The euro slowed its gains against the US dollar ahead of the announcement of the Fed's decision on monetary policy, which will be announced today. Since there are no other factors for the movement in the market, trade may remain in a narrow price range until the Fed's decision.

At the meeting, which has been going on since yesterday, the committee will make decisions on the US monetary policy. Just yesterday it was announced that the Fed has extended all lending programs until December 31 of this year, most of which were to be completed at the end of September. All seven emergency programs were extended for another three months, in order to support economic activity during the period of overcoming the coronavirus pandemic. The first programs were introduced last March, and its aim was to provide assistance to the population and business during the period of quarantine restrictions. The additional programs that were approved after the quarantine were more of a support in facilitating the economic recovery, but such led to the decline of the US dollar, as well as to a decrease in the yield of Treasury securities and an inversion of the yield curve. Low interest rates, which will persist for quite a long period of time, are no longer on the side of the US dollar.

At the same time, there are concerns on the recently proposed stimulus package that was approved by the US Congress. Of course, it will require more discussion in the Senate, but the changes introduced, which the Democrats disagree with, will lead to a change in monetary policy. The plan, which was proposed by the Republicans, provides for a threefold reduction in the unemployment allowance, which means that the current payout of $ 600 per week could be reduced to $ 200. If the benefits remain at the current level, there is a high risk that workers will find it difficult to return to their duties since some of the current benefits are higher than their current salaries. Such could result in a slower recovery in the US labor market, which will seriously affect the pace of economic recovery after the coronavirus pandemic,

If the Fed announces changes in the monetary policy or expands the bond purchase program (which is unlikely), demand for the dollar may decrease even further, and the risk assets, including the euro will continue a bullish trend. However, if the committee confines itself to statements that they are ready to act as needed, the demand for the US dollar may return, which will lead to a downward correction in the trading chart.

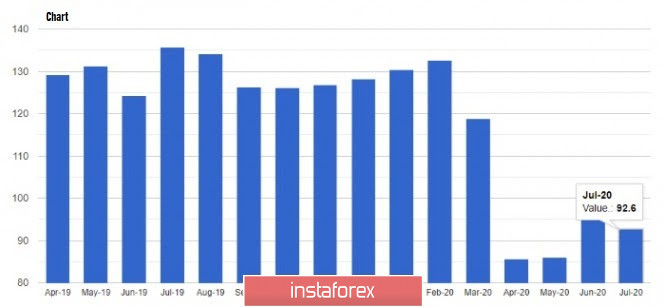

Meanwhile, with regards to macroeconomic reports that were published yesterday, recent data reveals that many Americans are doubting the US economy, which will negatively affect the pace of recovery this fall. According to the report of the Conference Board, consumer confidence has declined due to another coronavirus outbreak and additional social distancing measures and restrictions, falling from 98.3 points in June to 92.6 points in July, while economists had expected the index to be 94.3.

Basically, the decrease is associated with the short-term prospects of the US economy and the labor market, which is starting to deteriorate again. The largest decline was recorded in the states that have the most new cases of COVID-19 infection, which are Michigan, Florida, Texas and California.

As for activity in the manufacturing sector, the Richmond Fed published a report which indicated that the composite manufacturing index for its area was 10 points in July against 0 in June, while economists expected the index to rise to only 3 points. Back in April, the index was at -53 points.

House prices, meanwhile, have slowed its rise in May 2020, which is due to a sharp decline in sales caused by the restrictions on business activity in many regions of the country. According to S & P / CoreLogic / Case-Shiller, the national house price index rose 4.5% in May over the same period last year, after a 4.6% idle in April.

Retail sales data, which was ignored by the market, on the other hand, rose according to the report of the Retail Economist and Goldman Sachs, as it increased by 1.1% for the week from July 19 to July 25, but decreased by 8.5% per annum. The Redbook also said that retail sales in the first 3 weeks of July jumped by 1.1% m / m and fell by 7.2% y/y.

As for the technical picture of the EUR / USD pair, movement will depend on the Fed's decision today, in which if there are no significant changes made to the monetary policy, and the statements of Chairman Jerome Powell are also rather restrained and do not differ much from the previous statements, the US dollar will rise slightly, forming a downward correction in the trading chart. For this, it is necessary to break below the support level of 1.1700, as such will decrease the demand for the euro, which will lead to a decline to the level of 1.1650, and then to the support level of 1.1590. But if the bulls turn out to be stronger, a breakout from the resistance level of 1.1770 could occur, which will push the quote to new highs in the area of 1.1830, where the 19th figure is within easy reach.