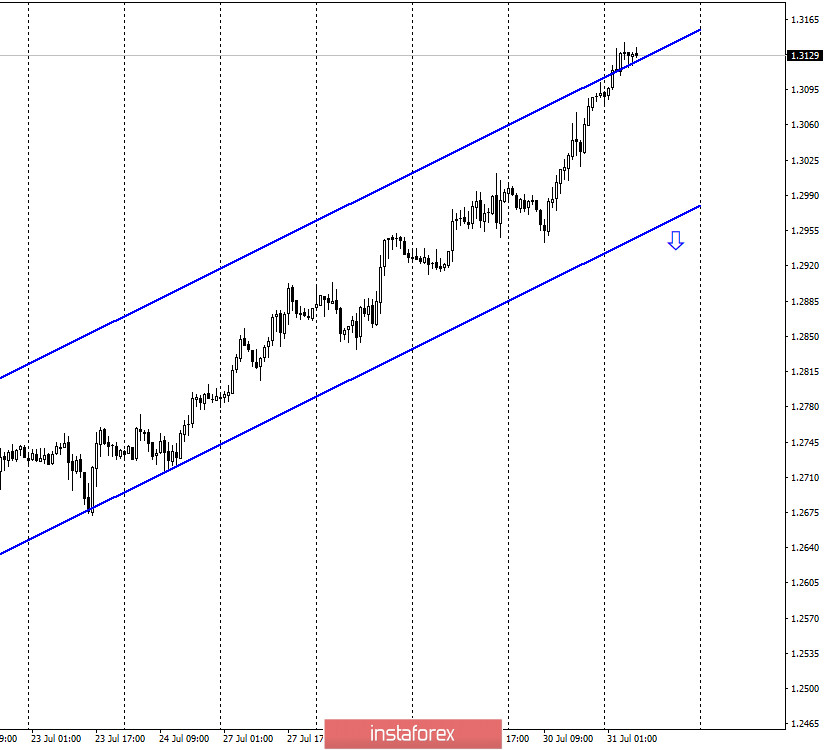

GBP/USD – 1H.

Hello, traders! On the hourly chart, the quotes of the GBP/USD pair continue the growth process, which has even accelerated somewhat in recent days. So now trading is taking place near the upper limit of the upward trend corridor, which still characterizes the current mood of traders as "bullish". Given that there is still no news from the UK and no economic reports are published there, traders are forced to trade based only on the information background from America. If earlier traders had enough information about the coronavirus epidemic, mass riots, and political turmoil in the United States to actively sell the dollar, now this news stream has been supplemented by the passive position of the Federal Reserve, as well as economic data on the state of the American economy. Thus, traders can only choose on the basis of which factor to sell the US dollar today. Well, there are no factors that could support the US dollar right now. We can only assume that a new pullback will start sooner or later for the pair, since no movement is possible without pullbacks at all. First of all, the pair's quotes will try to fall to the lower border of the ascending corridor.

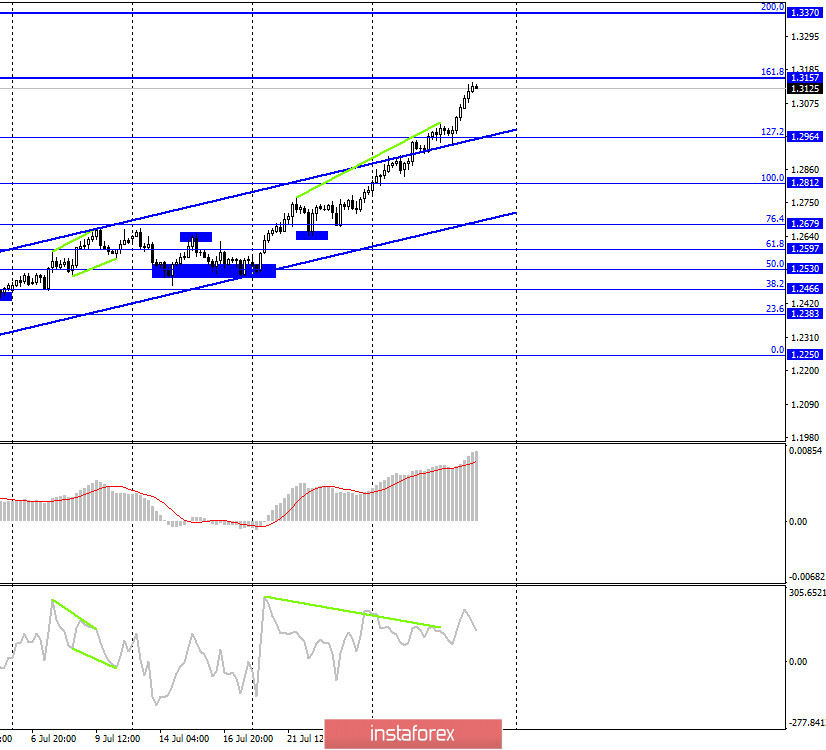

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair closed above the Fibo level of 127.2% (1.2964) and continues the growth process in the direction of the corrective level of 161.8% (1.3157), which it has almost reached. The bearish divergence of the CCI indicator could not stop the strong growth of the pair, its peak was overcome, which served as a signal for new purchases. The pair's rebound from the level of 161.8% will work in favor of the US currency and begin to fall in the direction of the corrective level of 127.2% (1.2964). Fixing quotes above the Fibo level of 161.8% will increase the chances of further growth in the direction of the corrective level of 200.0% (1.3370).

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 76.4% (1.2776). Thus, the growth process continues in the direction of the next corrective level of 100.0% (1.3199), the rebound from which will work in favor of the beginning of a fall in quotes.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. After that, the pair's quotes have already reached the first downward trend line and now they will try to rebound from it or fix it above it, depending on what it is, either start a fall or continue the growth process.

Overview of fundamentals:

On Thursday, the UK again did not release important reports. In America, there were several reports, however, the most important report on GDP in the second quarter was enough. It turned out that GDP fell by 32.9%, which predetermined the fate of the dollar in the afternoon.

News calendar for the US and UK:

US - change in the level of income and expenditure of the population (12:30 GMT).

US - consumer sentiment index from the University of Michigan (14:00 GMT).

On July 31, the UK news calendar is still empty. In America today, only secondary data will be released, which is unlikely to interest traders seriously.

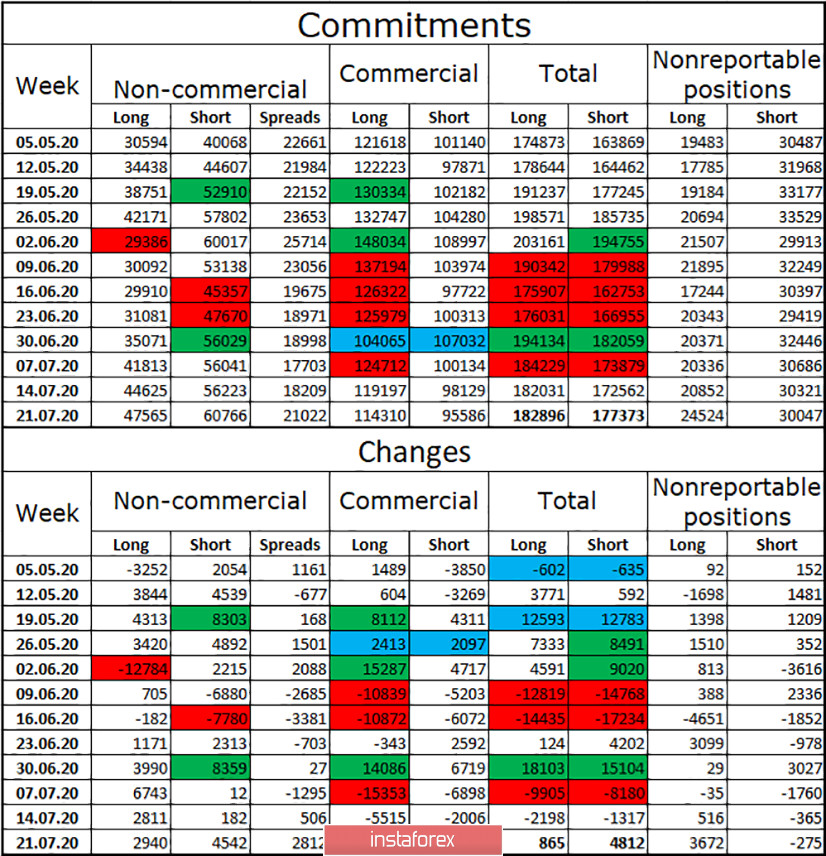

COT (Commitments of Traders) report:

The latest COT report on the pound was just as uninteresting as the previous one. However, despite the weak changes in the mood of major market players, the British pound continues to grow quite steadily. Although in the reporting week, speculators (the "Non-commercial" group) no longer opened long contracts, as a week earlier, but short ones. More precisely, it opened both groups of contracts, but short - much more by 1.5 thousand. But the "Commercial" group did not open a single new contract, getting rid of almost 5 thousand long and 2.5 thousand short. In general, almost 5 thousand shorts were opened and a small number of longs. Therefore, in some ways, the data in the COT report does not correspond to what is happening in the foreign exchange market. Hence the conclusion about a possible change in the mood of traders to "bearish" in the near future.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goal of 1.2812, if the closing is performed under the trend corridor on the hourly chart. I recommend buying the British currency again if the quotes close above the level of 1.3157 with the goals of 1.3200 - 1.3250.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.