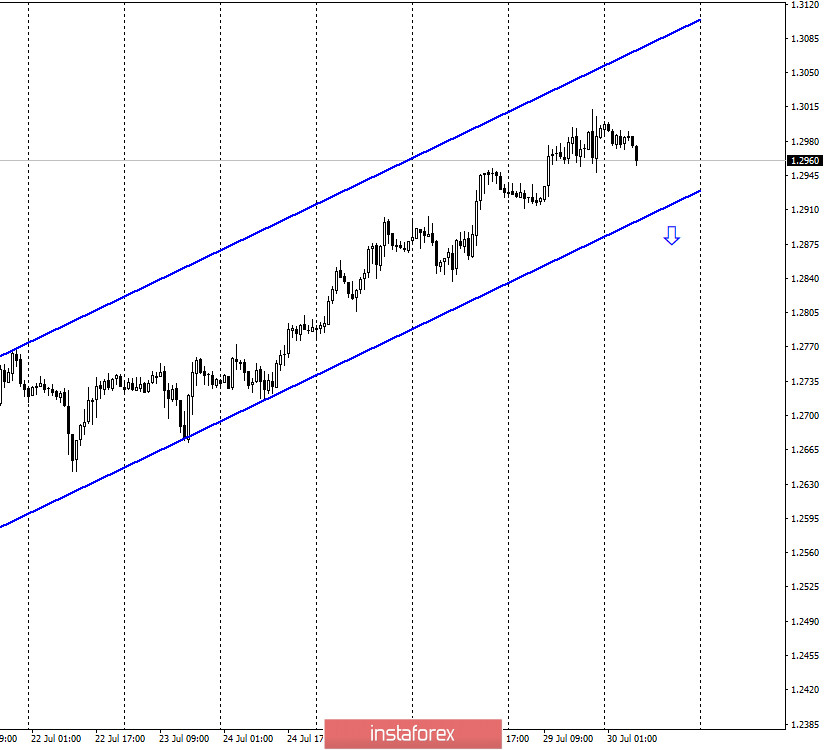

GBP/USD – 1H.

Hello, traders! On the hourly chart, the quotes of the GBP/USD pair continue the growth process exactly inside the ascending trend corridor. Thus, the "bullish" mood of traders is completely preserved. Before closing quotes under the trend corridor, I do not recommend opening sales of the pair. The events of last night could cause a stronger reaction from traders. Still, if the results of the meeting were not very interesting, since the Fed did not change anything in its policy, then the press conference with Jerome Powell was very productive. Unfortunately, Powell was again quite pessimistic. According to him, due to some sectors of the economy that have suffered the most from the crisis, the entire economy of the country is facing a strong slowdown in inflation, which may even turn into deflation in the near future. The consumer price index has been heading towards zero in recent months and is well below the 2% target. The Fed Chairman also said that the recovery will be long and difficult in any case, but the regulator will use all available means to support the economy. In general, these words could cause a new fall in the US currency. But this did not happen, so there are hopes for a small increase in the dollar.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair closed above the Fibo level of 127.2% (1.2964). However, the formation of a bearish divergence in the CCI indicator allows traders to count on a reversal in favor of the US currency and a slight drop in quotes in the direction of the corrective level of 100.0% (1.2812). Nevertheless, the upward trend corridor keeps the mood of traders "bullish", but a small correction of the British dollar does not contradict this. Closing the pair's exchange rate above the last divergence peak will increase the chances of resuming growth in the direction of the corrective level of 161.8% (1.3157).

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 76.4% (1.2776). Thus, the growth process can be continued towards the next corrective level of 100.0% (1.3199). However, the lower charts indicate a correction at this time.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines. It is in this direction that the pair's quotes continue to move in recent weeks.

Overview of fundamentals:

On Wednesday, there were no important reports released in the UK, while in America there was a summing up of the Fed meeting and a press conference with Jerome Powell.

News calendar for the US and UK:

US - change in GDP for the quarter (12:30 GMT).

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On July 30, the news calendar of the UK is still empty. In America, the most important report on GDP for the second quarter will be released today.

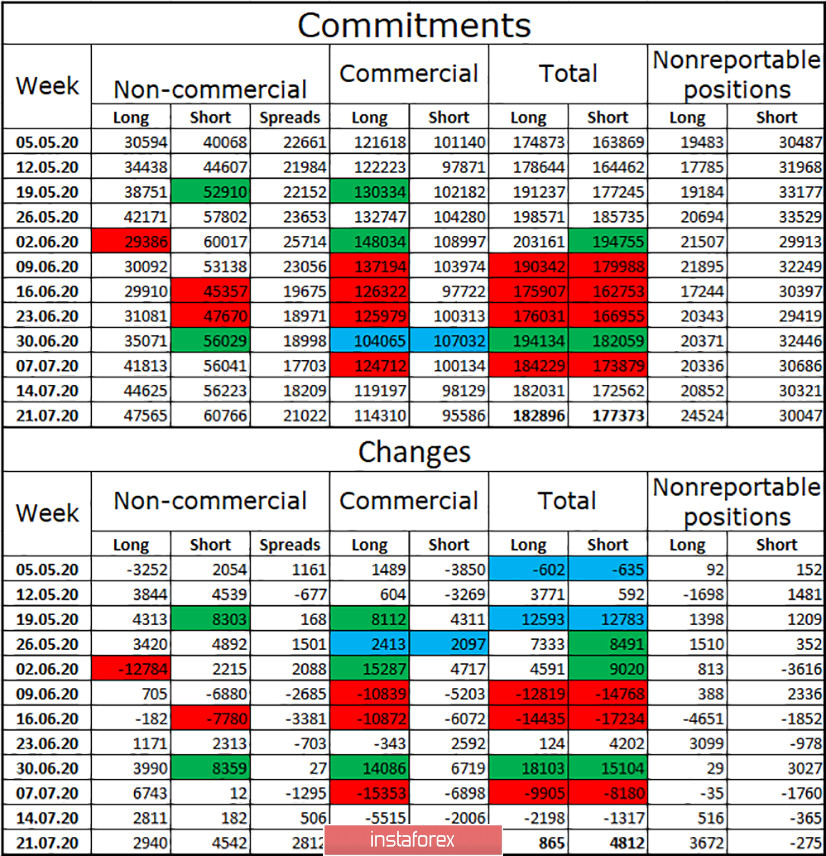

COT (Commitments of Traders) report:

The latest COT report on the pound was just as uninteresting as the previous one. However, despite the weak changes in the mood of major market players, the British pound continues to grow quite steadily. Although in the reporting week, speculators (the "Non-commercial" group) no longer opened long contracts, as a week earlier, but short ones. More precisely, it opened both groups of contracts, but short - much more by 1.5 thousand. But the "Commercial" group did not open a single new contract, getting rid of almost 5 thousand long and 2.5 thousand short. In general, almost 5 thousand shorts were opened and a small number of longs. Therefore, in some ways, the data in the COT report does not correspond to what is happening in the foreign exchange market. Hence the conclusion about a possible change in the mood of traders to "bearish" in the near future.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goals of 1.2812 and 1.2679, if the closing is performed under the trend corridor on the hourly chart. Although the bearish divergence on the 4-hour chart also allows you to sell the pair. I recommend buying the British currency again if the quotes close above the last peak of the bearish divergence with the goal of 1.3157.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.