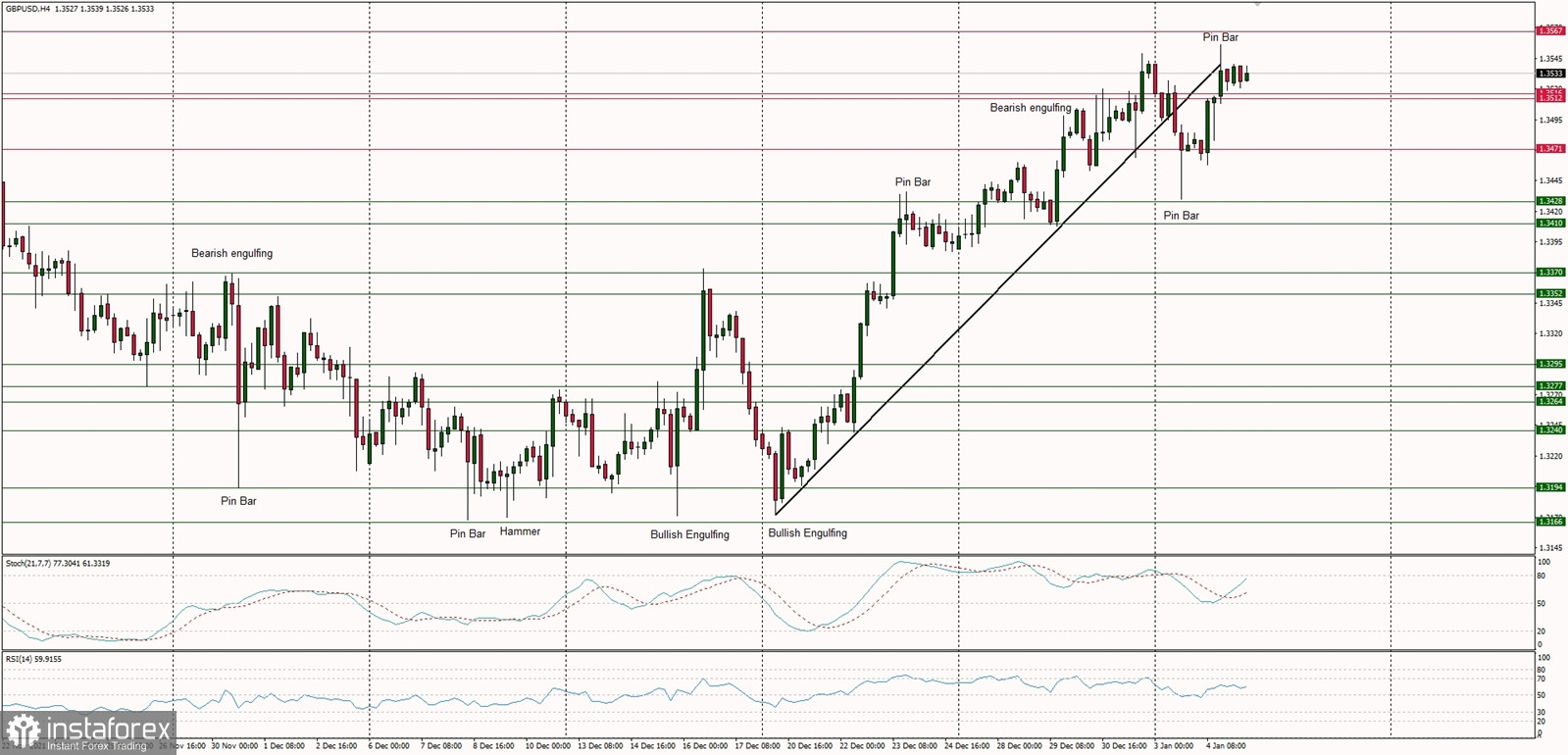

Technical Market Outlook

The GBP/USD pair has made a new swing high at the level of 1.3556, but this high was ended with a Pin bar candlestick pattern. The next target for bulls is located at 1.3604. The immediate technical support is seen at 1.3512 and 1.3516. The strong and positive momentum support the short-term bullish outlook for GBP, however, the market conditions are now extremely overbought on the H4 time frame chart, so a pull-back towards the level of 1.3428 or below is welcome.

Weekly Pivot Points:

WR3 - 1.3774

WR2 - 1.3658

WR1 - 1.3620

Weekly Pivot - 1.3485

WS1 - 1.3451

WS2 - 1.3393

WS3 - 1.3287

Trading Outlook:

Despite the recent breakout above the level of 1.3514, the GBP/USD is still in the down trend as the 61% Fibonacci retracement of the last wave down hasn't been event tested yet. The market is in the down trend with a long-term target located at 1.2668 ( September 2020 lows) as long as the level of 1.3579 is not clearly broken.