At the end of July, the US dollar lost noticeably against the main currencies, although it had already declined for two months before that against the basket of major currencies. The ICE dollar index also fell to its lowest level in September 2018 and is likely to continue its decline.

Earlier, during the outbreak of the coronavirus pandemic in the world, the dollar received support due to the demand for the US currency as a safe haven currency, as well as for gold, the Japanese yen, the Swiss franc and government bonds of economically strong countries of the world. Its increase was also stimulated by the most powerful sell-offs of risky assets in February and March of this year. But by the end of spring and summer, the situation had changed radically. However, in the hopes that COVID-19 vaccines will be invented by the fall, demand for company shares began to grow, of course, not for all, but only for those that were able to work actively during the period of self-isolation. This applies primarily to online retail, computer software manufacturers, entertainment, and the like.

The strongest blow for the dollar was the unprecedented measures taken by the US Treasury and the Federal Reserve to support the economy and citizens.

Amid these events, the dollar began to lose its function as a safe-haven currency and was transformed into a funding currency. Something similar happened to it in 2009-11, when, after the crucial stage of the crisis, the American regulator began to implement quantitative easing measures to stimulate economic growth.

In addition, news about the early introduction of vaccines against COVID-19 into mass production became negative for the dollar. It is already clear that no matter how effective they are, more effective or less, this factor will become another event that will cause failure for a strong dollar. As before, we believe that the global weakening of the US currency will continue, which in fact is quite consistent with the desire of the American authorities and the government's financial bloc, as it will help a more efficient and faster recovery of the national economy. Against the background of the "weak" dollar, American goods will be more competitive in world markets, and this is exactly what the United States needs now.

This week, the market will focus on the publication of important production data from America, the decision on the monetary policy of the RBA and the Bank of England, as well as the values of employment in the US. First of all, investors will closely follow the American statistics, since its problems are too noticeably reflected in the dynamics of world markets in general and in the currency market in particular.

Forecast of the day:

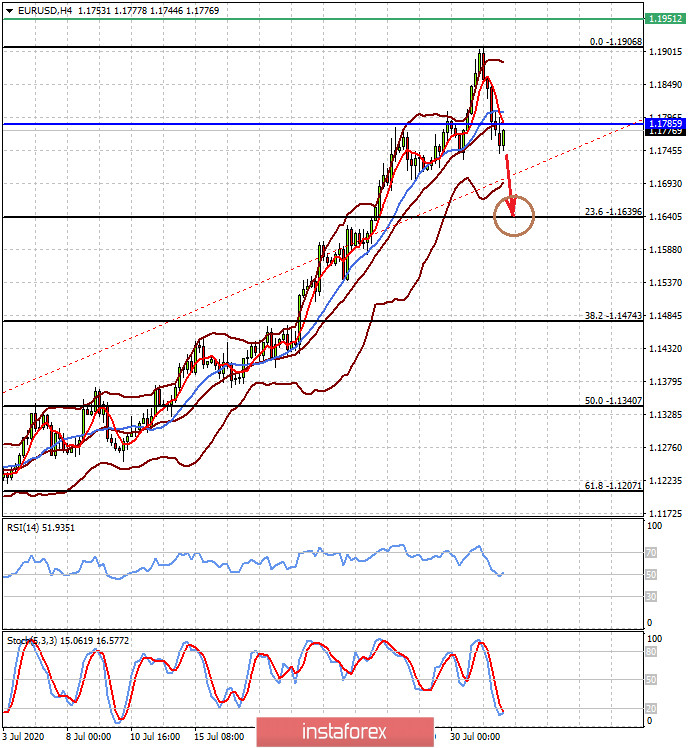

The EUR/USD pair is trading below 1.1785. It may continue to correct down 23% Fibonacci to 1.1640 if it does not rise above this level. Growth limiting factor may be the expectation of important data on employment in America, which will be published this week. At the same time, the price increase above the level of 1.1785 will stimulate local growth to 1.1950.

The AUD/USD pair found support amid strong data on the Chinese economy, which showed a rise in manufacturing business activity in July. If the pair holds above the level of 0.7180, its local growth to 0.7200 with the prospect of rising to 0.7260 should be expected.