The euro and the pound sterling went on losing ground against the US dollar despite the news about a record high number of confirmed coronavirus cases in July. It is possible that investors who were betting on a rise in the risky assets decided to take a pause after a rally that was logging since June. Even today's data on the eurozone industrial production failed to help buyers of risky assets.

At the same time, there is information that the US Fed may switch to a new stance. It may set the targeted inflation level at 2.0%. The previous strategy has been used for the last 30 years.

Even now, when the inflation rate is above 2.0%, the US Fed is likely to remain stick to low interest rates that will allow to pump more funds in the economy. In other words, during the economic recovery accompanied by a rise in prices, the regulator is likely to take a wait-and-see approach allowing the indicator to go above the average reading. The Fed explained its decision by a necessity to neutralize the previous weak reports on inflation. However, the regulator may face risk associated with low interest rates. In case of one more financial crisis and pandemic or other catastrophes, the Fed will not have an opportunity to change interest rates or stimulate the country's economy by means of interest rates. This will limit the regulator's instruments aimed at the economic support.

This weekend, US Democrats and Republicans failed to reach an agreement on a new package of measures to support the economy in the context of the coronavirus pandemic. This is bad for both ordinary citizens and stock market. Let me remind you that on August 31, the US government stopped paying $600 in a form of a weekly benefit to all those who sought help due to the coronavirus pandemic. The decision on further additional assistance to the unemployed was also not made.

Additional pressure on risky assets was exerted by a report prepared by Johns Hopkins University, which showed that in July, more than 1.9 million new cases of infections were recorded in the United States. This twice exceeds the level seen in any previous month. In other words, if the United States closes for quarantine again, the euro and the pound sterling may collapse again, but with even greater force. The isolation will not lead to anything good.

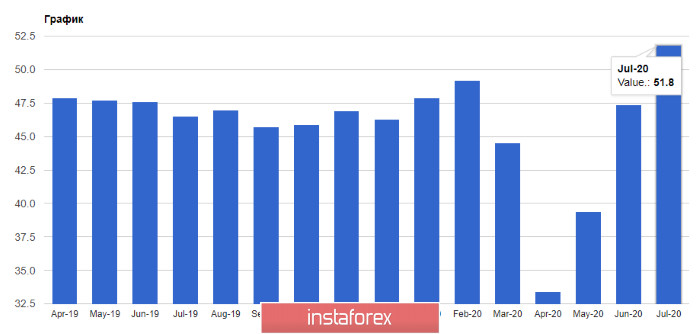

Let's take a look at the figures that were released today for the eurozone. It is already clear that the easing of the quarantine measures allowed the manufacturing sector of the eurozone to return quickly to normal levels in July this year. All countries returned to growth, and most indices passed a value above 50 points, which indicates an increase in activity. Another question is whether indices will be able to remain at these levels in the spring of this year, when a sharp surge after the opening of the economy will end and harsh realities of recovery will come. In Spain, PMI for the manufacturing sector rose to 53.5 points in July from 49 points in June.

In Italy, the same indicator hit 51.9 points in July, with a forecast of 51 points. In June, it was at the level of 47.5 points. In France, the manufacturing PMI jumped to 52.4 points in July. In Germany, the same indicator was advanced to 51 points after 45.2 points in June this year. If we take the euro area as a whole, for the first time since the coronavirus crisis the overall indicator exceeded the 50-point mark and amounted to 51.8 in July against 47.4 points in June this year.

According to the technical analysis, the euro/dollar pair remained unchanged. Bulls did not show activity in the area of resistance at 1.1780. This increased pressure on risky assets after the release of statistics. An unsuccessful attempt to return to this range led to a new wave of declines in risky assets. Bears' immediate target is a larger support level of 1.1700. If the pair breaks this level, it may reach the area of 1.1640. If the euro buyers find strength to regain the range of 1.1780, we can expect a new wave of growth to the high of 1.1850. It is possible that bears will be able to build a new upper border of the descending channel. Besides, this range could be broken and a rise in the euro will continue. This may lead to an update of the highs of 1.1910 and 1.1985.

GBP/USD

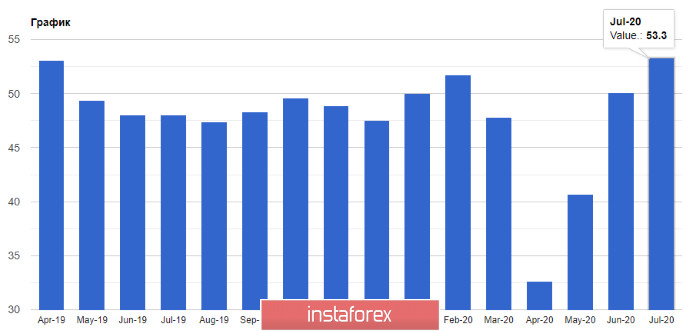

The British pound is not very strong even after positive data on manufacturing activity. Everyone understands that the weakness of the US dollar alone is not enough to boost the pound sterling.

According to the data, expectations of demand stabilization to post-crisis levels led to a strengthening of the indicator. Thus, the PMI IHS Markit and CIPS hit 53.3 points against the preliminary estimate of 53.6 points and the June value of 50.1 points. Let me remind you that the reading above 50 points indicates an increase in activity. However, only optimistic still expect that the UK economy will take a V-shaped recovery.

It is most likely that pressure on the British pound will resume in autumn, when the UK and the EU will once again return to the Brexit trade negotiations. The lack of progress will influence the pound sterling. According to the technical analysis of the pound/dollar pair, a break of the 1.3020 support will certainly lead to the demolition of a number of stop orders from buyers and increase pressure on the trading instrument, which will open the way to the lows of 1.2940 and 1.2840. We can say that buyer could resume control, if the pound rises above the resistance of 1.3100. This may lead to updating of the highs in the area of 1.3230 and 1.3320.