Hello, dear colleagues!

At yesterday's trading, the main currency pair of the Forex market continued to demonstrate an upward trend. This time, the bullish scenario of the July 30 session can be attributed to a crushing drop in US GDP in the second quarter. The unfortunate COVID-19 pandemic, whose main focus was in the United States of America, is to blame for everything. So the head of the Federal Reserve, Jerome Powell, was right, who at his last press conference this Wednesday attributed all the difficulties of the US economic recovery to the influence of the coronavirus. It turned out that this was not a postscript or even a fraud. The COVID-19 pandemic really took a major toll on the world's leading economy in the second quarter.

Nevertheless, the real figures for the fall in US GDP were better than the forecasts of economists, which were reduced to minus 34.1%. In fact, the world's leading economy collapsed by only 32.9% in the second quarter. Since the statistics began, this is the highest drop in GDP in the history of the United States. If we finish with the topic of GDP, the figures could have been even worse if not for the large-scale stimulus program, which amounts to about three billion dollars.

However, it should be noted here that this data is for April-June, that is, for those months when the epidemic was particularly rampant. Although, everything is relative. After several days of stabilization and a slight decrease in the daily increase in infected and dead people, the outbreak of the pandemic reignited in Texas, California, and Florida. The result is sad and tragic. As of last night, the daily number of infected people in the United States again exceeded 70,000, and the number of deaths was 1,500.

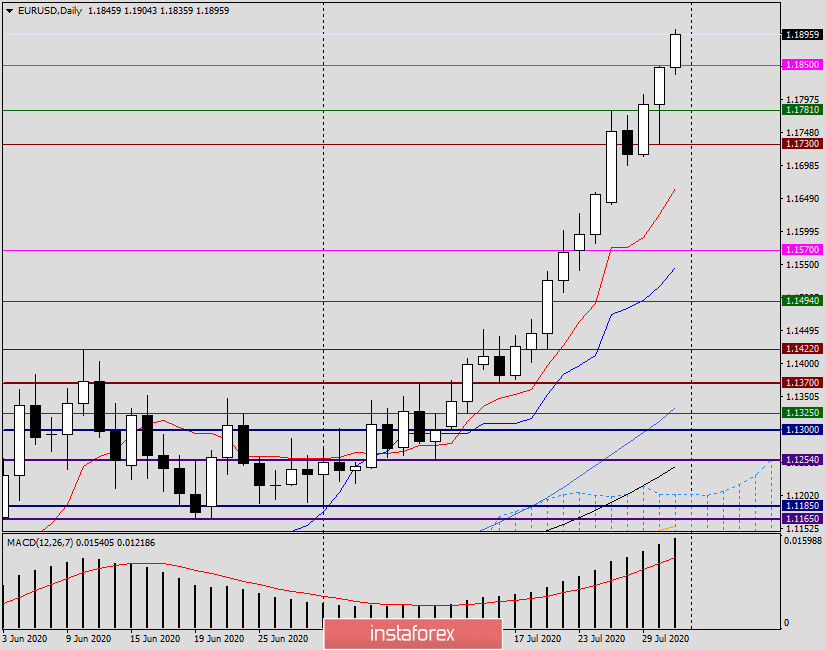

Daily

Despite the fact that the final data on US GDP were better than the forecast value, this did not save the US currency from another round of decline. As a result of yesterday's growth, the EUR/USD currency pair finished trading at 1.1846, which is much higher than the significant technical level of 1.1800, as well as another strong mark of 1.1830. The quote continues to actively move in the north direction, and it seems that at the moment, such dynamics are unlikely to be hindered by anything. The upward trend of the euro/dollar is strong.

Now about today's prospects for price movement. Let me remind you that today is the so-called "triple closing" - day, week, month. In my opinion, this is not the best time to open new positions. The pair can either continue to grow and end the July and weekly trading on a major note. Another option may be a corrective pullback, which will occur against the background of profit taking.

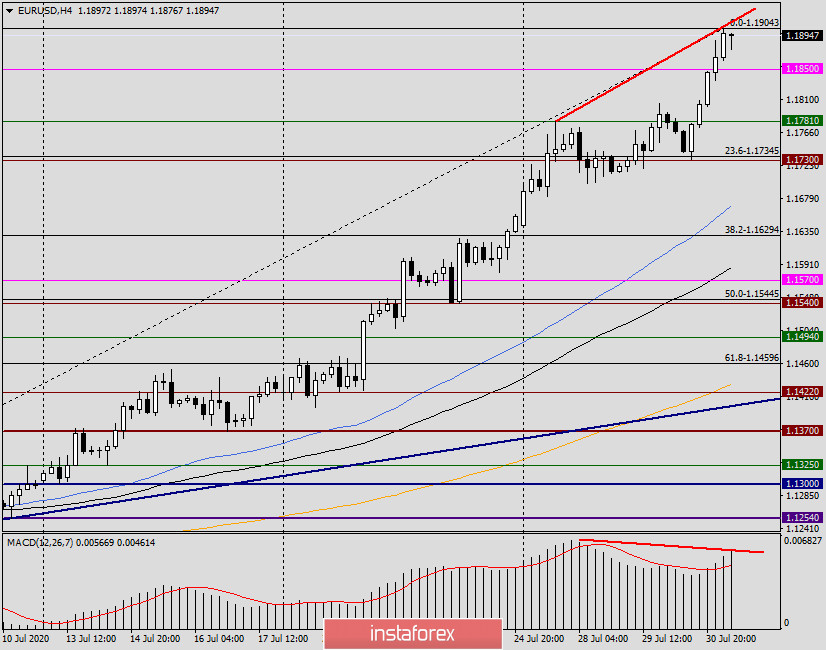

H4

As can be clearly seen on the four-hour chart, today the rise of the quote continues and has already tested another fairly important mark of 1.1900 for strength, which has so far resisted and became the culprit of a slight pullback in the price. There is almost no doubt that the euro bulls will try to test this significant level again today. Closing the month, week and day above 1.1900 will only emphasize the strength of bullish sentiment on the main currency pair and open the way to the landmark psychological level of 1.1000. If this level goes up, the next resistance of sellers is expected in the price zone of 1.2030-1.2070.

Bearish divergence on H4 may repeat the recent fate of the day and hour divers, which were broken, after which the growth continued with renewed vigor. At least that's what it's all about. The market is steadily moving up, not noticing any obstacles in its path.

Now for trading recommendations. If someone intends to open deals today, it is better to do it after minor corrective pullbacks down, and with small goals, so as not to transfer positions to Monday. Naturally, we are talking about purchases of EUR/USD, which should be considered after short-term declines in the price zone of 1.1870-1.1855.

On Monday, we will analyze the monthly timeframe and discuss trading recommendations based on the closing of the month and week.

Good luck!