GBP/USD easily reached the target of 1.3 having set earlier. This move enabled traders to yield a decent profit. The currency pair closed July with the strongest monthly gain since May 2010 due to several factors. The US dollar logged the worst dynamic in nearly a decade. Investors revised their outlook on the British economy and monetary policy of the Bank of England. Nevertheless, not all analysts paint the rosy picture of the pound sterling. Experts at BofA Merrill Lynch point out that GBP/USD closed most frequently in the red in 4 out of 5 months in the period from August to December over past years.

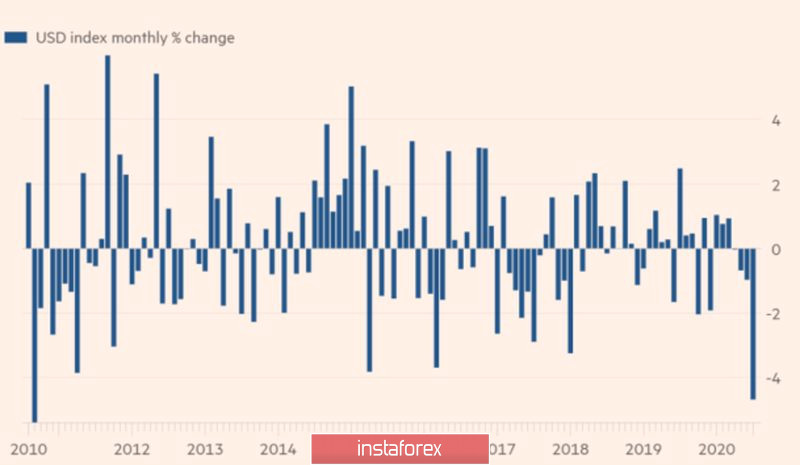

The bank's forecast rests on the pandemic background, weakness of the UK economy, Brexit, and expectations of QE expansion by the Bank of England. Experts at BofA Merrill Lynch predict a deep downward correction of GBP/USD until the end of 2020. Interestingly, the leading American bank has always been bearish about the sterling. In the meantime, its forecast is far from reality. Perhaps, their expectations will come true in the near future. From my viewpoint, if GBP/USD makes a retracement sooner or later, it is the US dollar to be responsible for that correction rather than the sterling.USD dynamic

Despite serious headwinds, the pound sterling is on a sound footing. The tabloid media reports that the Brexit talks are in the gridlock. However, the Financial Times says the odds are that the trade agreement with the EU authorities will be finalized this autumn. Brexit negotiator Michel Barnier made a roundup to EU commissioners behind the closed doors. Citing insider information, he stated that Boris Johnson is willing to regain his reputation. The UK Premier was wrong in his assessments of the COVID-19 rates and prospects. Another argument for the deal is that he is eager to repel the attacks from the Scottish nationalists.

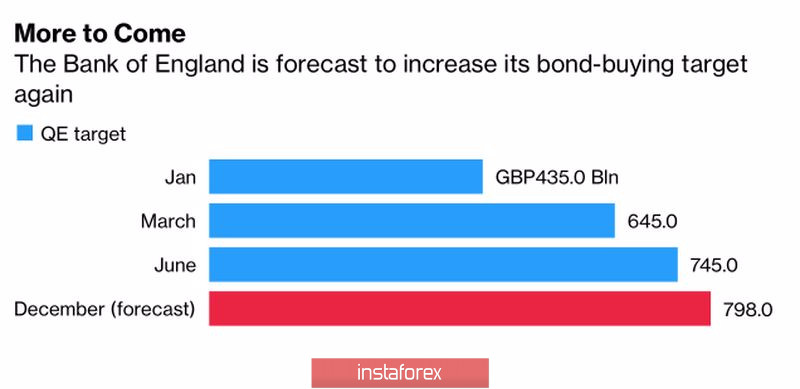

The spot and debt markets share the idea that the Bank of England will carry on with its QE program. Bloomberg foresees expansion of the QE program by £50 billion until the end of 2020. At the same time, upbeat PMIs and retail sales suggest that the British economy will be able to recover rapidly. Besides, investors are speculating that at a policy meeting on August 6 Andrew Bailey and his colleagues at the Monetary Policy Committee will not signal any intentions on cutting the repo rate. The Bank of England is expected to come up with optimistic assessment on the economic health.

Scale and outlook of Bank of England QE

When it comes to the US dollar, it looks heavily oversold at present. Investors are reacting to unsuccessful measures to contain coronavirus rates in the US. Another thing is that Congress has not passed the long-awaited bill on the new stimulus package. Last but not least, investors are fretted about uncertainty of the presidential elections. Importantly, it takes a long time for central banks to diversify their gold and forex reserves. Any positive macroeconomic data on the US economy will invite dollar bulls back to the market. One of the fresh upbeat data is a 5.6% gain in retail sales in June. The data surpassed expectations that encouraged investors to take profit from long deals on GBP/USD. So, the currency pair declined a bit.

To sum up, any trend is interrupted by a correction. According to this logic, the pound sterling is now making a downward correction that comes as no surprise. So, it makes sense to consider short positions on GBP/USD in the near term if support of 1.301 and 1.2985 is broken.

Daily chart of GBP/USD