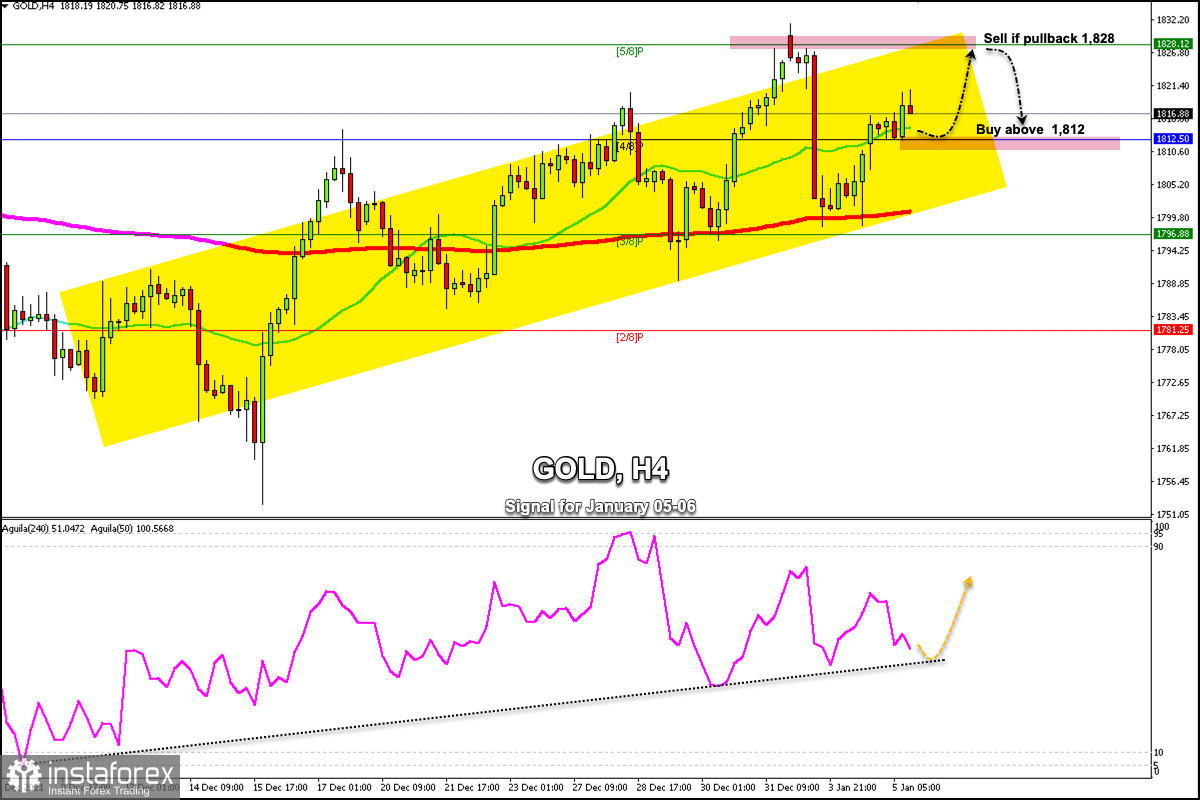

Gold is trading above the 21 SMA and above the 4/8 Murray in anticipation of US ADP data to be released in a few hours. As long as gold remains above this zone, the bullish force is likely to continue to the resistance of 5/8 Murray around 1,828.

US lawmakers began talks about another round of stimulus provided for businesses as relief from COVID-19, according to Reuters.

This relief measure could have a negative impact on Wall Street. On the contrary, gold could benefit from this downward correction, giving investors the possibility of taking refuge in view of the risk aversion.

On the other hand, the Fed minutes, together with the labor market figures, may exert changes in the expectations of monetary policy of the central bank, consequently gold may be affected.

According to the 4-hour chart, it can be seen that since December 9, gold is in an uptrend. Strong resistance is expected at 5/8 Murray around 1,828.

The eagle indicator remains oscillating above the uptrend channel. It is likely that it is now giving a correction signal. However, it could resume its upward movement when volume and market volatility increase in the American session.

Our trading plan is to buy above the 21 SMA around 1,814 with targets at 1,820 and 1,828. On the contrary, a pullback could happen towards 1,828. If the metal fails to beat this level, we may have an opportunity to sell.

Support and Resistance Levels for January 05 - 06, 2022

Resistance (3) 1,838

Resistance (2) 1,828

Resistance (1) 1,821

----------------------------

Support (1) 1,813

Support (2) 1,803

Support (3) 1,796

***********************************************************

Scenario

Timeframe 4-hours

Recommendation: Buy above

Entry Point 1,812

Take Profit 1,820, 1,828 (5/8)

Stop Loss 44,200

Murray Levels 1812 (4/8), 1828 (5/8), 1,846 (6/8)

***********************************************************

Alternative scenario

Recommendation: Sell if pullback

Entry Point 1,828

Take Profit 1,820, 1812

Stop Loss 1,835

Murray Levels 1,812 (4/8) 1,796 (3/8)

*********************************************************