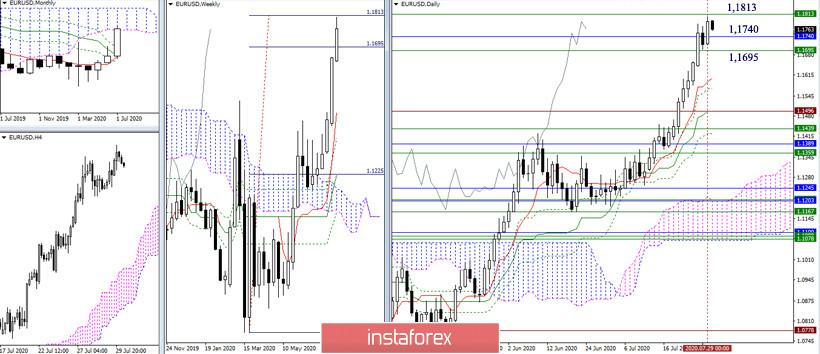

EUR / USD

The pair continues to work in the zone of attraction and influence of the met targets - 1.1695 - 1.1740 - 1.1813 (weekly target for the breakdown of the Ichimoku cloud + the lower border of the monthly cloud). The result of interaction will affect the further development of the movement and open up new prospects for the winner. The main interest of the players for the rise, in case of breaking through the resistance, will be directed to the rise to the upper border of the monthly cloud (1.2166). When a full-fledged rebound from the resistances encountered is formed, the players on a declinel will strive to execute an effective correction to begin with. The initial reference points in this direction will be the support levels of the daily cross (1.1604 Tenkan + 1.1496 Kijun), and then the pair will face the weekly levels (Tenkan 1.1453 + Fibo Kijun 1.1359) strengthened by the monthly Fibo Kijun (1.1389).

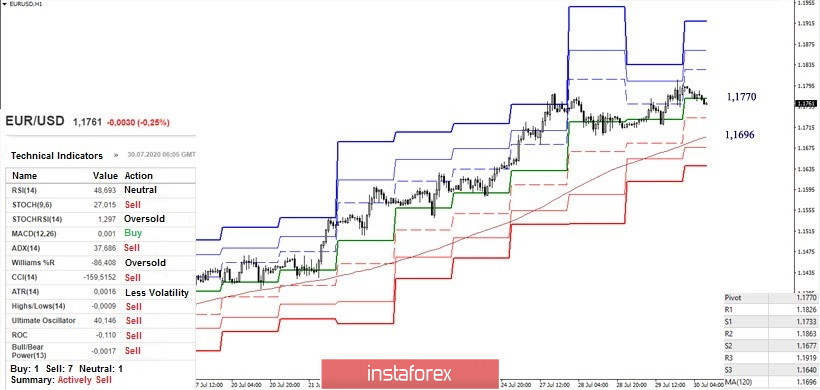

In the lower halves, the initial corrective declines are limited by the support of the central pivot level, so that the change of preferences is not observed for a long time. The advantages remain on the side of the players for promotion. At the moment, the pair is working in the correction zone again, testing the support of the central pivot level of the day (1.1770). The breakdown of the level makes the main downward reference point for the weekly long-term trend (1.1696), nearest support can be noted at 1.1733 (S1) today. Anchoring below (1.1696) can make changes in the current balance of forces on H1. In case of the next completion of the downward correction and with the continuation of the rise, the reference points within the day will be the classic pivot levels 1.1826 (R1) - 1.1863 (R2) - 1.1919 (R3).

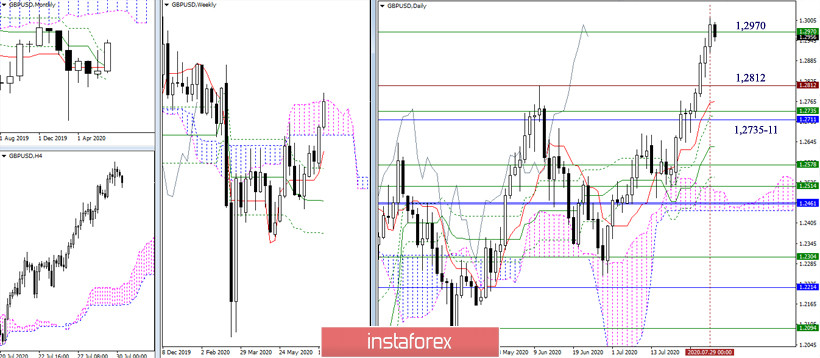

GBP / USD

The pound performed a rise to the upper limit of the weekly cloud (1.2970). This resistance is quite strong and determines a lot. A breakout of the cloud and a reliable anchor in the bullish zone relative to the cloud will open new horizons for players to increase and form new upward goals. The formation of the rebound will limit the current achievements of players to increase, returning the relevance of the support, the location of which currently allows you to perform a sufficiently effective reduction. The nearest supports for the higher halves are at 1.2812 (historical extremum) and 1.2711-35 (daily Tenkan + monthly Fibo Kijun + weekly Senkou Span B).

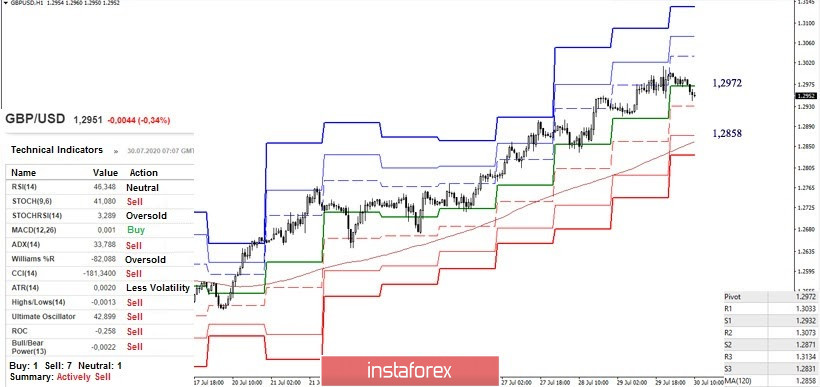

The advantage on H1 belongs to the players to increase. On the lower ones, they have been limiting the correction depth to the central Pivot level or S1 support for a long time. At the current moment, the development of another downward correction is observed. The bears managed to move below the central pivot level (1.2973), the next support is at 1.2932 (S1). But what's more significant is the support of the weekly long-term trend (1.2858), breaking through the level can affect the current balance of power. Since the central pivot level (1.2973) is strengthened by the resistance of the upper border of the weekly cloud (1.2970) today, it will be difficult for bullish traders to overcome the influence and attraction of the level and continue the rise. If this happens, despite the priority of bearish sentiment today, the next upward guidance within the day will be the classic Pivot levels R1 (1.3033) -R2 (1.3073) - R3 (1.3134).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)