Good day, dear traders!

Yesterday's Fed decision on rates coincided with market expectations. Let me remind you that at the end of its two-day meeting, the Federal Reserve decided not to change the parameters of its monetary policy and to keep the key rate in the range of 0.00% -0.25%. However, the future prospects of the world's leading economy were described as uncertain, due to the unpredictable consequences that the COVID-19 pandemic has caused and continues to cause to the American economy.

Against the background of its colleagues from the Federal Reserve, the Bank of Canada looks at the economic future of the country more positively. According to the overwhelming majority of economists, the Canadian Central Bank will refrain from further steps to ease its monetary policy. However, like all other leading world central banks, the Bank of Canada will take into account the negative consequences of the coronavirus epidemic and the extent of its impact on the economy of the Maple Leaf country.

If we turn to important macroeconomic statistics, tomorrow at 13:30 (London time), Canada will receive data on the country's GDP. Well, today the USD/CAD pair will be influenced by macroeconomic reports from the US. Let me remind you that at 13:30 London time, the United States will publish data on initial applications for unemployment benefits and, more importantly, statistics on the country's GDP for the second quarter. The forecast is disappointing, with the US economy expected to contract by 34.1% in the second quarter. Disastrously strong fall of the world's leading economy! However, for final conclusions, of course, it is necessary to wait for the actual figures.

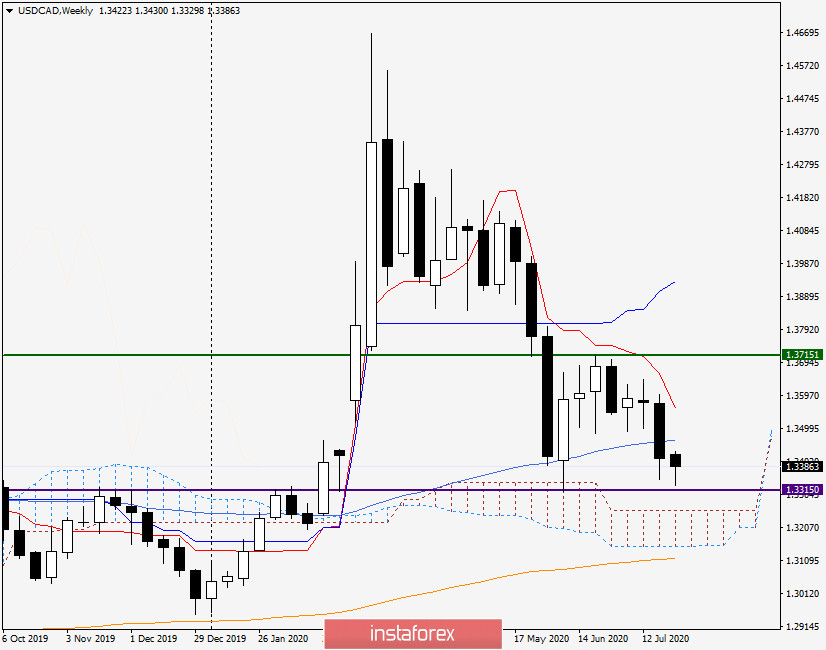

We are moving to the technical part of the analysis of the USD/CAD currency pair and for completeness, we will start with a weekly scale.

Weekly

As you can see, the pair is under selling pressure for the second week in a row. However, given the upcoming US and Canadian GDP reports, much may change. At the moment, the pair is trading in close proximity to the lower limit of the 1.3715-1.3315 range. If at the end of the week the strong technical level of 1.3315, which currently serves as a support, is broken and the week ends under this mark, further bearish prospects for the instrument will significantly increase.

To control the pair, bulls need to return a quote above 50 of the simple moving average, then break through the Tenkan line of the Ichimoku indicator, and then bring the price up from the designated range by breaking the 1.3715 level. The task, to put it mildly, is not easy, especially given the vague economic forecasts of the Fed and the pressure under which the US currency has been for several weeks.

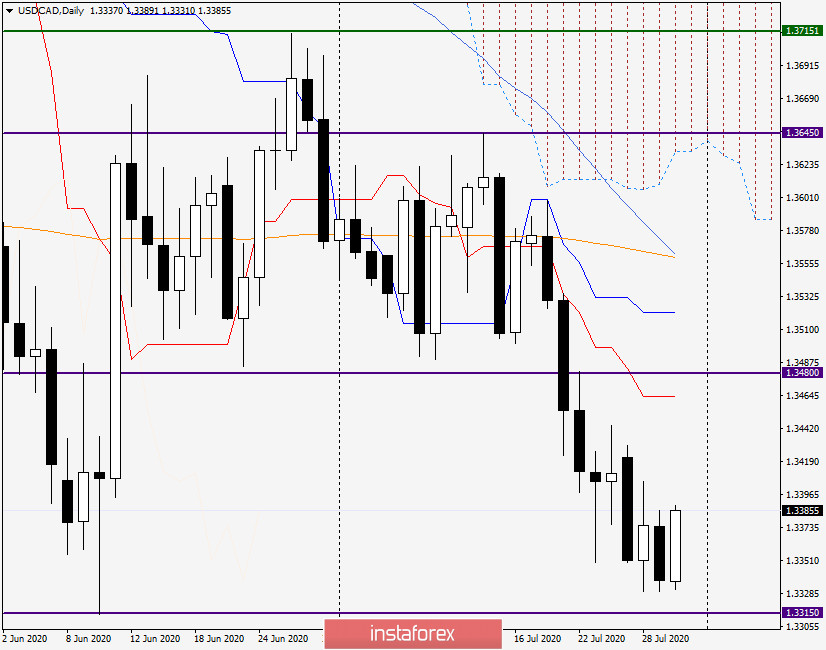

Daily

After yesterday's decline in today's trading, at the moment of writing, the USD/CAD currency pair shows strengthening and is trading near the strong technical level of 1.3380. If the USD/CAD bulls can continue to lift the exchange rate and raise the price above 1.3400, the pair will head to a strong price resistance zone of 1.3465-1.3480. As you can see, here is the Tenkan line of the Ichimoku indicator and the resistance of sellers at 1.3480. Given that the significant psychological and technical level of 1.3500 is slightly higher, the price zone of 1.3465-1.3500 seems quite interesting and promising for opening short positions on USD/CAD.

Lower prices for immediate and aggressive sales should be looked for in the price zone of 1.3400-1.3420. The current growth of the pair seems to be no more than an adjustment to the previous decline, so the main trading idea for USD/CAD is sales from the designated price zones.

Good luck!