EUR/USD – 1H.

Hello, traders! On July 31, the EUR/USD pair performed a reversal in favor of the US currency and began the process of falling in the direction of the first upward trend line. There is also a second upward trend line, however, it is located far away and it is not visible on the chart. Thus, at the moment, the potential for a fall in the pair's quotes is limited to the level of 1.1685. The mood of traders, thanks to the trend lines, is still characterized as "bullish". Following the US GDP on Friday, the EU GDP also came out, which was also very far from the characteristic "optimistic" or at least "hopeful". -12.1% - this is the value in the second quarter. Of course, this value cannot be compared with the fall of the American economy, but, nevertheless, -12% can also not be called a weak fall. Thus, traders on Friday began to get rid of the euro currency. The inflation report had no effect, although it was slightly better than traders' expectations. In general, Friday's news was enough to start the fall. But will the pair be able to close under the trend line? Let me remind you that the situation with the epidemic in the United States remains very difficult and it is dragging other spheres of life and sectors of the economy down. Thus, it is still quite difficult for the US dollar to expect strong growth.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed a new reversal in favor of the US dollar after the formation of a new bearish divergence in the CCI indicator. As a result, the pair performed a fall to the corrective level of 127.2% (1.1729). The rebound of quotes from this Fibo level will allow traders to expect a reversal in favor of the euro currency and a resumption of growth in the direction of the corrective level of 161.8% (1.2024). Closing the pair's exchange rate at 127.2% will allow traders to expect a continuation of the fall in the direction of the next corrective level of 100.0% (1.1496).

EUR/USD – Daily.

On the daily chart, the EUR/USD pair performed a false breakout of the corrective level of 261.8% (1.1825). As a result, the rebound from this level was performed, which now allows us to count on a slight drop in quotes, and this is confirmed by the 4-hour chart.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation over the "narrowing triangle", which now allows us to count on further growth of the euro currency, which can be very strong and long-lasting. However, in the shorter term, the price is expected to fall, as indicated by smaller charts.

Overview of fundamentals:

On July 31, the EU released important reports on GDP and inflation. GDP in the second quarter decreased by 12.1% q/q and 15% y/y. The consumer price index rose in July to 0.4% y/y, while core inflation rose to 1.2% y/y. In America, the change in the level of income of Americans in June was -1.1%, and spending +5.6%. The University of Michigan consumer sentiment index declined again to 72.5. In general, I can say that the most important report of the day - EU GDP - had the final effect.

News calendar for the United States and the European Union:

EU - index of business activity in the manufacturing sector (08:00 GMT).

US - index of business activity in the manufacturing sector (13:45 GMT).

US - ISM manufacturing index (14:00 GMT).

On August 3, traders will be most interested in the ISM manufacturing index in the United States. The other reports will be secondary.

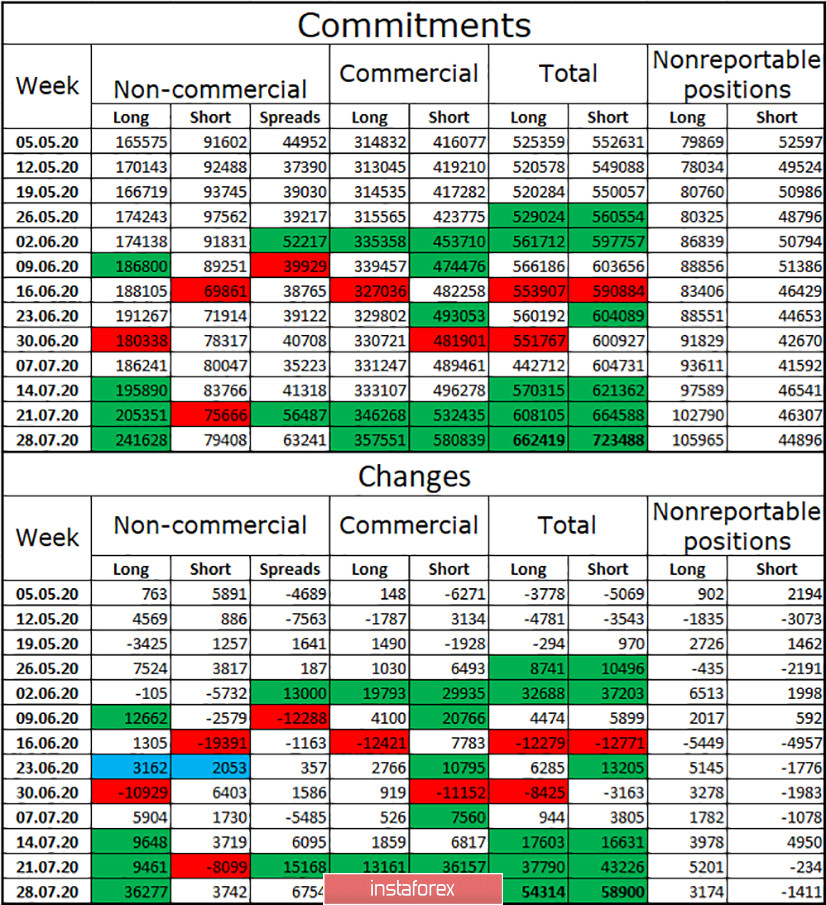

COT Commitments of Traders) report:

The latest COT report was extremely interesting. The Non-commercial group opened as many as 36,277 purchase contracts during the reporting week. This is a very high value. And it was it that formed the upward trend for the reporting period. Thus, this figure alone from the entire report was already enough to make a conclusion about the current mood of major traders in the European currency. The Commercial group also actively opened and closed contracts, however, data for this group is not important. In total, 241 thousand long-contracts and only 79 thousand short-contracts are now placed in the hands of speculators. Thus, the latest COT report does not yet give any reason to assume the end of the upward trend.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend continuing to buy the currency pair with the goal of 1.2024, if the rebound from the level of 1.1729 is completed. I recommend selling the pair with the target level of 1.1496 if the closing is made under the level of 1.1729, as well as under the ascending trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.