Hello, dear colleagues!

Now it is Wednesday - the day when the US Federal Reserve (FRS) will end its two-day meeting on monetary policy and announce the final decision on interest rates. Also, updated economic forecasts will be published, and then-Fed Chairman Jerome Powell will hold a press conference. In other words, the July meeting of the Fed will be held in full. The main intrigue of this most important event for the markets is whether the Fed will be able to surprise investors with something or everything will pass within expectations. Let me remind you that according to the consensus forecast, the federal funds rate will not be changed and will remain at the level of 0.25%. If so, the main impact on the course of trading will have updated forecasts for the US economy and the rhetoric of the speech of the head of the Federal Reserve Jerome Powell.

Given the situation with COVID-19, it is reasonable to assume that the press conference of the chief American banker will be colored in soft "dovish" notes. Most likely, Powell will once again confirm the Fed's commitment to further ultra-soft monetary policy, as well as speak about the long and difficult recovery of the world's leading economy from the consequences of the coronavirus pandemic. In his speech, the Fed Chairman will not ignore the topic of raising inflation to the target level of 2%. Also, Powell is sure to touch on the $ 1 trillion plan to help the American economy, which was developed by Senate Republicans together with the administration of US President Donald Trump. Let me remind you that the Fed will announce its decision on rates at 19:00 (London time), and the press conference of the head of this department will begin at 19:30 London time.

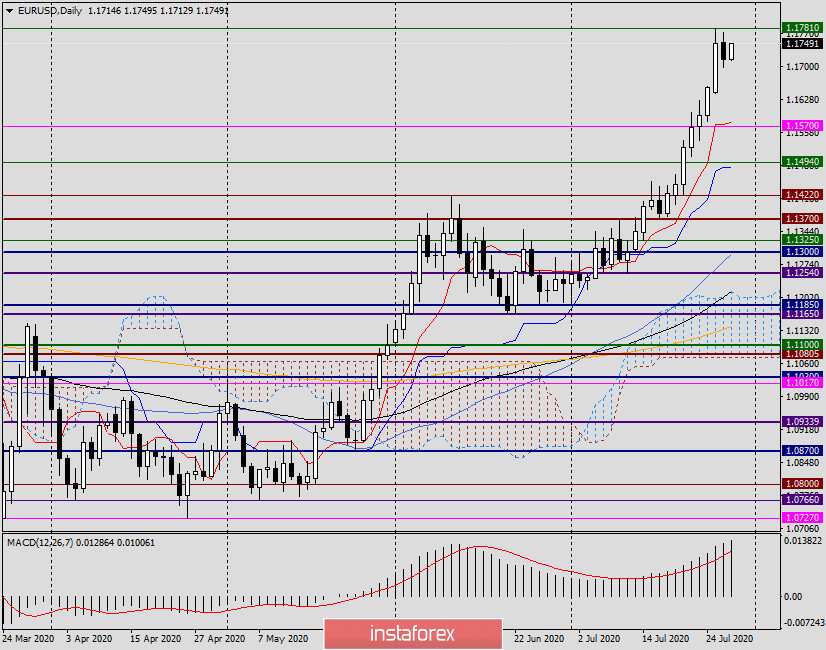

Daily

Following the results of yesterday's trading, the main currency pair of the Forex market fell slightly, drawing a candle on the daily chart, which may well be considered a reversal. Thus, it seems that the market prepared for today's trading and took into account both possible scenarios.

The first scenario assumes the continuation of the current upward trend and absorption by the growth of yesterday's bearish candle. In this case, the maximum values at 1.1781 shown on July 27 will be rewritten, after which the euro/dollar pair will rise to 1.1800, 1.1830, and possibly to 1.1860.

If the updated economic forecasts and the tone of the speech of the head of the Federal Reserve support the US currency, the market will start to play back yesterday's daily candle and the pair will go for a correction, the goals of which will be 1.1680, 1.1640, 1.1600 and possibly 1.1580/70.

Given the strong bearish sentiment on the US dollar, it is difficult to imagine what Jerome Powell should say to radically change the situation in the foreign exchange market in favor of his national currency. At the same time, it has been noted that market participants may react to certain speeches of high-ranking monetary officials in completely different ways. Most often, the market reaction coincides with the current price dynamics. In other words, I am more inclined to believe that EUR/USD will continue to grow, which means that you need to look for points to open long positions, preferably after short-term corrective pullbacks.

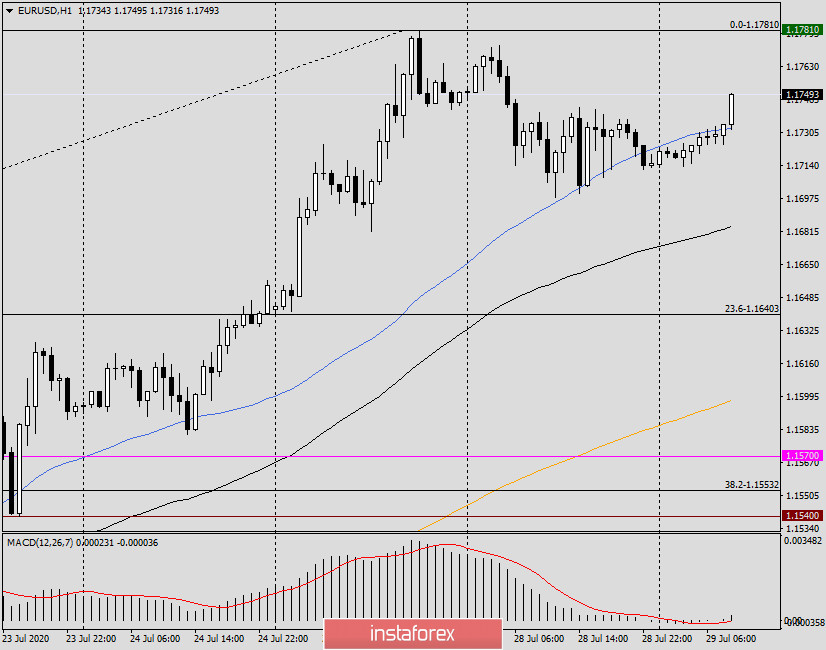

H1

On the hourly chart, at the moment of completion of the article, there is a typical flat, which is very typical in the run-up to such an important event, which is expected this evening. However, most likely, the market will not wait for the announcement of the Fed's results but will start moving more actively earlier. Another thing is that after nine o'clock in the evening, we expect increased volatility and sharp multidirectional movements.

I immediately note that it is very difficult to trade in such conditions, so for those who are new to the market, I recommend just watching what is happening. For other traders, I recommend planning purchases of the main currency pair after its declines to 1.1680, 1.1640, 1.1600, and possibly to 1.1580/70. For those who use a breakout strategy, I recommend considering buying the pair at the breakout of the sellers' resistance at 1.1781 or after a true breakout of this mark on the pullback to it.

Despite yesterday's daily candle, sales continue to be more risky positioning. In my personal opinion, in times of such strong trends, a reversal signal, in this case, a bearish one, is better seen on a weekly period for greater confidence.

Good luck with trading!