As the first day of the Federal Reserve meeting begins, demand for the US dollar is gradually returning. But rather, traders are simply taking profits before such an important event, which most likely will not change anything in the market. The absence of important fundamentals in the first half of the day also led to a slight decline in the European currency and the British pound, as there are no new benchmarks from which buyers of the European currency would be able to move further.

From the good news, we can note the growth of the index of expectations for manufacturing exports in Germany in July this year. Data from the Ifo Institute indicated an increase in the indicator from -2.2 points immediately to 6.9 points, which indicates cautious optimism among exporters. Lifting restrictions, opening borders and restoring the economies of neighboring regions - all this is quite favorable for German exports. The biggest increase was recorded in the automotive industry, where exports jumped the most after a difficult time that was experienced during the closure of the economy due to quarantine measures. Significant growth was also registered in the chemical industry.

It is not surprising that investors are betting on the euro as the Eurozone economy continues to move along the path of rapid recovery. However, in the autumn period, we should expect a slowdown in growth, since the latest signals on lending and the aggregate of the money supply indicate such a high probability. The benchmark is again shifted to the recovery of domestic demand, and after the crisis period, when companies and households are particularly active in spending money, will end this summer. Therefore, in the autumn, we can expect a decrease in the pace of economic recovery.

Today, the European regulator issued recommendations to banks to refrain from paying dividends and buying back shares until next year. Initially, the moratorium was imposed until October of this year. But now, when there is a serious enough threat to face a lack of liquidity and a shortage of capital, the restrictions are extended until January next year. And although this is just a recommendation, banks are likely to comply with it, as negative interest rates and the growth of problem loans after the coronavirus pandemic will seriously hit profits.

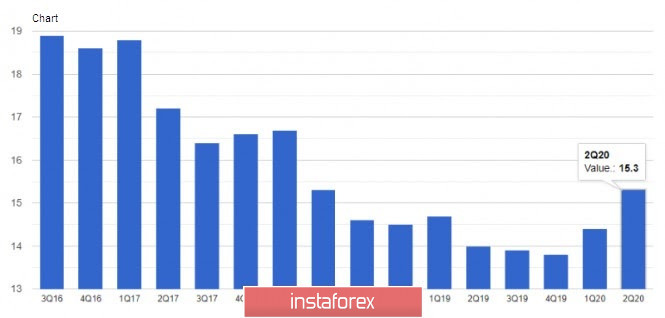

We can not ignore today's report on the unemployment rate in Spain, which in the 2nd quarter of this year grew quite seriously, although it was below the forecasts of economists. The problems in the tourism sector faced by Spain due to the coronavirus pandemic have left many out of work in the summer, and this figure is most likely just the beginning of an upward trend in unemployment. According to data, the unemployment rate in Spain rose to 15.3%. Employment fell by 6.7% compared to the previous quarter, and the number of hours worked fell by 22.6%. And we see such indicators provided that some employers practice a shorter working day. Without it, the unemployment rate could easily reach 30%. It is expected that the peak will be in the 1st quarter of 2021, when unemployment will hit 19% as unpaid leave ends.

As for the technical picture of the EURUSD pair, the prospects for further growth of the euro are questionable. The bulls have already used everything to the maximum to get to the 18th figure, where the demand for risky assets has slowed sharply. Most likely, there will be no significant changes in the market until tomorrow's decision of the Federal Reserve on monetary policy, which may form a small downward correction in the trading instrument. If the bears manage to gain a foothold below the support of 1.1700, it is likely that the pressure on the euro will increase, which will lead to an update of the larger minimum of 1.1650. But even a serious decline in the EURUSD to this range will not significantly harm the current bullish trend observed since the beginning of this month. A break of the 18th figure will easily open a direct path for risky assets to the maximum of 1.1000.