The macroeconomic reports released last Friday failed to support the European currency, as a result of which, the euro lost by more than 130 points against the US dollar. However, such a huge downward correction does not pose a real threat to the bull market yet, which began in the middle of last month.

The contraction of the French economy in the 2nd quarter was not a surprise since from March to early May, quarantine restrictions were still present in the country. The report published last Friday indicated that the economy shrank 13.8% in the second quarter, while economists had expected GDP to contract 15.4%. Compared to the second quarter of last year, the economy dropped by 19%.

As for inflation, the report released last Friday said that CPI in France rose 0.4% in July and 0.8% year-on-year, while economists forecasted a decline of 0.1% and an increase of 0.2%, respectively. Such data is very encouraging for the central bank, since on the one hand, there are no deflationary expectations, and on the other, zero interest rates have not led to a sharp inflationary jump, which allows the preservation of the current monetary policy, thereby supporting the economy. The CPI, harmonized by EU standards, jumped by 0.9% per annum in July against 0.2% in June.

With regards to consumer spending, a sharp recovery in June was another positive news for the economy. According to the data, consumer spending in France jumped by 9.0% in June and 1.3% y / y, while economists predicted growth of 6.5% m / m and a fall of 2.3% y / y. This suggests that the economy is on a good track of recovery.

Italy also recorded a sharp contraction in GDP in the second quarter, coming out at 12.4% against the previous quarter. Such immediately threw the economy back to its state in the early 1990s, with which poor recovery of activity remains the main problem. It seems that it will take at least several years for the economy to return to pre-crisis levels, as economists forecast GDP to contract further by 13.0%. Compared to the same period of last year, GDP in the 2nd quarter decreased by 17.3%.

But despite such a gloomy GDP, it is encouraging that retail sales in Italy, like in other eurozone countries, have been growing for about two months now. Recent data reveals that the retail sales index rose by 12.1% in June, in which most of the growth came from non-food products, sales of which jumped 24.4%. However, compared to the same period of last year, retail sales fell 2.2%.

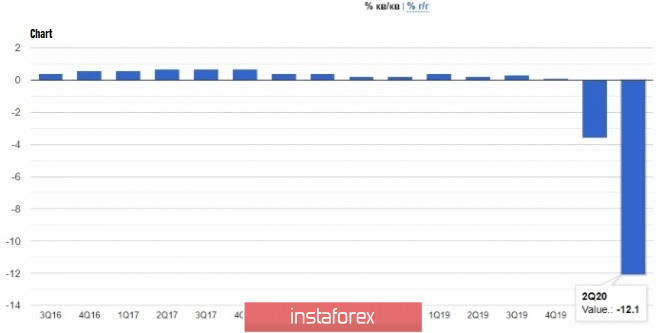

Thus, the overall state of the eurozone economy in the 2nd quarter declined by 12.1% as compared to the previous quarter, but, as said above, such fact was ignored since it is clear that GDP dropped because of the quarantine and social distancing measures that had to be implemented during the coronavirus pandemic. Economists already expected a 11.3% drop in GDP for the second quarter, in which countries in Southern Europe were the most affected. For example, GDP in Germany fell 10.1% in the second quarter, while GDP in Spain contracted 18.5%.

Unfortunately, inflation, which accelerated in the eurozone in July, cannot be ignored, and is a good signal for the European Central Bank. According to official data, the CPI of the eurozone rose 0.4% in July compared to the same month last year, after rising 0.3% in June. The increase was mainly due to a surge in energy prices, while core annual inflation, which does not take into account volatile prices, rose to 1.2% y / y from 0.8% in June. Economists expected core inflation to remain at 0.8% in July.

As for the United States, data that were released on Friday were very positive, so demand for the US dollar rose, increasing the position of the currency in the market. One of the reports was the rise of consumer spending in the US, which jumped by 5.2% in June and created a fairly solid basis for economic recovery in the third quarter of this year.

Data on business activity in Chicago also showed a recovery to its pre-crisis level, as the report indicated that PMI rose from 36.6 points in June to 51.9 points in July, while economists predicted the barometer to be 43.6 points.

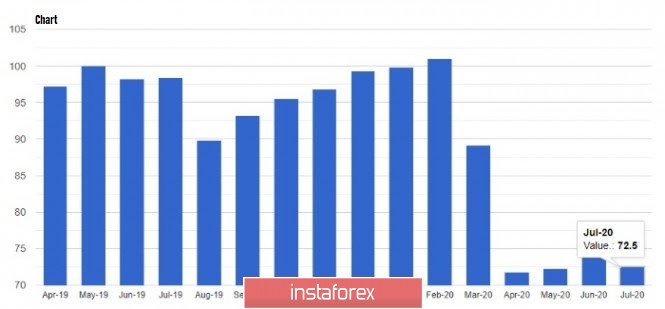

Unfortunately, consumer sentiment in the country fell in July, mainly due to the surge of COVID-19 infections, which raised the fear of Americans. According to the report published by the University of Michigan, the final consumer sentiment index came out 72.5 points in July, while economists expected the index to be 72.7.

Thus, for the technical picture of the EUR / USD pair, the movement of the quote will depend on the resistance level of 1.1780, a breakout of which will raise the pair to the level of 1.1850 in the trading chart. Such will lead to either the formation of a new upper limit of the downward channel by the bears, or a renewal of highs in the area of 1.1910 and 1.1985. However, an unsuccessful attempt to reach the level of 1.1780 will lead to a new wave of decline in risky assets, which will return the quotes to the large support levels at 1.1700 and 1.1640.