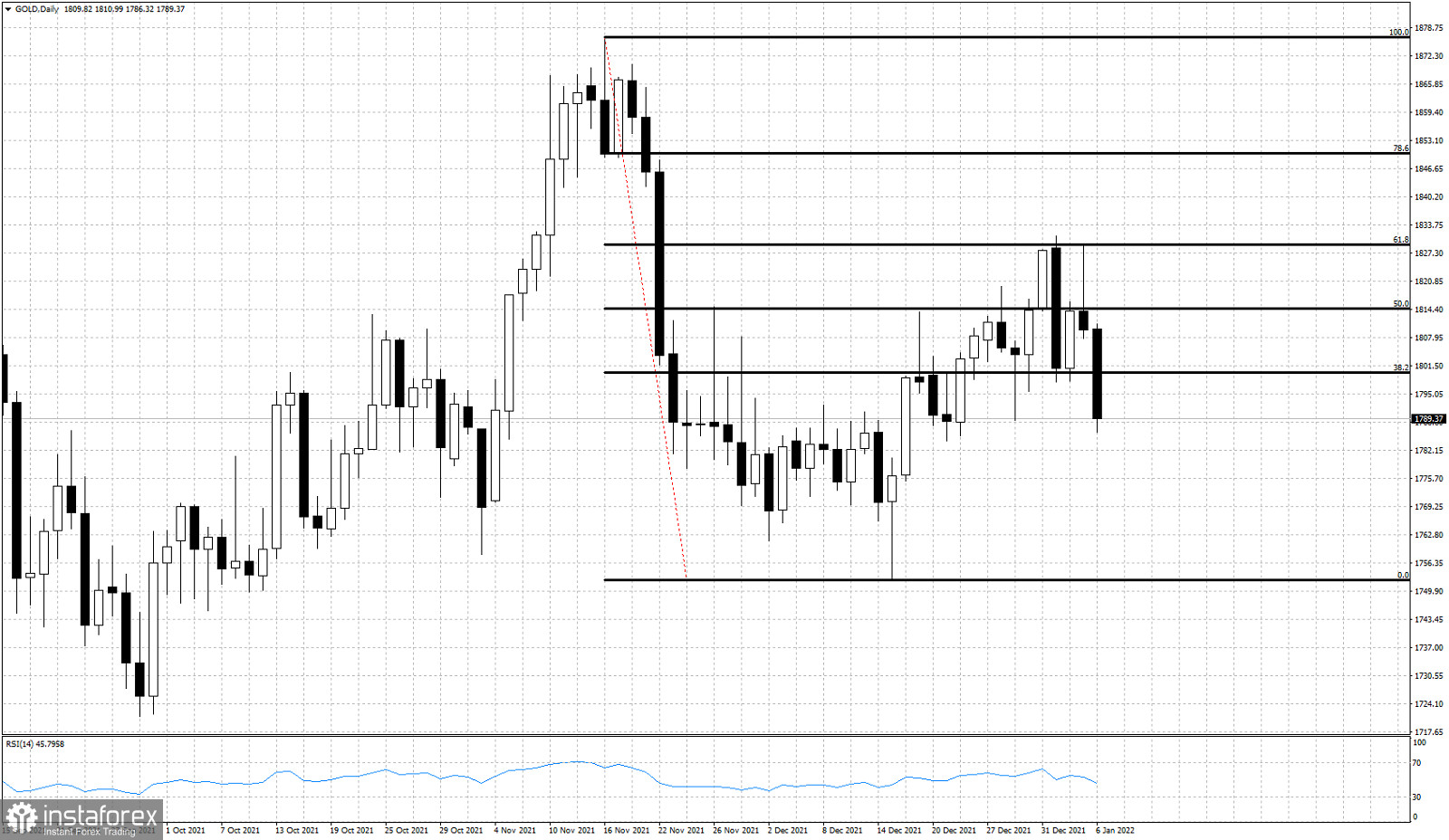

Yesterday we warned traders that the bearish candlestick formation combined with a rejection at $1,830 was a bearish sign and that would turn us neutral if not bearish Gold. We also made a note that a break below $1,797 would be an added bearish signal. Gold is under pressure and price is now at $1,790.

Gold price got rejected twice at the 61.8% retracement level. This was a bearish signal as we mentioned in previous posts and with price now breaking below $1,797 we got another sell signal. Gold price is vulnerable to break below $1,752. If this happens we expect to see a decline at least towards $1,700. Next short-term support is at $1,780. Bulls need to step in and push price above $1,830 in order to reclaim control of the short-term trend.