Gold is not the best investment when the global economy is healthy. However, it opens lucrative speculative opportunities amid the doom and gloom worldwide. In one of my previous articles, I pointed out that the precious metal set historic records against major currencies, except the US dollar. As it turned out, we waited a bit until gold leapt another $60 and set the all-time record. Moreover, futures contracts touched $2,000 per troy ounce. Well, what will follow next?

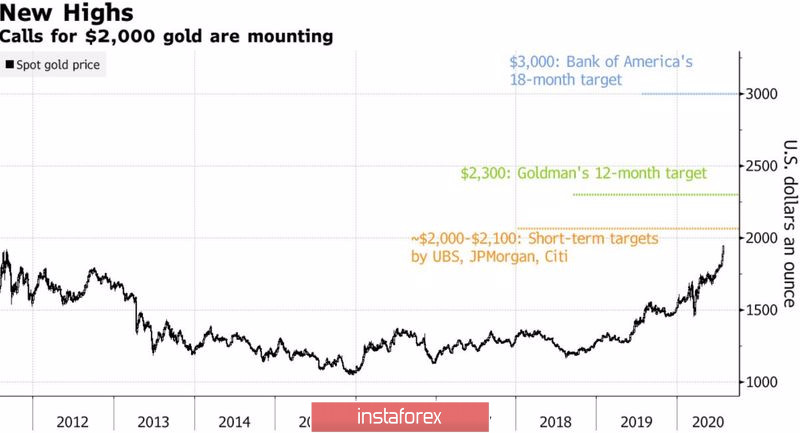

Analysts have different viewpoints. Experts at JP Morgan reckon that gold is likely to have reached its peak or it is at least an inch away from its historic high. They think that the metal is about to enter a consolidation stage at around the current levels. At the same time, other banks foresee a further rally. Goldman Sachs upgraded its 12-month outlook to $2,300 from $2,000 in the previous forecast. Citigroup notes that the ongoing cycle is unique and expects the yellow metal to shift towards more elevated levels than it used to trade. BofA Merrill Lynch believes that gold is on track to the high of $3,000 per ounce in the nearest 18 months.Gold dynamic and forecasts

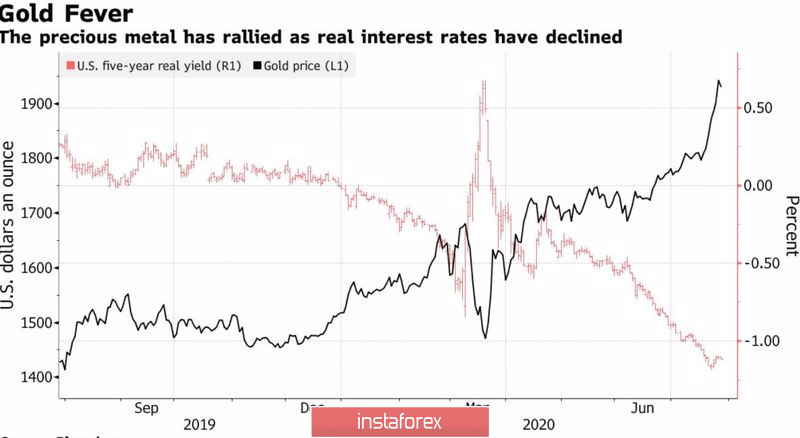

In fact, investors take to gold like a duck to water in the times when governments slash credit rates to historic lows, central banks devalue their monetary units, and the US dollar is about to lose its status of the world's number one reserve currency. The idea of sharp inflation acceleration resurfaces in financial markets. Until now, large banks preferred not to look back. Originally, they were worried that a large-scale monetary stimulus from the US Fed and other regulators could inflate consumer prices. Actually, this idea proved oneself wrong back in 2008-2011. Back then, gold hit a record high of $1,921 per ounce as investors believed that a broader money supply would speed up inflation and boost demand for trading instruments which allowed them to hedge inflation-related risks.

At present, mounting inflation expectations push down yields of debt securities on the one hand and propel a rally of XAU/USD on the other hand. Bond interest rates are moving as if the Federal Reserve has already targeted a yield curve. If it happens that Jerome Powell and his colleagues express tolerance towards the prospects of high CPI and PCE, gold could immediately jump as high as $2,000 in the spot market in response.

Gold dynamic and bond rates

Gold bulls are benefiting from the broad-based weakness of the US dollar. Indeed, dollar-denominated gold is developing a steady climb while the US dollar index is plumbing new depths. In this respect, buoyant demand for the euro which accounts for 57% in the US dollar index's breakdown is good news for buyers of XAU/USD. In the meantime, the single European currency is flexing muscles inspired by the green shoots of recovery in the EU economy and a massive EU-backed rescue fund. The strong euro props up other Forex assets and commodities.

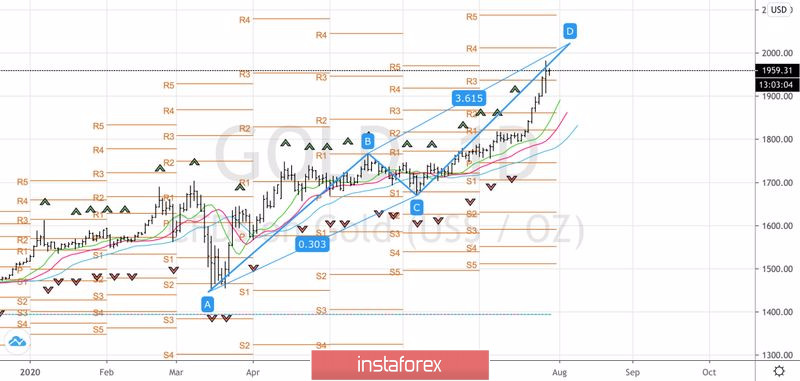

Having hit the target of $1,920 predicted earlier, gold is technically ready to reach the target of 361.8% fibo correction according to the pattern AB=CD which is located next to $2,025 per ounce. So, a good trading idea would be to buy on dips towards $1,920-1,925 and towards $1,890.

Daily chart of gold