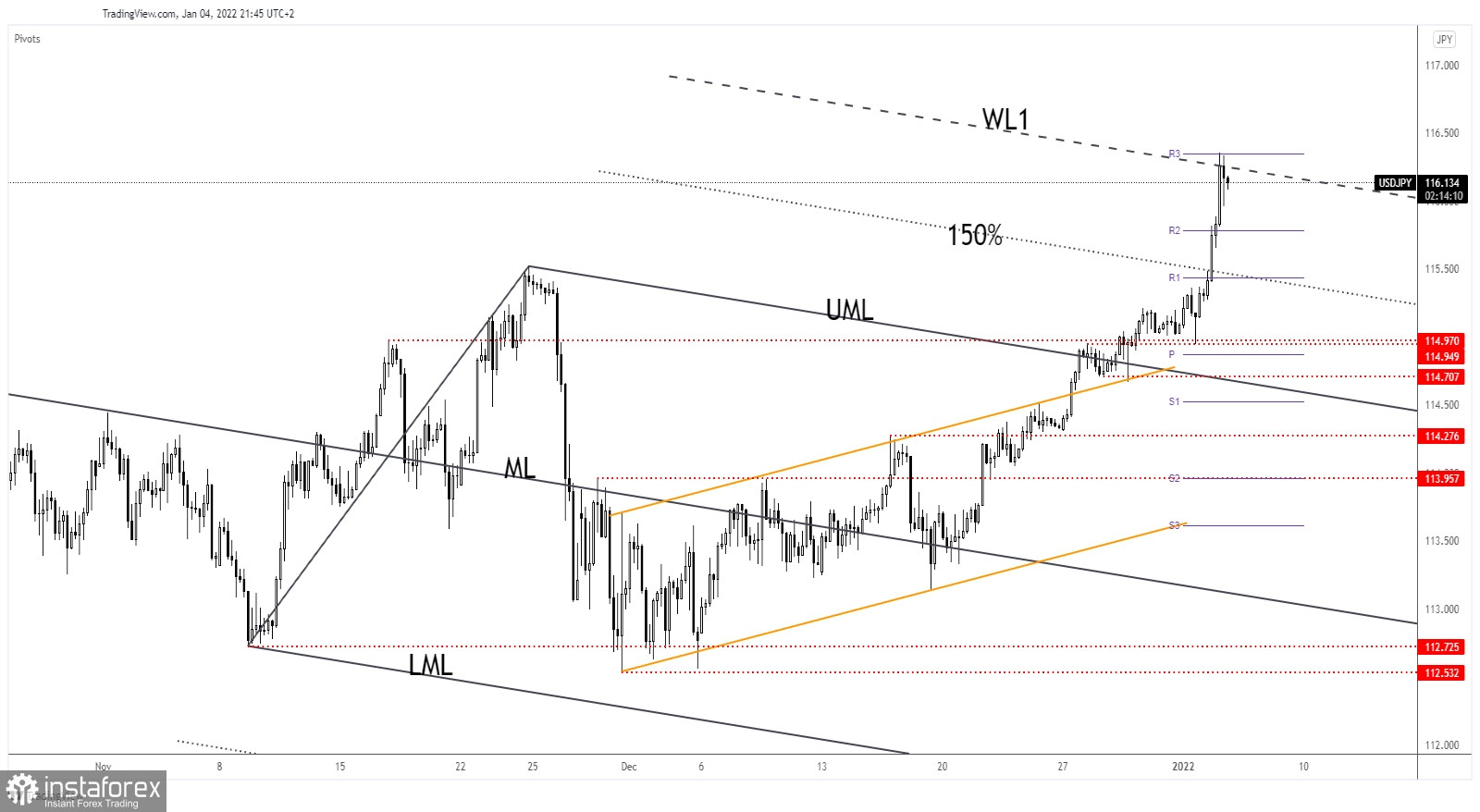

USD/JPY rallied as expected after yesterday's false breakdown with great separation below 114.97 static support. Now, it's trading at 116.14 level below 116.35 today's high. The pair registered a 1.22% growth from 114.94 yesterday's low to today's high.

Technically, it has reached a strong resistance area, so we cannot exclude a temporary decline. The pair developed an amazing rally as DXY advanced and because the Yen Futures plunged.

Fundamentally, the Japanese Final Manufacturing PMI increased from 54.2 to 54.3 points as expected. On the other hand, the US ISM Manufacturing PMI, JOLTS Job Openings, and the ISM Manufacturing Prices reported worse than expected data. In the short term, the USD was punished by today's poor economic figures.

USD/JPY Amazing Rally!

USD/JPY increased as much as 116.35 level where it has found resistance. As you can see on the H4 chart, the price reached the first warning line (WL1) and the R3 116.34 which are seen as upside obstacles, so a minor drop is natural.

Personally, I'll wait for a temporary decline before looking for new long opportunities. A temporary decline may help the buyers to catch a new bullish momentum. Also, a valid breakout above the first warning line (WL1) may announce an upside continuation.

USD/JPY Outlook!

The bias remains bullish despite a temporary decline. After its amazing rally, a minor retreat is natural. As long as it stays under the warning line (WL1), USD/JPY could come back down towards the R2 (115.78) or lower towards the 115.52 static support.

A temporary retreat or a new higher high could bring new long opportunities and could validate an upside continuation.