The USD/CAD pair is trading in the red at the 1.2702 level at the time of writing. The bias remains bearish as the Dollar Index has reached new lows today. As long as the DXY drops, the greenback could depreciate versus its rivals.

Technically, the pair continues to stay below a downtrend line, so we cannot talk about an upwards movement at this moment. Surprisingly or not, the USD depreciated in the last hours even if the ADP Non-Farm Employment Change was reported at 807K in December versus 405K expected. On the other hand, the Canadian Building Permits and the NHPI came in better than expected.

The FOMC Meeting Minutes could change the sentiment later. Maybe the USD drops a little ahead of this high-impact event only because the report could be bullish for the USD. The DXY maintains a bullish bias despite its current sell-off.

USD/CAD Downtrend Still Intact!

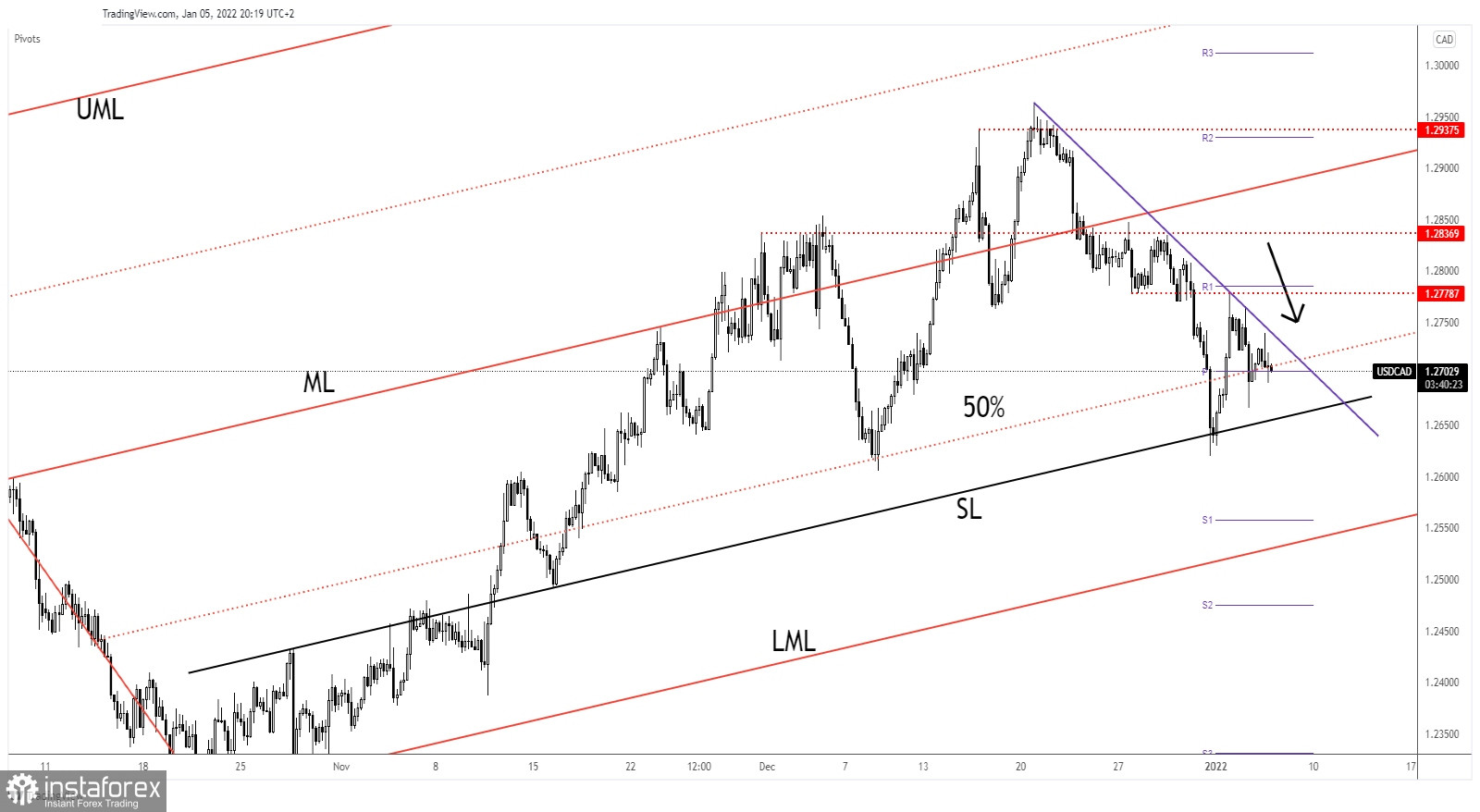

USD/CAD tested and retested the downtrend line confirming it as a dynamic resistance. Now, it challenges the weekly pivot point of 1.2702 and the downside 50% Fibonacci line of the ascending pitchfork.As long as it stays under the downtrend line, USD/CAD could come back towards the inside sliding line (SL). Only a valid breakout above the downtrend line could signal that the downside movement is over.

USD/CAD Prediction!

The bias is bearish, so further drop is in cards. Still, don't forget that the FOMC Minutes could change the sentiment. DXY's rally could push USD/CAD above the downtrend line. As you can see on the H4 chart, the pair failed to come back down towards the 1.2620 low in the previous attempt announcing that the sellers could be exhausted.

Only a valid breakout above the downtrend line could bring new buying opportunities and could announce a new leg higher.